Answered step by step

Verified Expert Solution

Question

1 Approved Answer

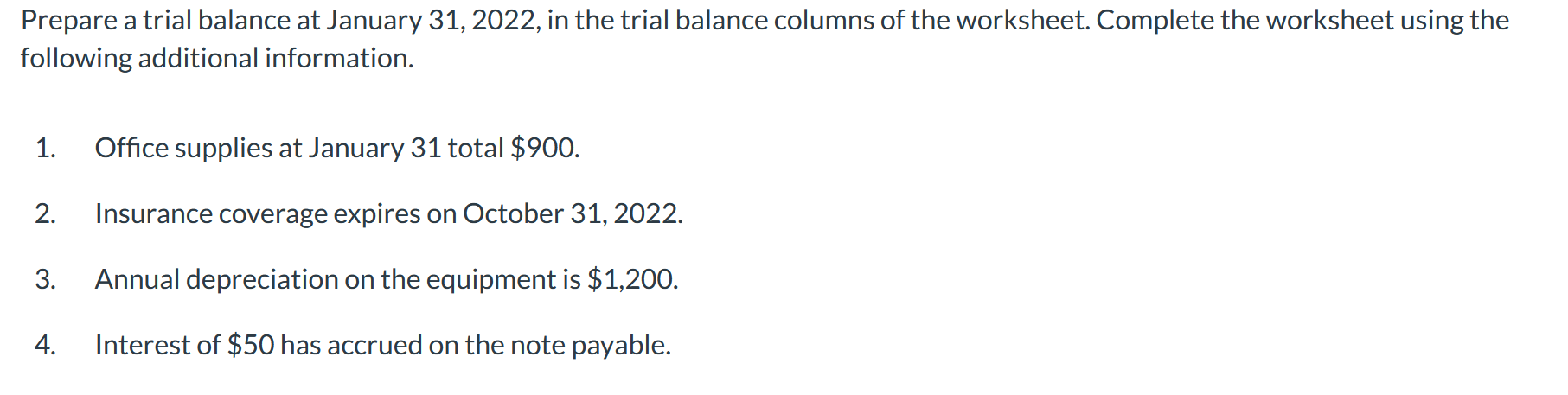

Trial balance adjustments adjusted trial balance income statement balance sheet Cash enter a debit balance enter a credit balance enter a debit amount enter a

