Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Trevor, a friend of yours from high school, works as a server at the ST Caf. He asks you to help him prepare his Federal

Trevor, a friend of yours from high school, works as a server at the ST Caf. He asks you to help him prepare his Federal income tax return. When you inquire about why his bank deposits substantially exceed his tip income, he confides to you that he is a bookie on the side. Trevor then provides you with the following documented income and expenses for the year:

|

*** I just need help with "B"*******

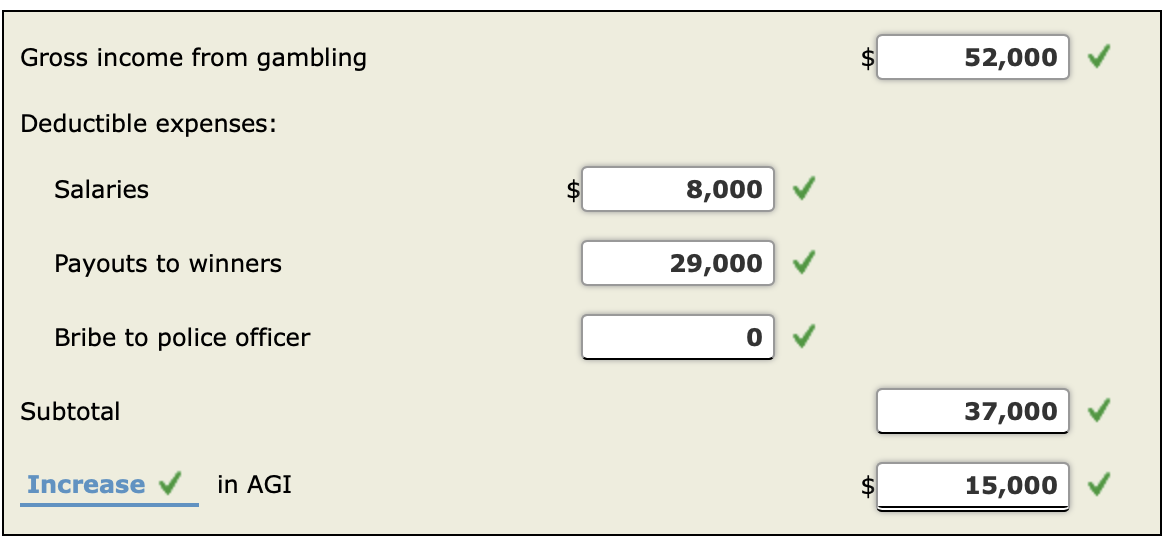

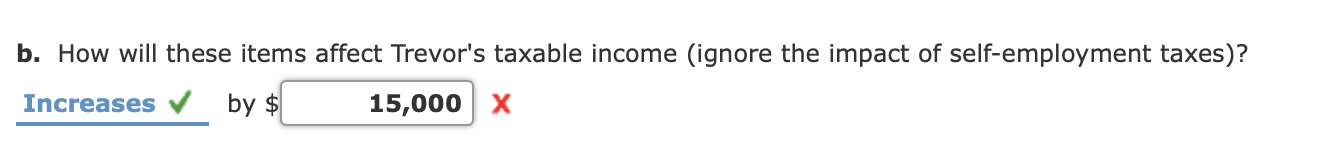

Gross income from gambling $ 52,000 Deductible expenses: Salaries $ 8,000 Payouts to winners 29,000 Bribe to police officer 0 Subtotal 37,000 Increase in AGI 15,000 b. How will these items affect Trevor's taxable income (ignore the impact of self-employment taxes)? Increases by $ 15,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started