Answered step by step

Verified Expert Solution

Question

1 Approved Answer

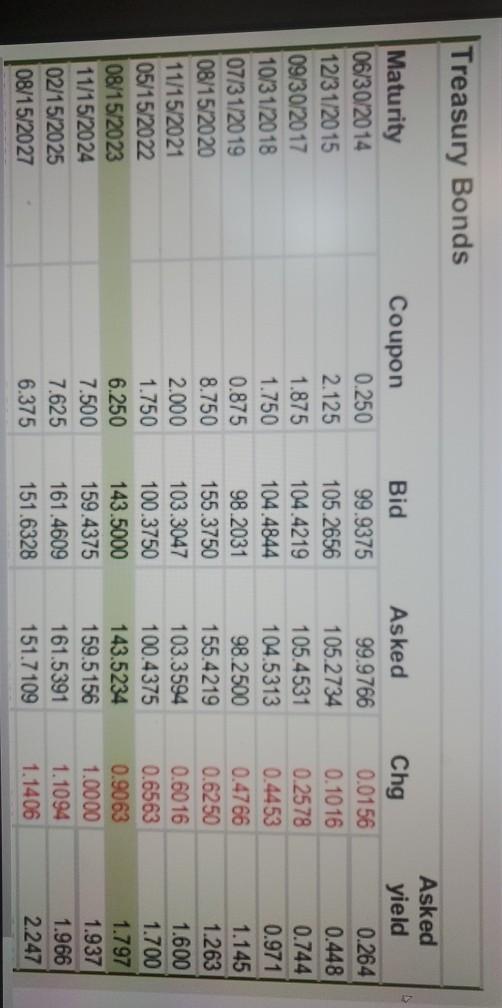

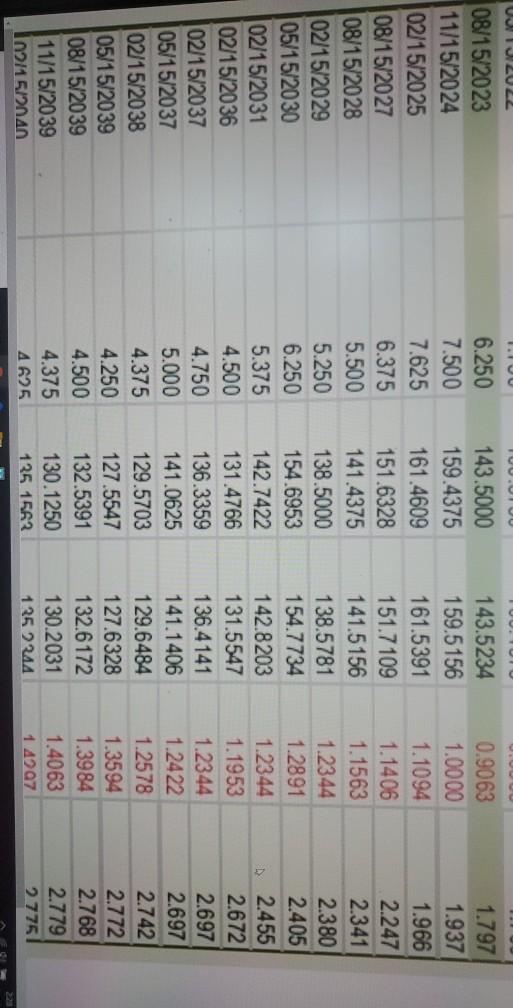

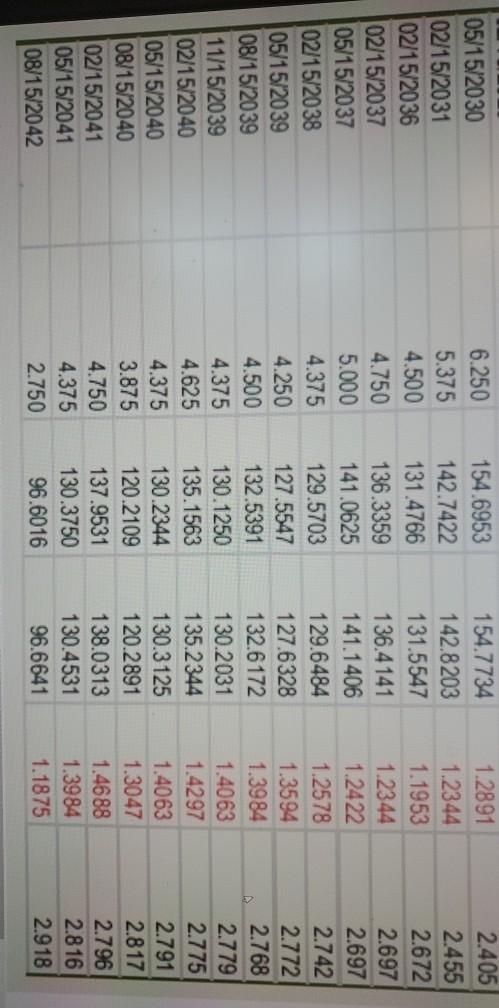

Treasury Bonds Maturity 06/30/2014 12/31/2015 09/30/2017 10/31/2018 07/31/2019 08/15/2020 11/15/2021 05/15/2022 08/15/2023 11/15/2024 02/15/2025 08/15/2027 Coupon 0.250 2.125 1.875 1.750 0.875 8.750 2.000 1.750 6.250