Trial balance adjustments adjusted trial balance income statement balance sheet

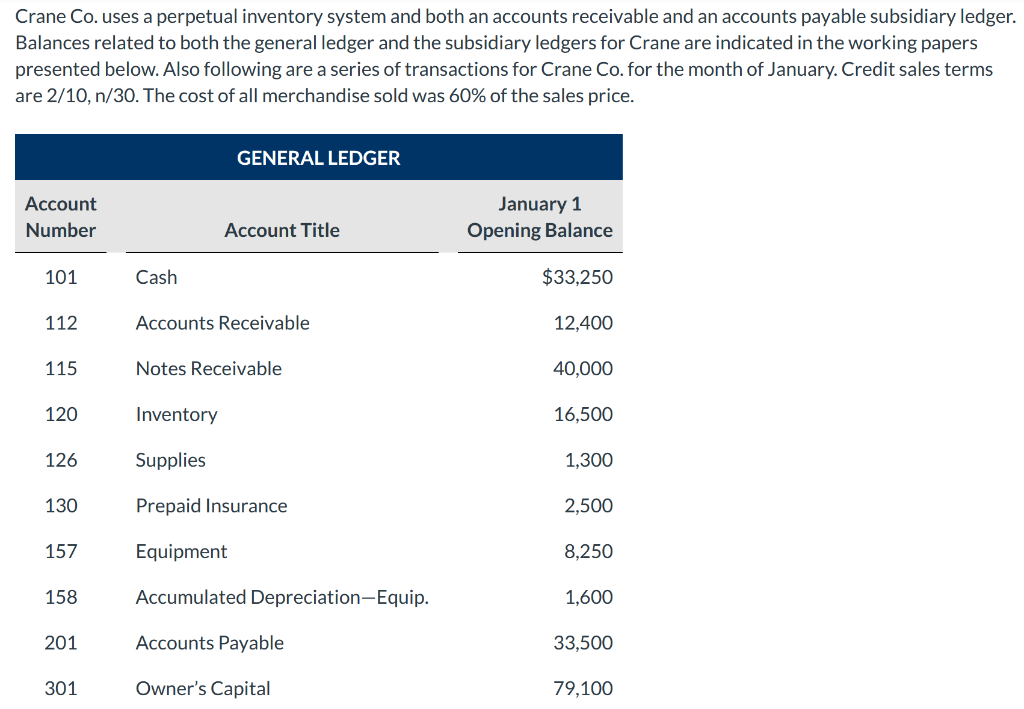

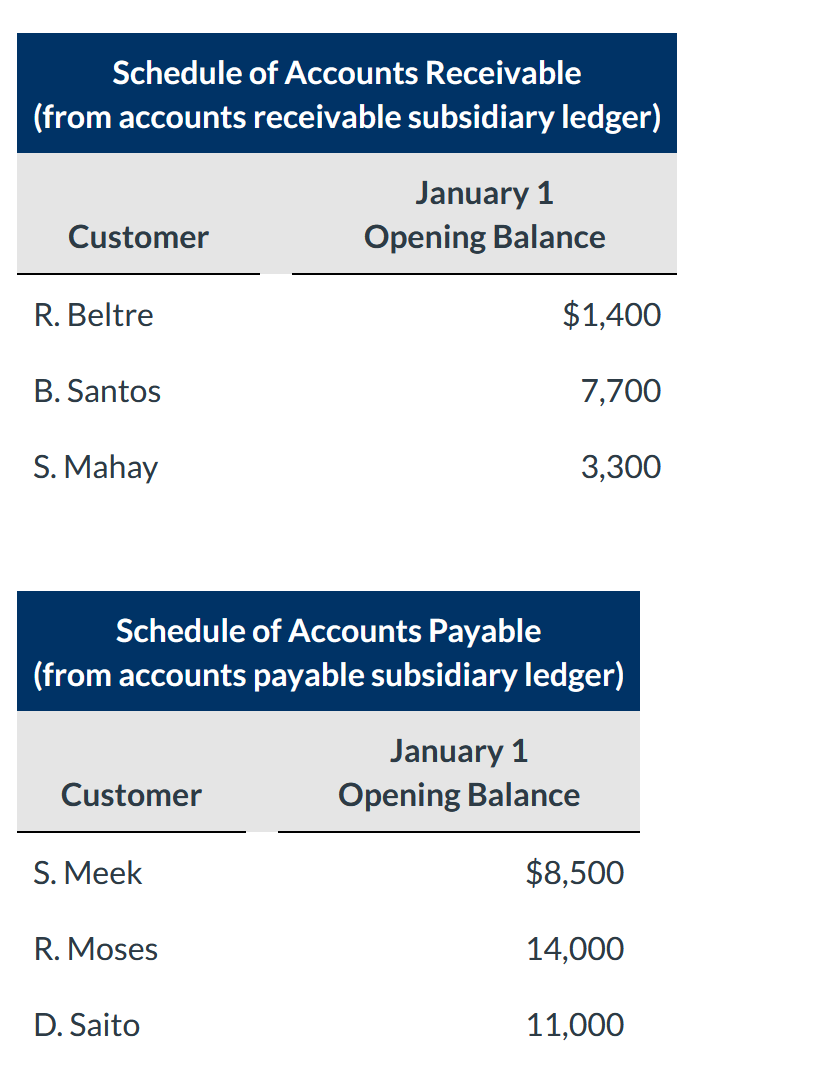

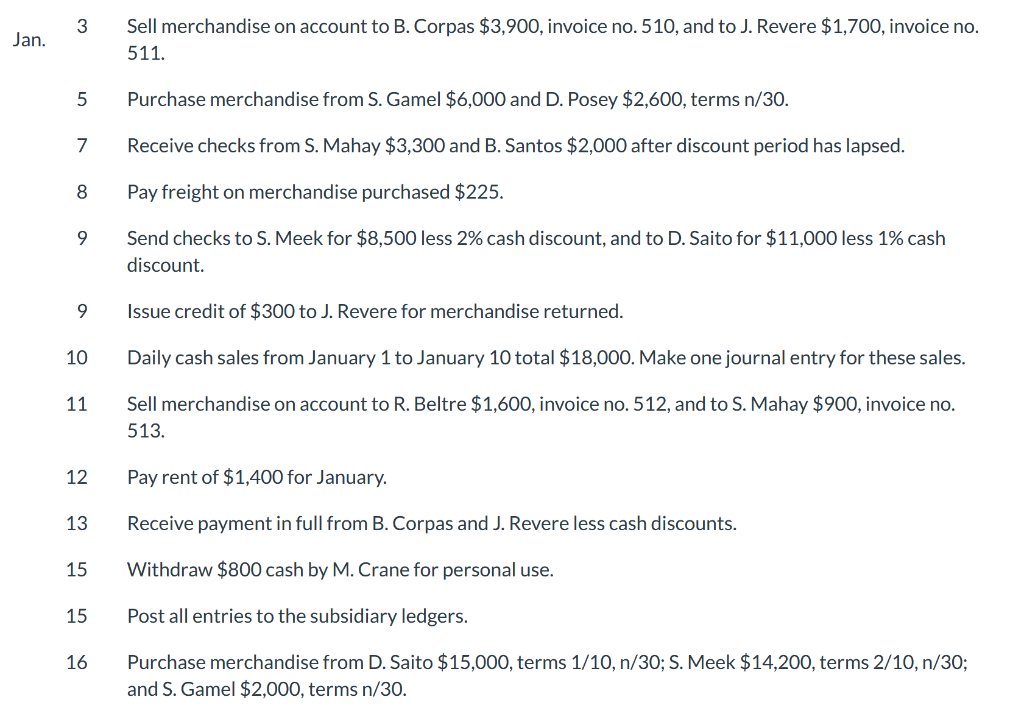

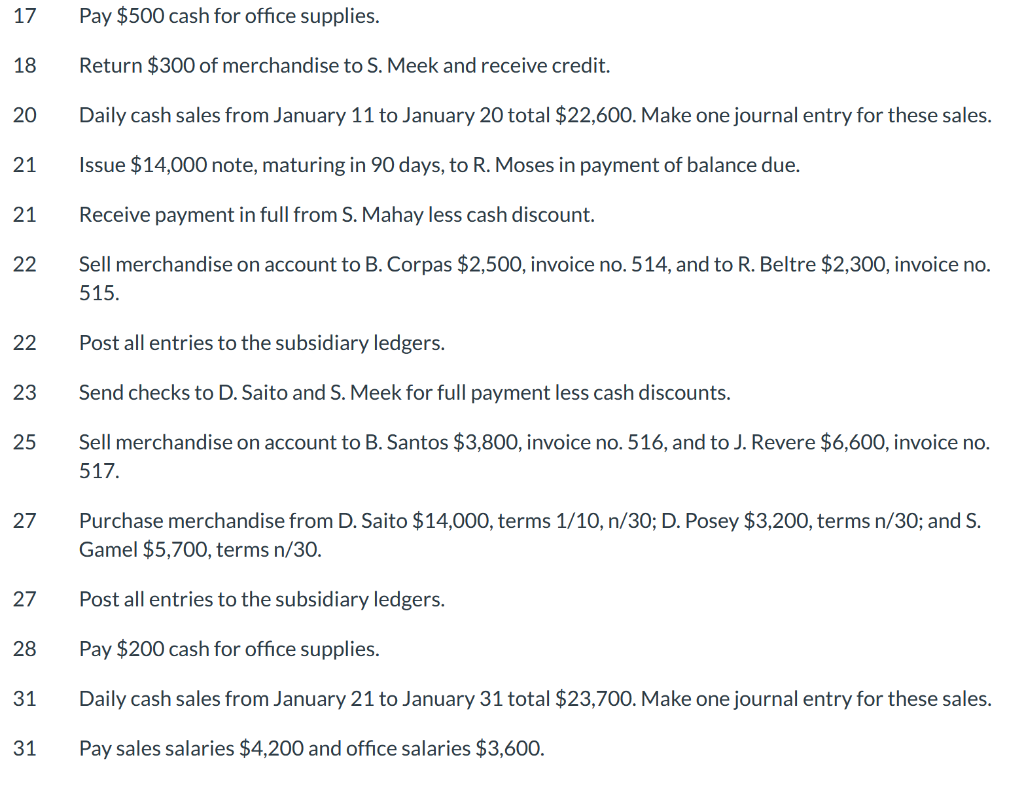

| Cash | enter a debit balance | enter a credit balance | enter a debit amount | enter a credit amount | enter an adjusted debit balance | enter an adjusted credit balance | enter a debit amount | enter a credit amount | enter a debit balance | enter a credit balance | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Accounts Receivable | enter a debit balance | enter a credit balance | enter a debit amount | enter a credit amount | enter an adjusted debit balance | enter an adjusted credit balance | enter a debit amount | enter a credit amount | enter a debit balance | enter a credit balance | ||||||||||

