Trevor is a single individual who is a cash-method, calendar-year taxpayer. For each of the next two years (year 1 and year 2), Trevor expects to report AGI of $84,000, contribute $8,200 to charity, and pay $2,900 in state income taxes.

Required:

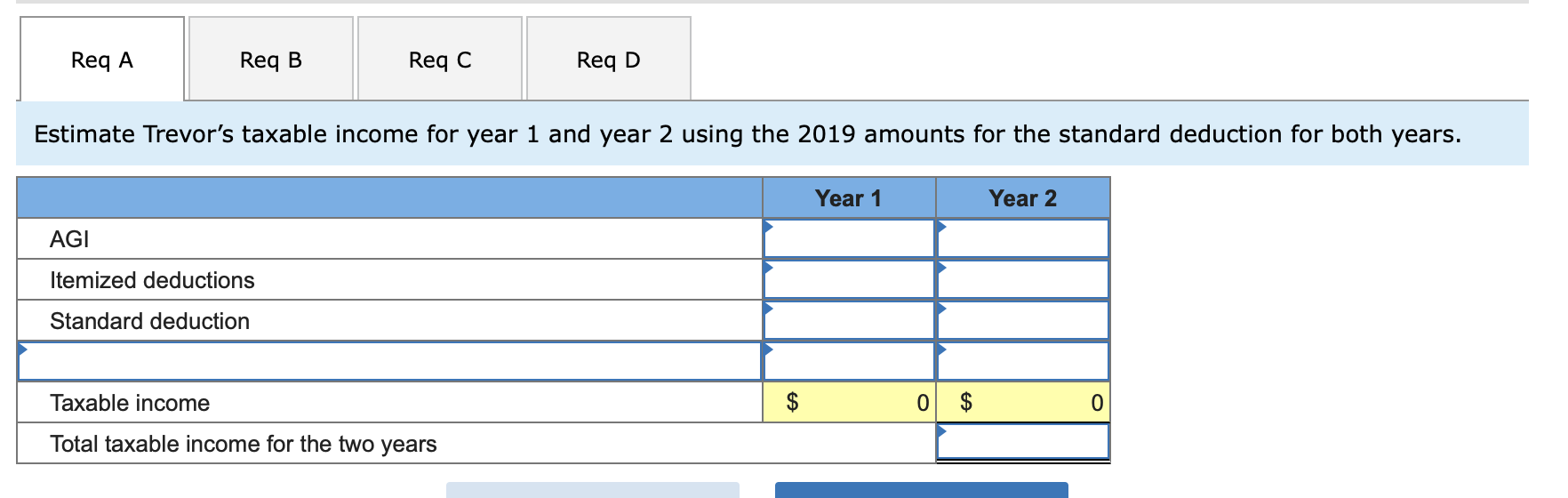

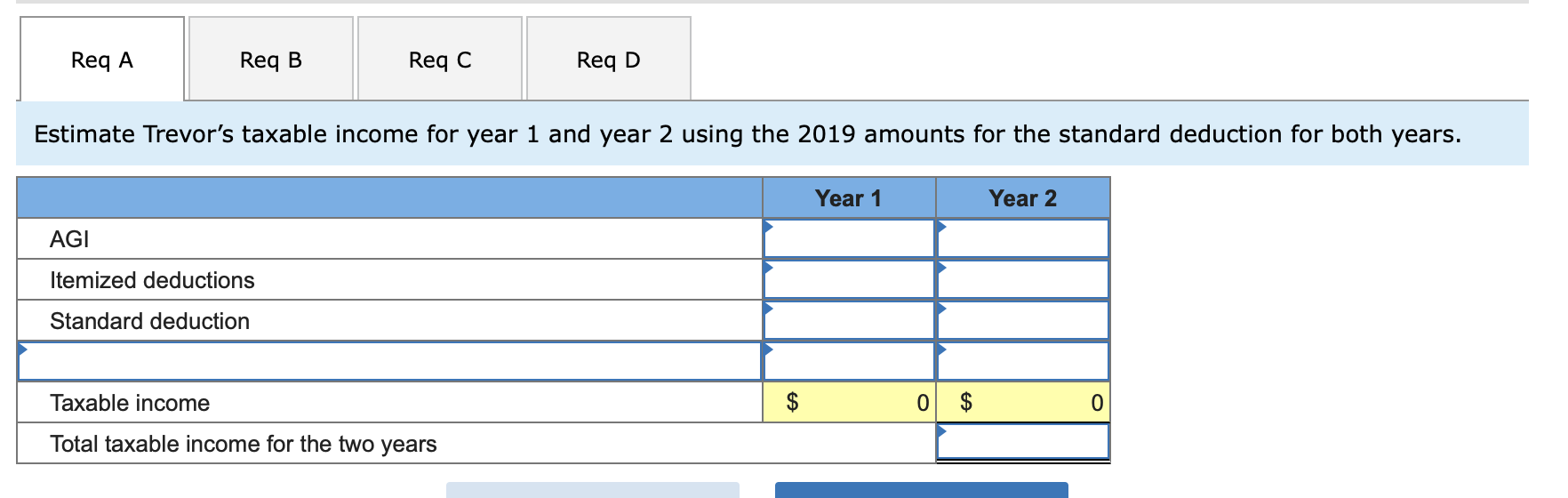

- Estimate Trevors taxable income for year 1 and year 2 using the 2019 amounts for the standard deduction for both years.

