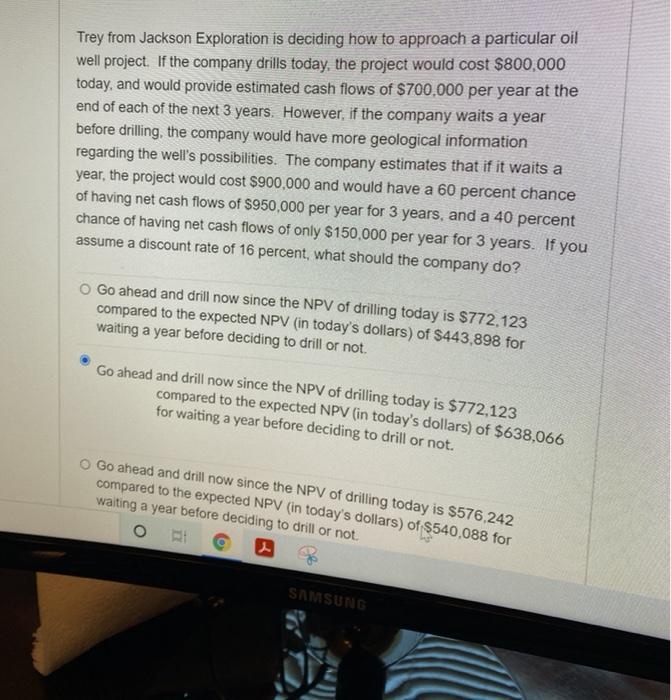

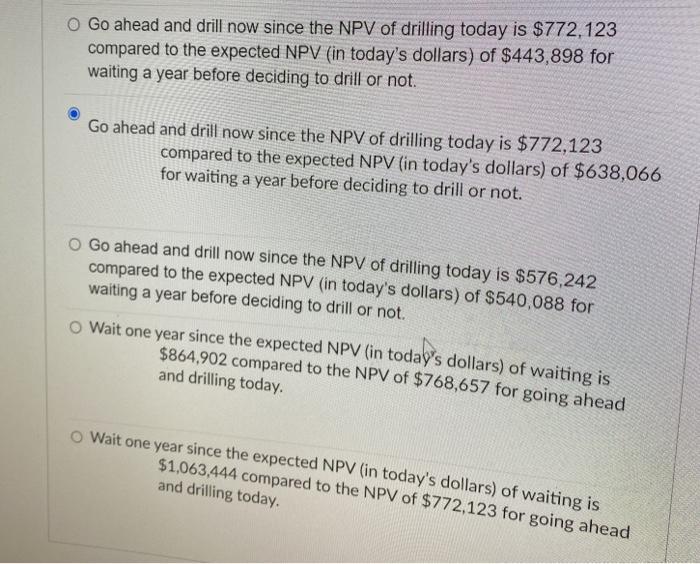

Trey from Jackson Exploration is deciding how to approach a particular oil well project. If the company drills today, the project would cost $800,000 today, and would provide estimated cash flows of $700.000 per year at the end of each of the next 3 years. However, if the company waits a year before drilling, the company would have more geological information regarding the well's possibilities. The company estimates that if it waits a year, the project would cost $900,000 and would have a 60 percent chance of having net cash flows of $950,000 per year for 3 years, and a 40 percent chance of having net cash flows of only $150,000 per year for 3 years. If you assume a discount rate of 16 percent, what should the company do? Go ahead and drill now since the NPV of drilling today is $772,123 compared to the expected NPV (in today's dollars) of $443,898 for waiting a year before deciding to drill or not. Go ahead and drill now since the NPV of drilling today is $772,123 compared to the expected NPV (in today's dollars) of $638,066 for waiting a year before deciding to drill or not. Go ahead and drill now since the NPV of drilling today is $576,242 compared to the expected NPV (in today's dollars) of $540,088 for waiting a year before deciding to drill or not. O SAMSUNG Go ahead and drill now since the NPV of drilling today is $772,123 compared to the expected NPV (in today's dollars) of $443,898 for waiting a year before deciding to drill or not. Go ahead and drill now since the NPV of drilling today is $772,123 compared to the expected NPV (in today's dollars) of $638,066 for waiting a year before deciding to drill or not. Go ahead and drill now since the NPV of drilling today is $576,242 compared to the expected NPV (in today's dollars) of $540,088 for waiting a year before deciding to drill or not. o Wait one year since the expected NPV (in today's dollars) of waiting is $864,902 compared to the NPV of $768,657 for going ahead and drilling today. Wait one year since the expected NPV (in today's dollars) of waiting is $1,063,444 compared to the NPV of $772,123 for going ahead and drilling today