Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Travis Welch, owner of Welch's Fun Ranch, wants to know the bottom line from his Year 1 operations. Data are below. a. Salaries and wages

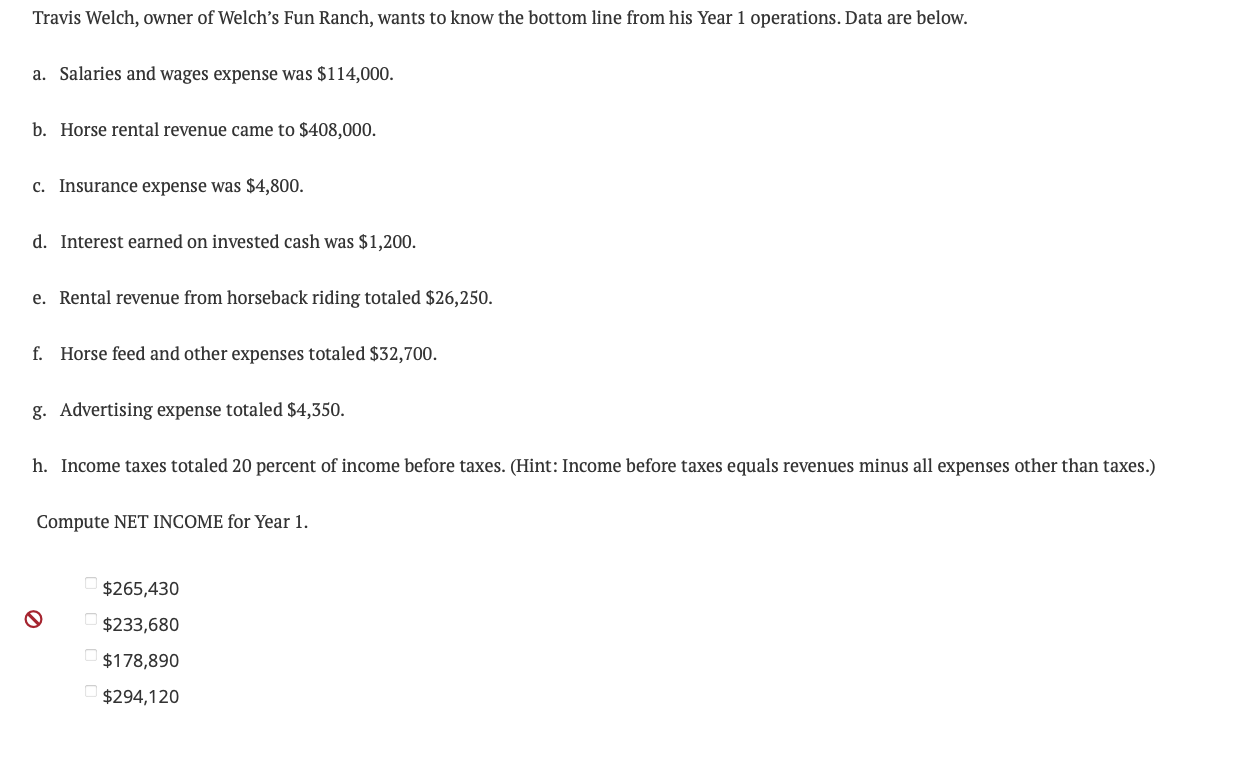

Travis Welch, owner of Welch's Fun Ranch, wants to know the bottom line from his Year 1 operations. Data are below. a. Salaries and wages expense was \\( \\$ 114,000 \\). b. Horse rental revenue came to \\( \\$ 408,000 \\). c. Insurance expense was \\( \\$ 4,800 \\). d. Interest earned on invested cash was \\( \\$ 1,200 \\). e. Rental revenue from horseback riding totaled \\( \\$ 26,250 \\). f. Horse feed and other expenses totaled \\( \\$ 32,700 \\). g. Advertising expense totaled \\( \\$ 4,350 \\). h. Income taxes totaled 20 percent of income before taxes. (Hint: Income before taxes equals revenues minus all expenses other than taxes.) Compute NET INCOME for Year 1. \\( \\$ 265,430 \\) ( \\( \\$ 233,680 \\) \\( \\$ 178,890 \\) \\( \\$ 294,120 \\)

Travis Welch, owner of Welch's Fun Ranch, wants to know the bottom line from his Year 1 operations. Data are below. a. Salaries and wages expense was \\( \\$ 114,000 \\). b. Horse rental revenue came to \\( \\$ 408,000 \\). c. Insurance expense was \\( \\$ 4,800 \\). d. Interest earned on invested cash was \\( \\$ 1,200 \\). e. Rental revenue from horseback riding totaled \\( \\$ 26,250 \\). f. Horse feed and other expenses totaled \\( \\$ 32,700 \\). g. Advertising expense totaled \\( \\$ 4,350 \\). h. Income taxes totaled 20 percent of income before taxes. (Hint: Income before taxes equals revenues minus all expenses other than taxes.) Compute NET INCOME for Year 1. \\( \\$ 265,430 \\) ( \\( \\$ 233,680 \\) \\( \\$ 178,890 \\) \\( \\$ 294,120 \\) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started