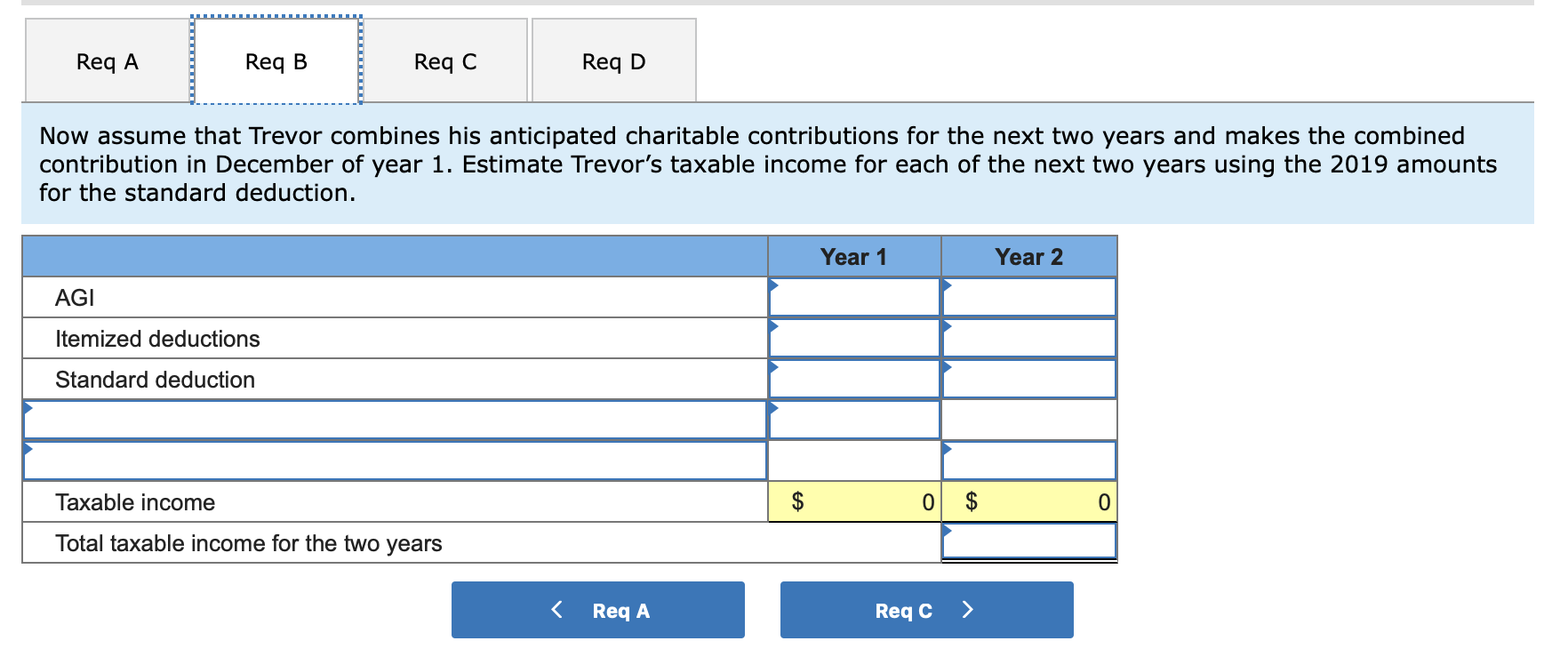

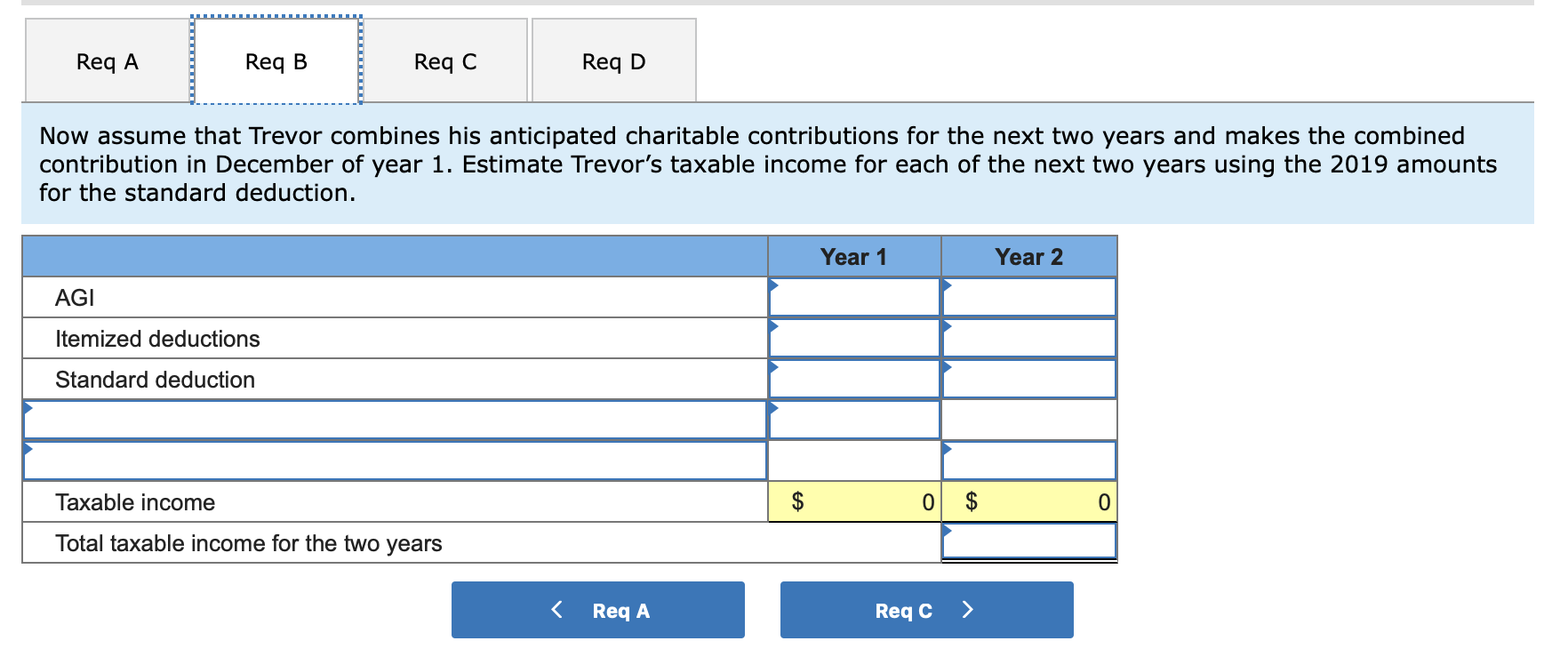

- Now assume that Trevor combines his anticipated charitable contributions for the next two years and makes the combined contribution in December of year 1. Estimate Trevors taxable income for each of the next two years using the 2019 amounts for the standard deduction.