| Notes Receivable | enter a debit balance | enter a credit balance | enter a debit amount | enter a credit amount | enter an adjusted debit balance | enter an adjusted credit balance | enter a debit amount | enter a credit amount | enter a debit balance | enter a credit balance | ||||||||||

| Inventory | enter a debit balance | enter a credit balance | enter a debit amount | enter a credit amount | enter an adjusted debit balance | enter an adjusted credit balance | enter a debit amount | enter a credit amount | enter a debit balance | enter a credit balance | ||||||||||

| Supplies | enter a debit balance | enter a credit balance | enter a debit amount | enter a credit amount | enter an adjusted debit balance | enter an adjusted credit balance | enter a debit amount | enter a credit amount | enter a debit balance | enter a credit balance | ||||||||||

| Prepaid Insurance | enter a debit balance | enter a credit balance | enter a debit amount | enter a credit amount | enter an adjusted debit balance | enter an adjusted credit balance | enter a debit amount | enter a credit amount | enter a debit balance | enter a credit balance | ||||||||||

| Equipment | enter a debit balance | enter a credit balance | enter a debit amount | enter a credit amount | enter an adjusted debit balance | enter an adjusted credit balance | enter a debit amount | enter a credit amount | enter a debit balance | enter a credit balance | ||||||||||

| Accum. DepreciationEquipment | enter a debit balance | enter a credit balance | enter a debit amount | enter a credit amount | enter an adjusted debit balance | enter an adjusted credit balance | enter a debit amount | enter a credit amount | enter a debit balance | enter a credit balance | ||||||||||

| Notes Payable | enter a debit balance | enter a credit balance | enter a debit amount | enter a credit amount | enter an adjusted debit balance | enter an adjusted credit balance | enter a debit amount | enter a credit amount | enter a debit balance | enter a credit balance | ||||||||||

