Answered step by step

Verified Expert Solution

Question

1 Approved Answer

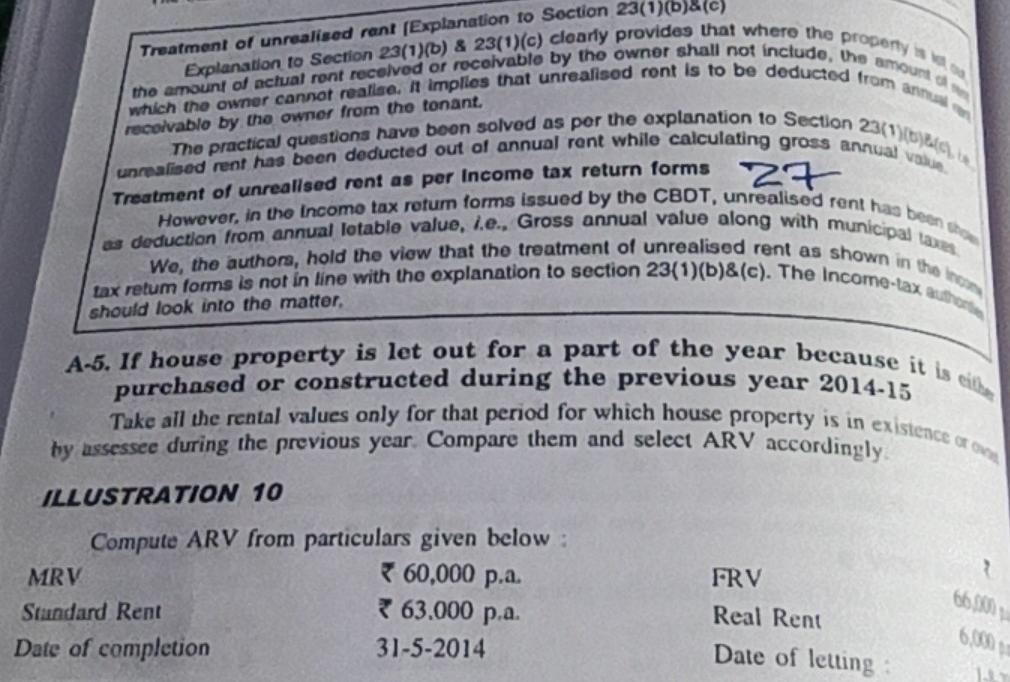

Treatment of unrealised rant (Explanation to Soction 23(1)0)&(c) recolvablo by the owner from the tonant, which the owner cannot realise. it implies that unrealisod ront

Treatment of unrealised rant (Explanation to Soction 23(1)0)&(c) recolvablo by the owner from the tonant, which the owner cannot realise. it implies that unrealisod ront is to be deducted from an the amount of actual ront recolvod or rocolvablo by the owner shall not include, the amount Explanation to Section 23(1)(b) & 23(1)(c) cloorly provides that whero the property The practical questions have boon solved as per the explanation to Section 23(1) unrealised rent has been deducted out of annual rent while calculating gross annual va However, in the Incomo tax return forms issued by tho CBDT, unrealised rent has been as deduction from annual lotable value, l.e., Gross annual value along with municipal We, the authors, hold the view that the treatment of unrealised rent as shown in the tax retum forms is not in line with the explanation to section 23(1)(b)&(c). The Income tax author should look into the matter, Z7 Treatment of unrealised rent as per Income tax return forms A-5. If house property is let out for a part of the year because it is eith purchased or constructed during the previous year 2014-15 Take all the rental values only for that period for which house property is in existence on by assessee during the previous year. Compare them and select ARV accordingly ILLUSTRATION 10 Compute ARV from particulars given below: MRV * 60,000 p.a. FRV Stundard Rent Real Rent Date of completion 31-5-2014 63.000 p.a. 66 6.000 Date of letting

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started