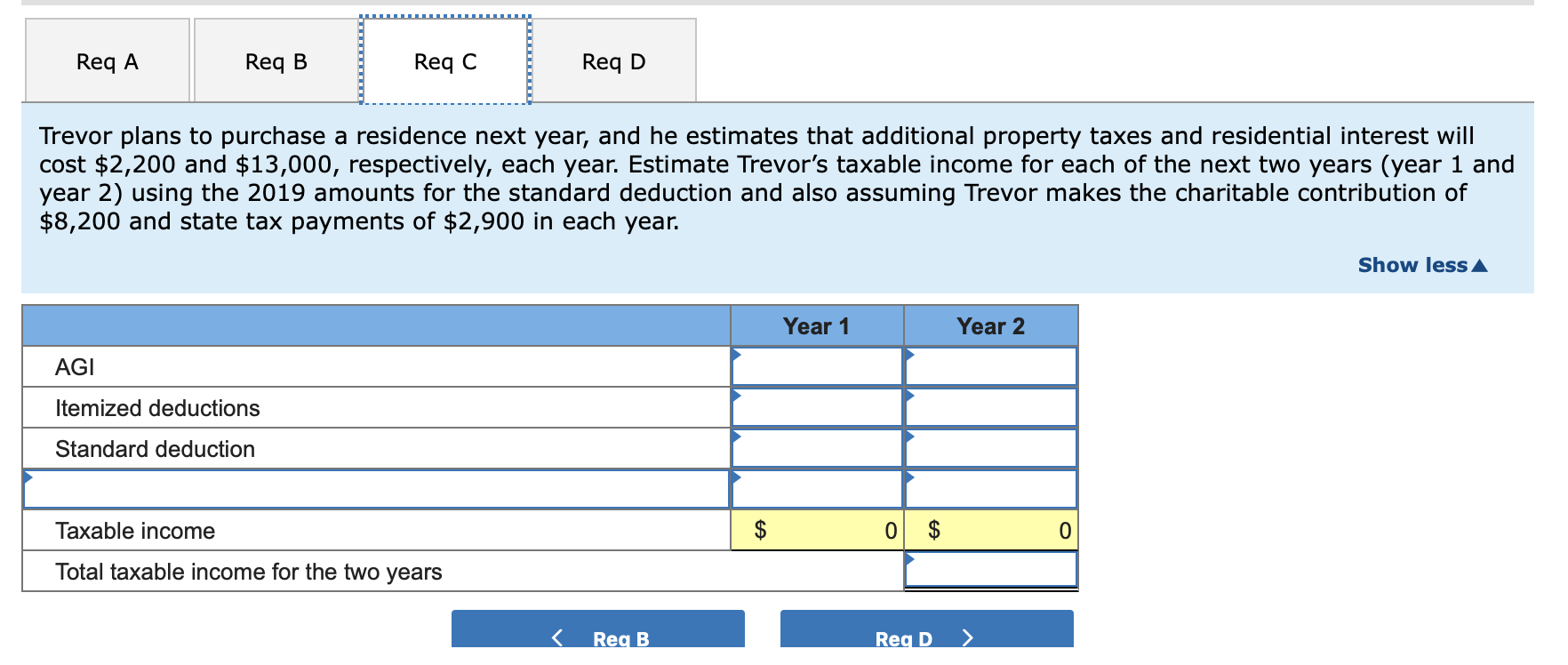

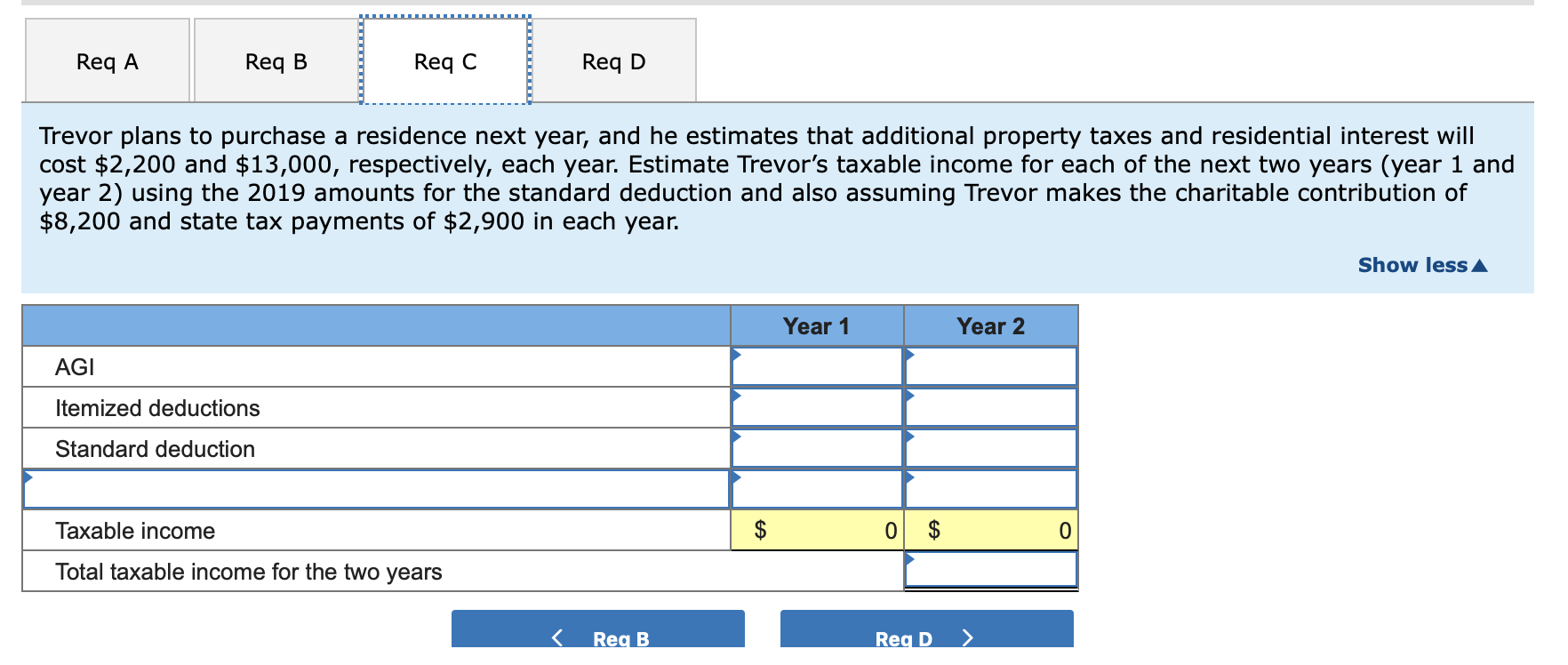

- Trevor plans to purchase a residence next year, and he estimates that additional property taxes and residential interest will cost $2,200 and $13,000, respectively, each year. Estimate Trevors taxable income for each of the next two years (year 1 and year 2) using the 2019 amounts for the standard deduction and also assuming Trevor makes the charitable contribution of $8,200 and state tax payments of $2,900 in each year.