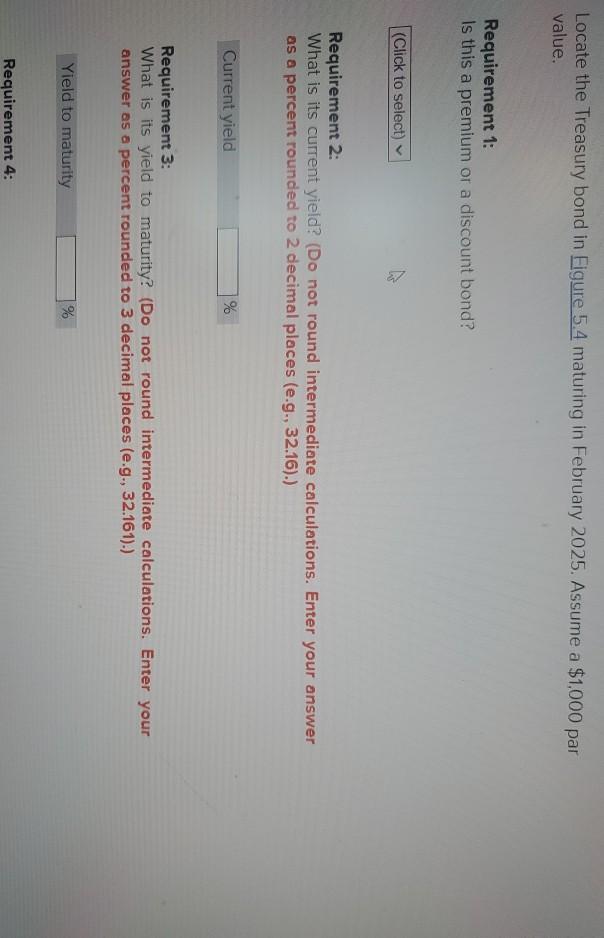

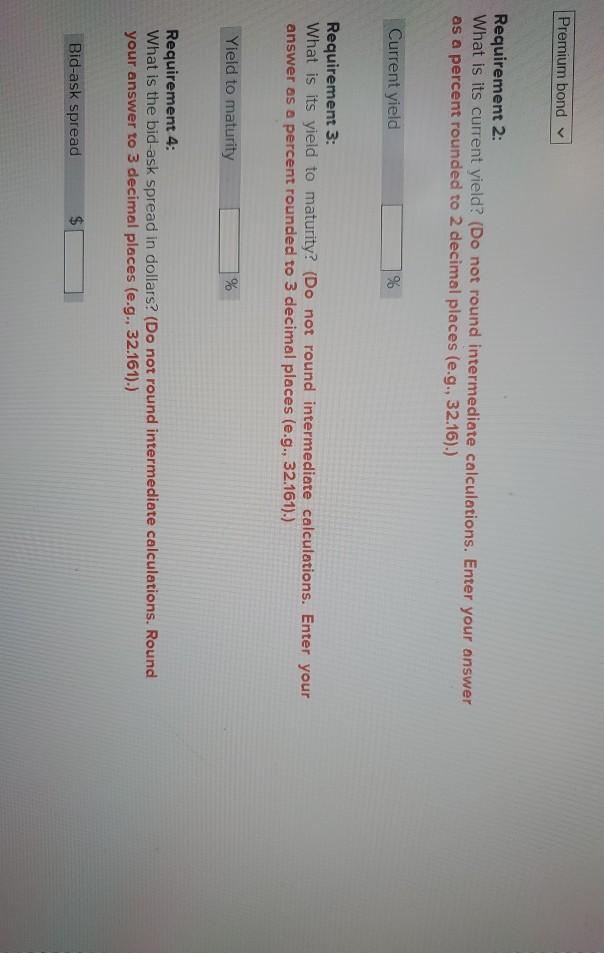

Treasury Bonds Maturity 06/30/2014 12/31/2015 09/30/2017 10/31/2018 07/31/2019 08/15/2020 11/15/2021 05/15/2022 08/15/2023 11/15/2024 02/15/2025 08/15/2027 Coupon 0.250 2.125 1.875 1.750 0.875 8.750 2.000 1.750 6.250 7.500 7.625 6.375 Bid 99.9375 105.2656 104.4219 104.4844 98.2031 155.3750 103.3047 100.3750 143.5000 159.4375 161.4609 151.6328 Asked 99.9766 105.2734 105.4531 104.5313 98.2500 155.4219 103.3594 100.4375 143.5234 159.5156 161.5391 151.7109 Chg 0.0156 0.1016 0.2578 0.4453 0.4766 0.6250 0.6016 0.6563 0.9063 1.0000 1.1094 1.1406 Asked yield 0.264 0.448 0.744 0.971 1.145 1.263 1.600 1.700 1.797 1.937 1.966 2.247 UZU22 TTUU TUUUUU UUTUN 1.797 1.937 1.966 2.247 2.341 2.380 2.405 08/15/2023 11/15/2024 02/15/2025 08/15/2027 08/15/2028 02/15/2029 05/15/2030 02/15/2031 02/15/2036 02/15/2037 05/15/2037 02/15/2038 05/15/2039 08/15/2039 11/15/2039 102115/2nan 6.250 7.500 7.625 6.375 5.500 5.250 6.250 5.375 4.500 4.750 5.000 4.375 4.250 4.500 4.375 4625 143.5000 159.4375 161.4609 151.6328 141.4375 138.5000 154.6953 142.7422 131.4766 136.3359 141.0625 129.5703 127.5547 132.5391 130.1250 125 1563 143.5234 159.5156 161.5391 151.7109 141.5156 138.5781 154.7734 142.8203 131.5547 136.4141 141.1406 129.6484 127.6328 132.6172 130.2031 125 2244 0.9063 1.0000 1.1094 1.1406 1.1563 1.2344 1.2891 1.2344 1.1953 1.2344 1.2422 1.2578 1.3594 1.3984 1.4063 14297 2.455 2.672 2.697 2.697 2.742 2.772 2.768 2.779 2775 105/15/2030 10215/2031 [02/15/2036 [02/15/2037 105/15/2037 [02/15/2038 105152039 108/1520 39 11/152039 102/15/2040 [05/152040 (08/152040 [02/152041 105/15/2041 [08/15/2042 6.250 5.375 4. 500 4.750 5.000 4.375 4.250 4.500 4.375 4.625 4.375 3.875 4.750 4.375 2.750 14.6953 142.7422 131.4766 136.3359 141.0625 129.5703 127.5547 132.5301 130.1250 135.1563 130 2344 120 2109 137.2531 130.3750 96.6016 14.7734 142.8203 131.5547 136.4141 141.1406 129.6484 127.6328 132.6172 130.2031 135.2344 130.3125 120.2891 138.0313 130.4531 96.6641 1.2891 1.2344 1.1953 12344 1.2422 1.2578 1.3594 1.3984 1.403 1.4297 1.4063 1.3047 1.4688 1.3984 1.1875 2.4051 245 2672 2697 2.697 2.742 2772 2768 2779 2775 2791 2817 2.796 2816 2018 Locate the Treasury bond in Figure 5.4 maturing in February 2025. Assume a $1,000 par value. Requirement 1: Is this a premium or a discount bond? (Click to select) Requirement 2: What is its current yield? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places (e.g., 32.16).) Current yield % Requirement 3: What is its yield to maturity? (Do not round intermediate calculations. Enter your answer as a percent rounded to 3 decimal places (e.g., 32.161).) Yield to maturity % Requirement 4: Premium bond Requirement 2: What is its current yield? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places (e.g., 32.16).) Current yield % Requirement 3: What is its yield to maturity? (Do not round intermediate calculations. Enter your answer as a percent rounded to 3 decimal places (e.g., 32.161).) Yield to maturity % Requirement 4: What is the bid-ask spread in dollars? (Do not round intermediate calculations. Round your answer to 3 decimal places (e.g., 32.161).) Bid-ask spread Locate the Treasury bond in Figure 5.4 maturing in February 2025. Assume a $1,000 par value. Requirement 1: Is this a premium or a discount band? Premium bond Requirement 2 What is its current yield? (Do not round Intermediate calculations. Enter your answer as a percent rounded to 2 decimal places (e.g., 32.16).) Current yield % Requirement 3 What is its yield to maturity? (Do not round intermediate calculations. Enter your answer as a percent rounded to 3 decimal places (e.g., 32.161).) Yield to maturity Requirement 4: What is the hid ask snread in dollars? (Do not round Intermedinte calculations. Round Requirement 2: What is its current yield? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places (e.g. 32.16).) Current yield Requirement 3 What is its yleld to maturity? (Do not round intermediate calculations. Enter your answer as a percent rounded to 3 decimal places (e.g. 32.161). Yield to maturity 1% Requirement 4: What is the bid ask spread in dollars? (Do not round intermediate calculations. Round your answer to 3 decimal places (e.g. 32.161).) Bid ask spread

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started