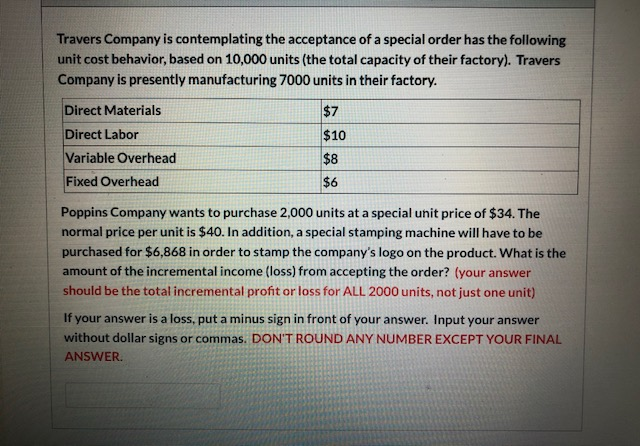

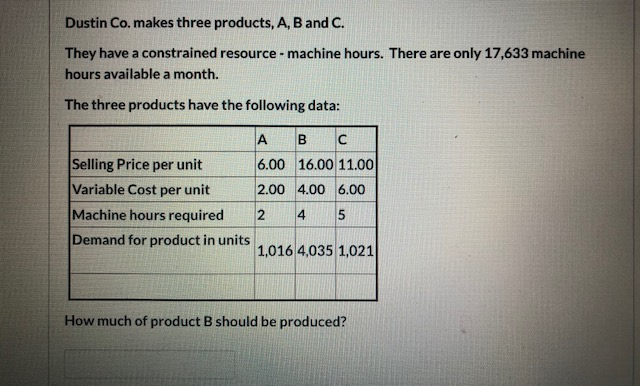

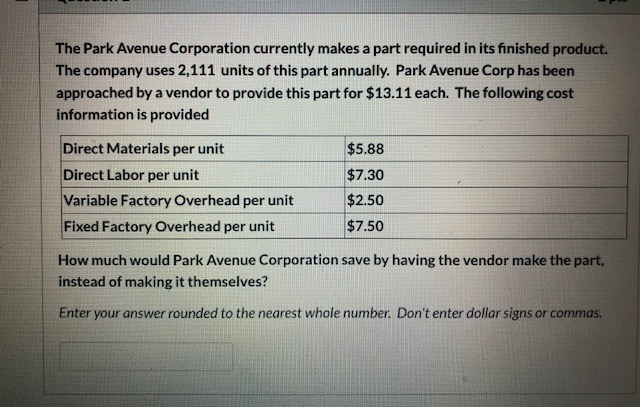

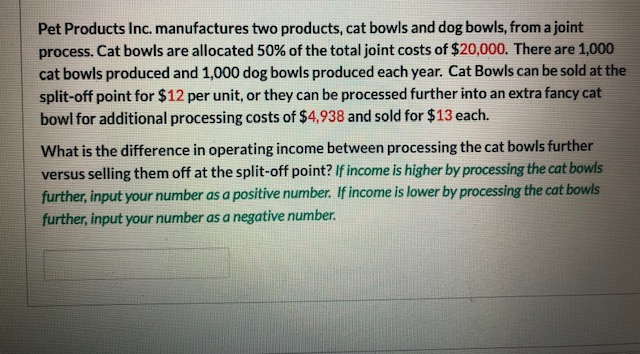

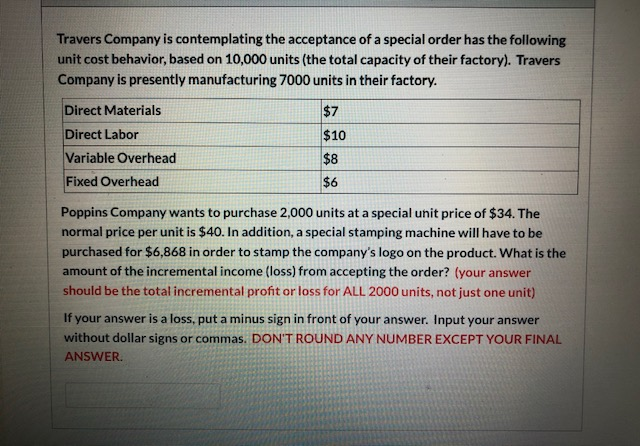

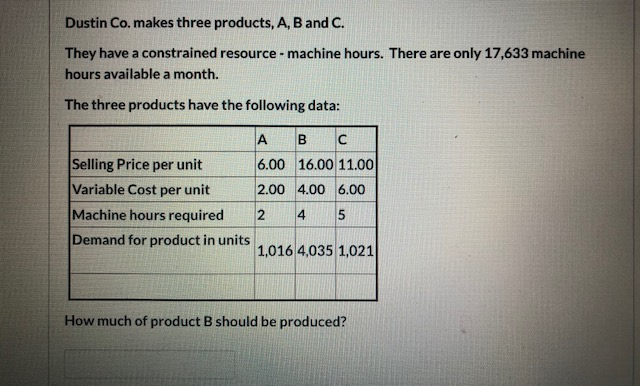

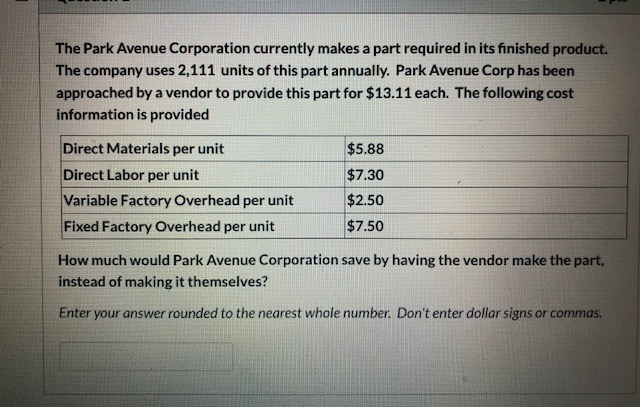

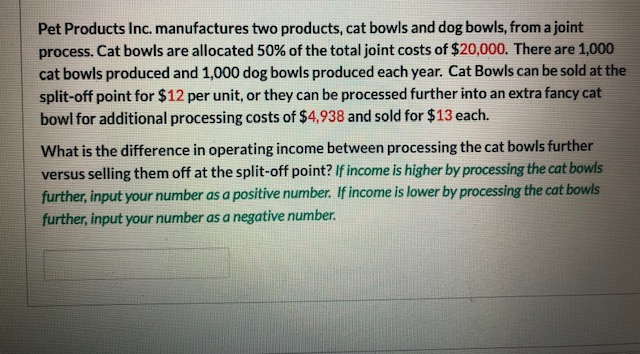

Travers Company is contemplating the acceptance of a special order has the following unit cost behavior, based on 10,000 units (the total capacity of their factory). Travers Company is presently manufacturing 7000 units in their factory. $7 Direct Materials Direct Labor Variable Overhead Fixed Overhead $10 $8 $6 Poppins Company wants to purchase 2,000 units at a special unit price of $34. The normal price per unit is $40. In addition, a special stamping machine will have to be purchased for $6,868 in order to stamp the company's logo on the product. What is the amount of the incremental income (loss) from accepting the order? (your answer should be the total incremental profit or loss for ALL 2000 units, not just one unit) If your answer is a loss, put a minus sign in front of your answer. Input your answer without dollar signs or commas. DON'T ROUND ANY NUMBER EXCEPT YOUR FINAL ANSWER Dustin Co. makes three products, A, B and C. They have a constrained resource - machine hours. There are only 17,633 machine hours available a month. The three products have the following data: B C Selling Price per unit 6.00 16.00 11.00 Variable Cost per unit 2.00 4.00 6.00 Machine hours required 2 4 5 Demand for product in units 1,016 4,035 1,021 How much of product B should be produced? The Park Avenue Corporation currently makes a part required in its finished product. The company uses 2,111 units of this part annually. Park Avenue Corp has been approached by a vendor to provide this part for $13.11 each. The following cost information is provided Direct Materials per unit Direct Labor per unit Variable Factory Overhead per unit Fixed Factory Overhead per unit $5.88 $7.30 $2.50 $7.50 How much would Park Avenue Corporation save by having the vendor make the part, instead of making it themselves? Enter your answer rounded to the nearest whole number. Don't enter dollar signs or commas. Pet Products Inc. manufactures two products, cat bowls and dog bowls, from a joint process. Cat bowls are allocated 50% of the total joint costs of $20,000. There are 1,000 cat bowls produced and 1,000 dog bowls produced each year. Cat Bowls can be sold at the split-off point for $12 per unit, or they can be processed further into an extra fancy cat bowl for additional processing costs of $4,938 and sold for $13 each. What is the difference in operating income between processing the cat bowls further versus selling them off at the split-off point? If income is higher by processing the cat bowls further, input your number as a positive number. If income is lower by processing the cat bowls further, input your number as a negative number