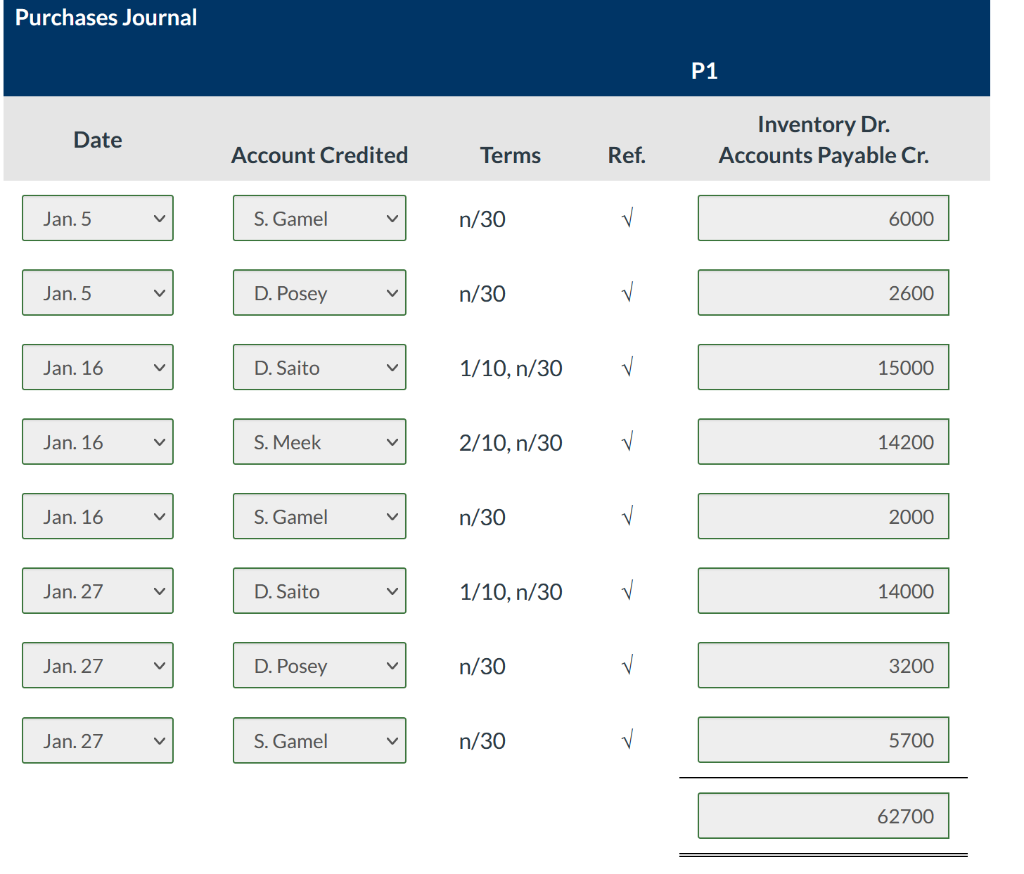

| Accounts Payable | enter a debit balance | enter a credit balance | enter a debit amount | enter a credit amount | enter an adjusted debit balance | enter an adjusted credit balance | enter a debit amount | enter a credit amount | enter a debit balance | enter a credit balance | ||||||||||

| Owners Capital | enter a debit balance | enter a credit balance | enter a debit amount | enter a credit amount | enter an adjusted debit balance | enter an adjusted credit balance | enter a debit amount | enter a credit amount | enter a debit balance | enter a credit balance | ||||||||||

| Owners Drawings | enter a debit balance | enter a credit balance | enter a debit amount | enter a credit amount | enter an adjusted debit balance | enter an adjusted credit balance | enter a debit amount | enter a credit amount | enter a debit balance | enter a credit balance | ||||||||||

