Answered step by step

Verified Expert Solution

Question

1 Approved Answer

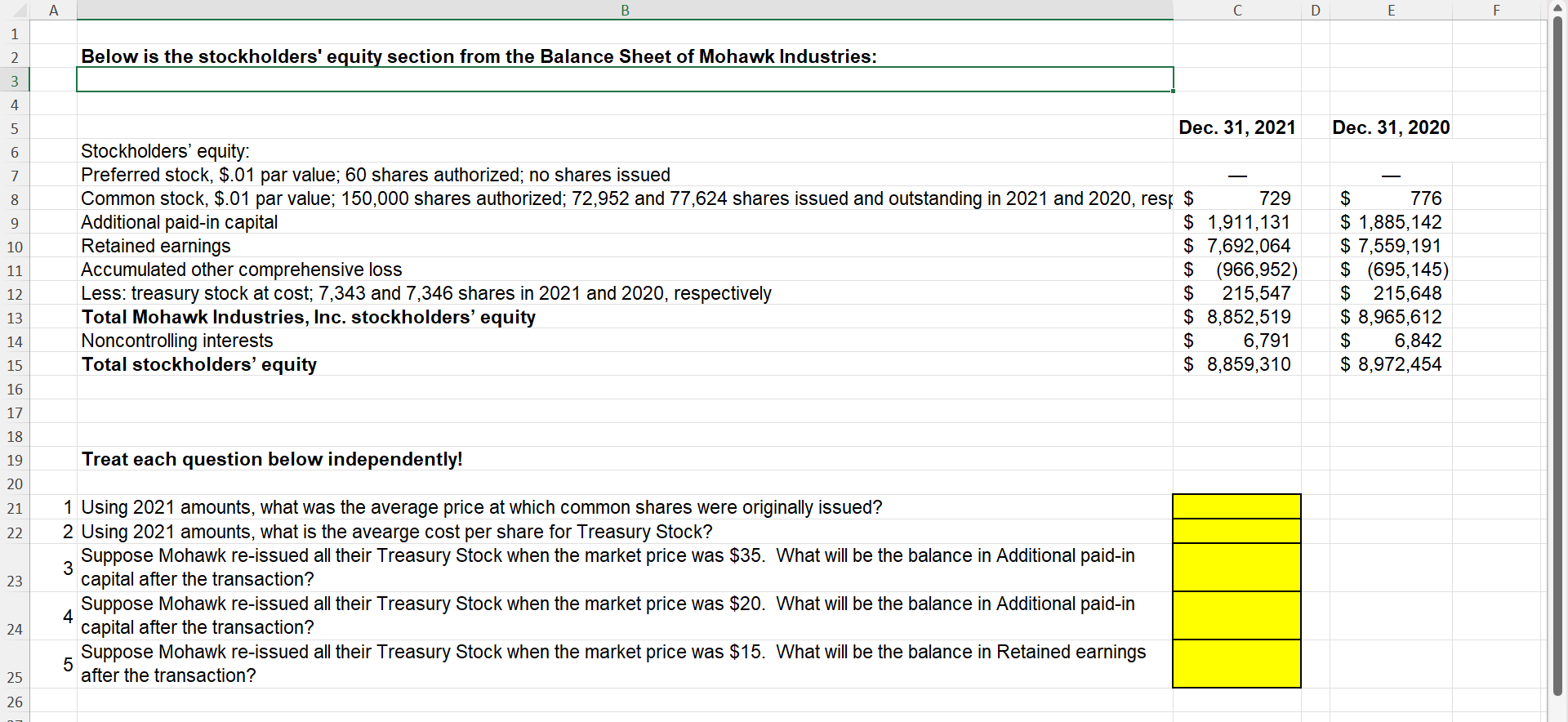

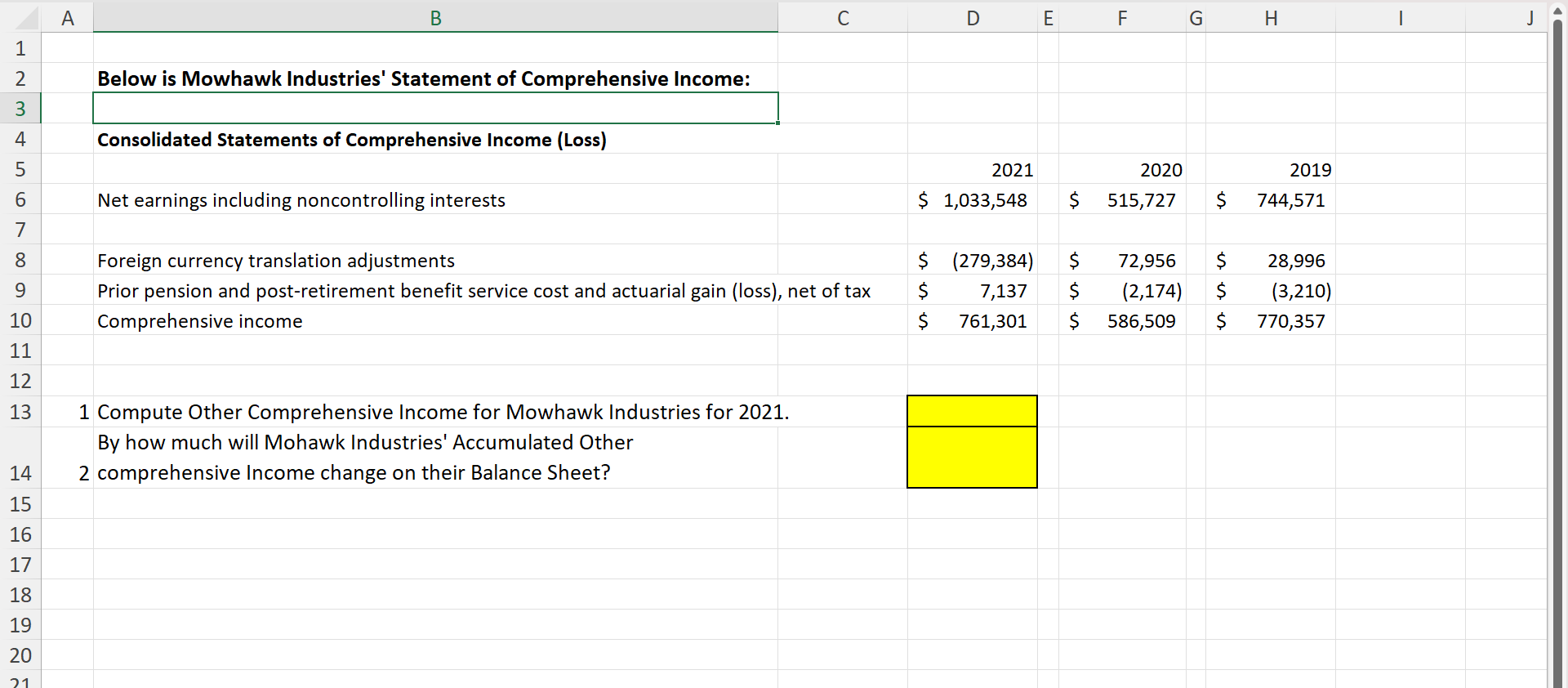

Treat each question below independently! 1 Using 2021 amounts, what was the average price at which common shares were originally issued? 2 Using 2021 amounts,

Treat each question below independently! 1 Using 2021 amounts, what was the average price at which common shares were originally issued? 2 Using 2021 amounts, what is the avearge cost per share for Treasury Stock? 3 Suppose Mohawk re-issued all their Treasury Stock when the market price was $35. What will be the balance in Additional paid-in capital after the transaction? 4 Suppose Mohawk re-issued all their Treasury Stock when the market price was $20. What will be the balance in Additional paid-in capital after the transaction? 5 Suppose Mohawk re-issued all their Treasury Stock when the market price was $15. What will be the balance in Retained earnings after the transaction? \begin{tabular}{|l|} \hline \\ \hline \\ \hline \\ \hline \\ \hline \\ \hline \end{tabular} Treat each question below independently! 1 Using 2021 amounts, what was the average price at which common shares were originally issued? 2 Using 2021 amounts, what is the avearge cost per share for Treasury Stock? 3 Suppose Mohawk re-issued all their Treasury Stock when the market price was $35. What will be the balance in Additional paid-in capital after the transaction? 4 Suppose Mohawk re-issued all their Treasury Stock when the market price was $20. What will be the balance in Additional paid-in capital after the transaction? 5 Suppose Mohawk re-issued all their Treasury Stock when the market price was $15. What will be the balance in Retained earnings after the transaction? \begin{tabular}{|l|} \hline \\ \hline \\ \hline \\ \hline \\ \hline \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started