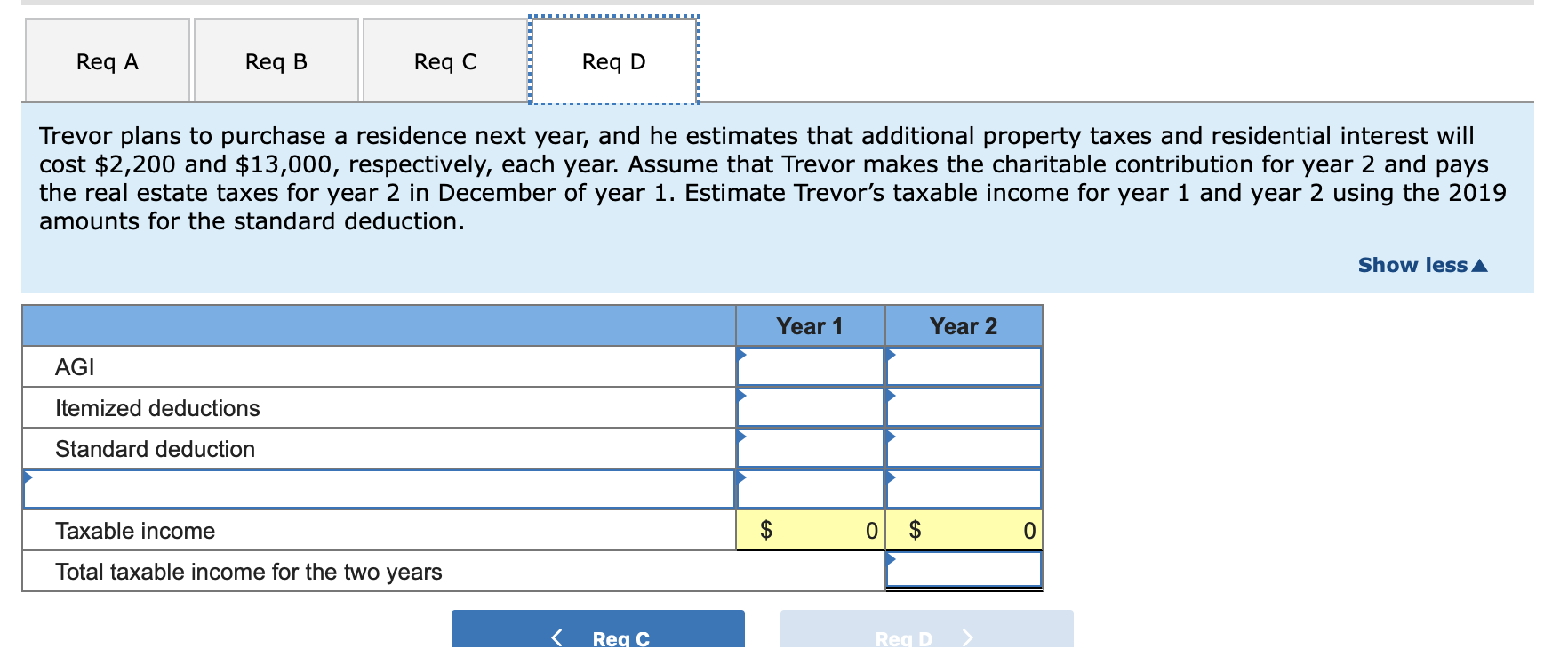

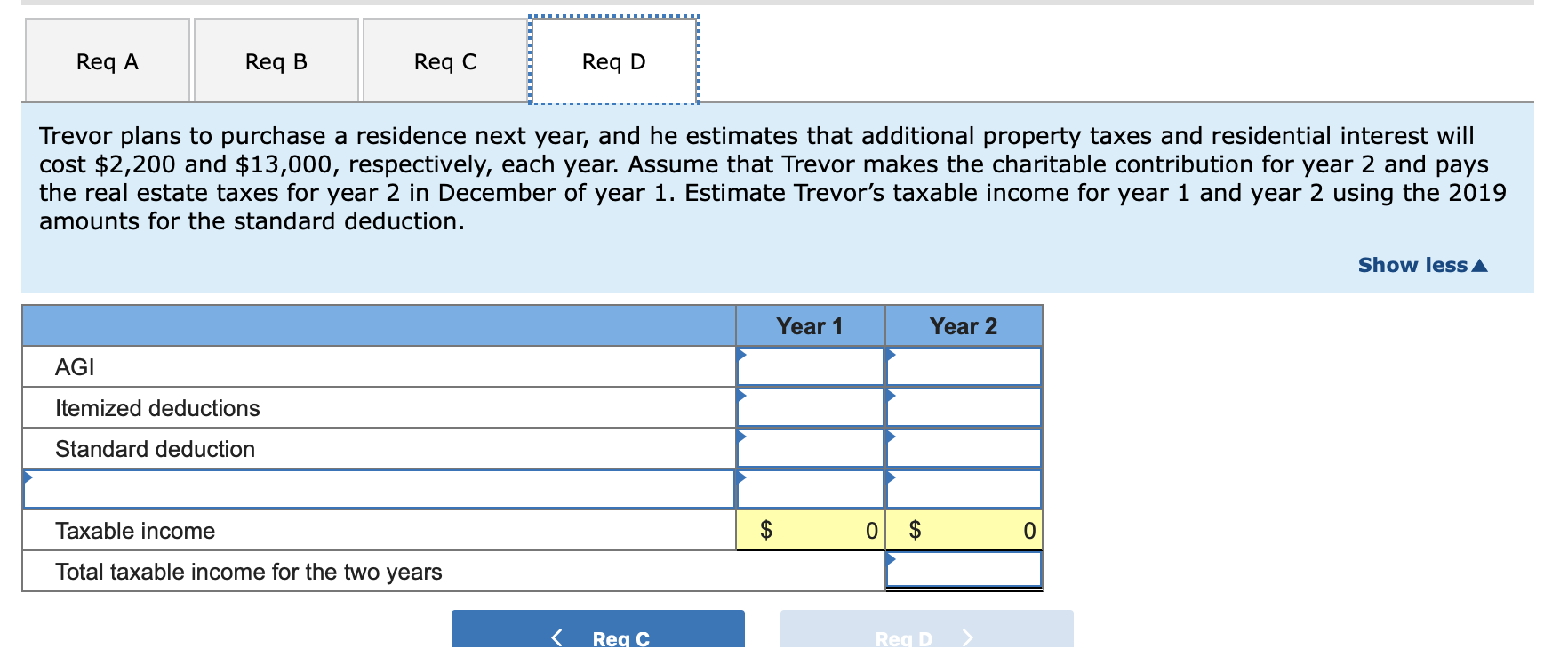

- Trevor plans to purchase a residence next year, and he estimates that additional property taxes and residential interest will cost $2,200 and $13,000, respectively, each year. Assume that Trevor makes the charitable contribution for year 2 and pays the real estate taxes for year 2 in December of year 1. Estimate Trevors taxable income for year 1 and year 2 using the 2019 amounts for the standard deduction.

Req A Req B Req C Req D Estimate Trevor's taxable income for year 1 and year 2 using the 2019 amounts for the standard deduction for both years. Year 2 Year 1 AGI Itemized deductions Standard deduction $ $ Taxable income 0 0 Total taxable income for the two years EA Req C Req A Req B Req D Now assume that Trevor combines his anticipated charitable contributions for the next two years and makes the combined contribution in December of year 1. Estimate Trevor's taxable income for each of the next two years using the 2019 amounts for the standard deduction. Year 1 Year 2 AGI Itemized deductions Standard deduction Taxable income 0 Total taxable income for the two years > Req A Req C Req A Req B Req C Req D Trevor plans to purchase a residence next year, and he estimates that additional property taxes and residential interest will cost $2,200 and $13,000, respectively, each year. Estimate Trevor's taxable income for each of the next two years (year 1 and year 2) using the 2019 amounts for the standard deduction and also assuming Trevor makes the charitable contribution of $8,200 and state tax payments of $2,900 in each year. Show lessA Year 2 Year 1 AGI Itemized deductions Standard deduction 0$ Taxable income Total taxable income for the two years Req B Req D Req C Req A Req B Req D Trevor plans to purchase a residence next year, and he estimates that additional property taxes and residential interest will cost $2,200 and $13,000, respectively, each year. Assume that Trevor makes the charitable contribution for year 2 and pays the real estate taxes for year 2 in December of year 