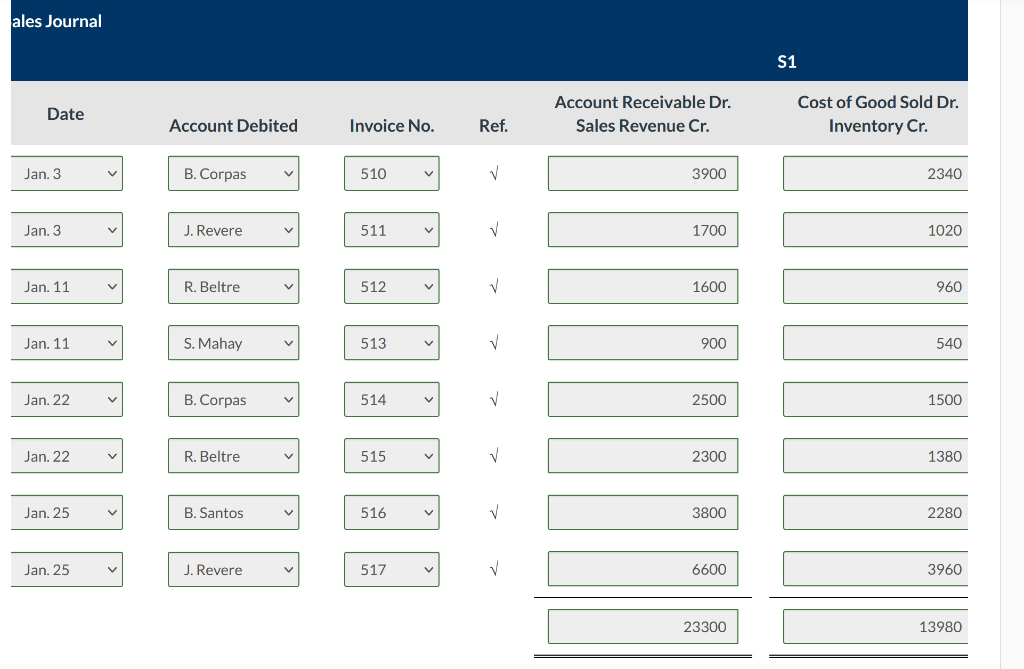

| Sales Revenue | enter a debit balance | enter a credit balance | enter a debit amount | enter a credit amount | enter an adjusted debit balance | enter an adjusted credit balance | enter a debit amount | enter a credit amount | enter a debit balance | enter a credit balance | ||||||||||

| Sales Returns and Allowances | enter a debit balance | enter a credit balance | enter a debit amount | enter a credit amount | enter an adjusted debit balance | enter an adjusted credit balance | enter a debit amount | enter a credit amount | enter a debit balance | enter a credit balance | ||||||||||

| Sales Discounts | enter a debit balance | enter a credit balance | enter a debit amount | enter a credit amount | enter an adjusted debit balance | enter an adjusted credit balance | enter a debit amount | enter a credit amount | enter a debit balance | enter a credit balance | ||||||||||

| Cost of Goods Sold | enter a debit balance | enter a credit balance | enter a debit amount | enter a credit amount | enter an adjusted debit balance | enter an adjusted credit balance | enter a debit amount | enter a credit amount | enter a debit balance | enter a credit balance | ||||||||||

| Salaries and Wages Expense | enter a debit balance | enter a credit balance | enter a debit amount | enter a credit amount | enter an adjusted debit balance | enter an adjusted credit balance | enter a debit amount | enter a credit amount | enter a debit balance | enter a credit balance | ||||||||||

| Rent Expense | enter a debit balance | enter a credit balance | enter a debit amount | enter a credit amount | enter an adjusted debit balance | enter an adjusted credit balance | enter a debit amount | enter a credit amount | enter a debit balance | enter a credit balance | ||||||||||

| Totals | enter a total for the debit column | enter a total for the credit column | ||||||||||||||||||

| Interest Payable | enter a debit amount | enter a credit amount | enter an adjusted debit balance | enter an adjusted credit balance | enter a debit amount | enter a credit amount | enter a debit balance | enter a credit balance | ||||||||||||

| Supplies Expense | enter a debit amount | enter a credit amount | enter an adjusted debit balance | enter an adjusted credit balance | enter a debit amount | enter a credit amount | enter a debit balance | enter a credit balance | ||||||||||||

| Insurance Expense | enter a debit amount | enter a credit amount | enter an adjusted debit balance | enter an adjusted credit balance | enter a debit amount | enter a credit amount | enter a debit balance | enter a credit balance | ||||||||||||

| Depreciation Expense | enter a debit amount | enter a credit amount | enter an adjusted debit balance | enter an adjusted credit balance | enter a debit amount | enter a credit amount | enter a debit balance | enter a credit balance | ||||||||||||

| Interest Expense | enter a debit amount | enter a credit amount | enter an adjusted debit balance | enter an adjusted credit balance | enter a debit amount | enter a credit amount | enter a debit balance | enter a credit balance | ||||||||||||

| Totals | enter a total for the debit column | enter a total for the credit column | enter a total for the debit column | enter a total for the credit column | enter a total for the debit column | enter a total for the credit column | enter a total for the debit column | enter a total for the credit column | ||||||||||||

| Net Income | enter a total net income or loss amount | enter a total net income or loss amount | enter a total net income or loss amount | enter a total net income or loss amount | ||||||||||||||||

| Totals |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started