1. Estimate Trevor's taxable income for year 1 and year 2 using the 2019 amounts for the standard deduction Show less A Year 2 Year 1 AGI Itemized deductions Standard deduction 0$ Taxable income 0 Total taxable income for the two years Req C Req D Req A Req B Req C Req D Estimate Trevor's taxable income for year 1 and year 2 using the 2019 amounts for the standard deduction for both years. Year 2 Year 1 AGI Itemized deductions Standard deduction $ $ Taxable income 0 0 Total taxable income for the two years EA Req C Req A Req B Req D Now assume that Trevor combines his anticipated charitable contributions for the next two years and makes the combined contribution in December of year 1. Estimate Trevor's taxable income for each of the next two years using the 2019 amounts for the standard deduction. Year 1 Year 2 AGI Itemized deductions Standard deduction Taxable income 0 Total taxable income for the two years > Req A Req C Req A Req B Req C Req D Trevor plans to purchase a residence next year, and he estimates that additional property taxes and residential interest will cost $2,200 and $13,000, respectively, each year. Estimate Trevor's taxable income for each of the next two years (year 1 and year 2) using the 2019 amounts for the standard deduction and also assuming Trevor makes the charitable contribution of $8,200 and state tax payments of $2,900 in each year. Show lessA Year 2 Year 1 AGI Itemized deductions Standard deduction 0$ Taxable income Total taxable income for the two years Req B Req D Req C Req A Req B Req D Trevor plans to purchase a residence next year, and he estimates that additional property taxes and residential interest will cost $2,200 and $13,000, respectively, each year. Assume that Trevor makes the charitable contribution for year 2 and pays the real estate taxes for year 2 in December of year 1. Estimate Trevor's taxable income for year 1 and year 2 using the 2019 amounts for the standard deduction Show less A Year 2 Year 1 AGI Itemized deductions Standard deduction 0$ Taxable income 0 Total taxable income for the two years Req C Req D