Answered step by step

Verified Expert Solution

Question

1 Approved Answer

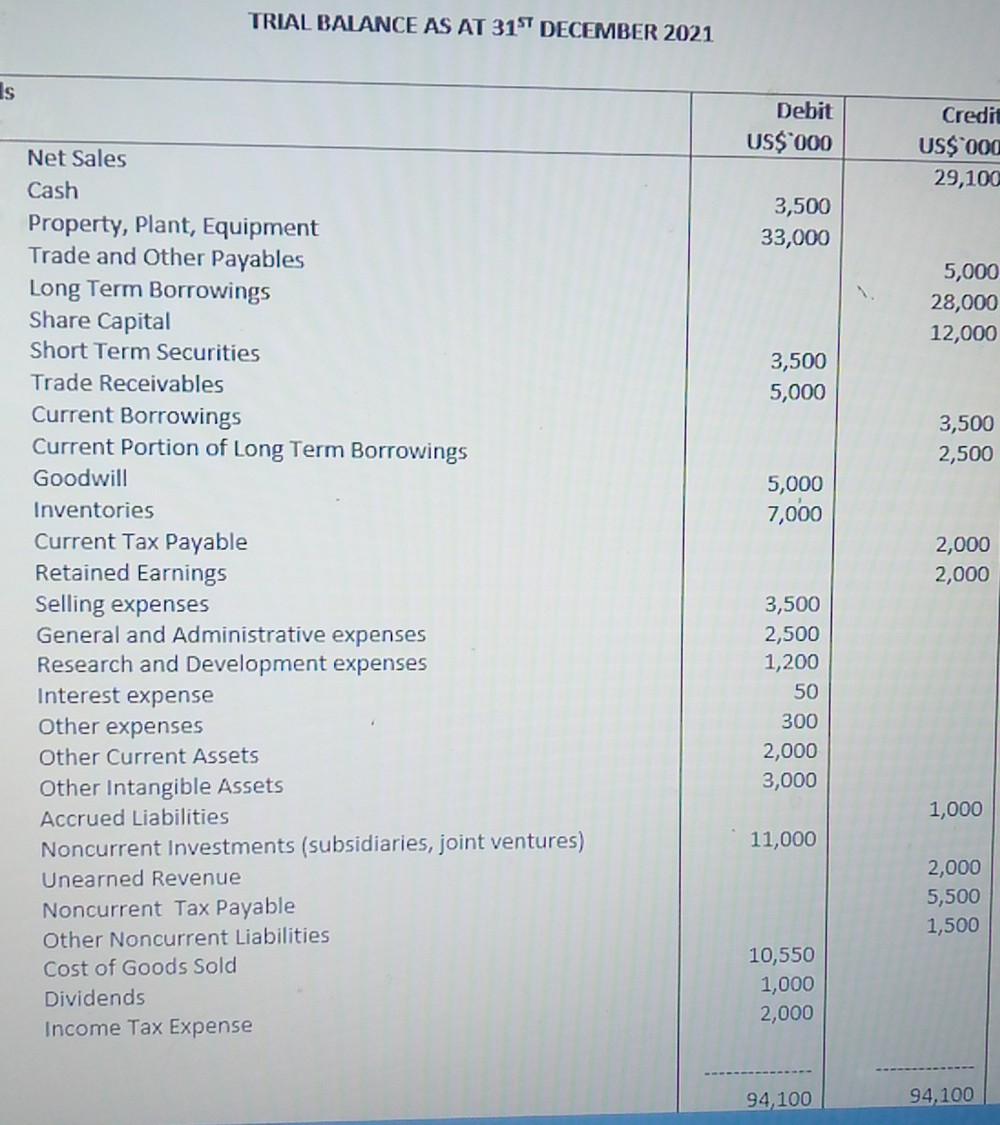

TRIAL BALANCE AS AT 31ST DECEMBER 2021 Is Debit US$ 000 Credi US$ 000 29,100 3,500 33,000 5,000 28,000 12,000 3,500 5,000 3,500 2,500 5,000

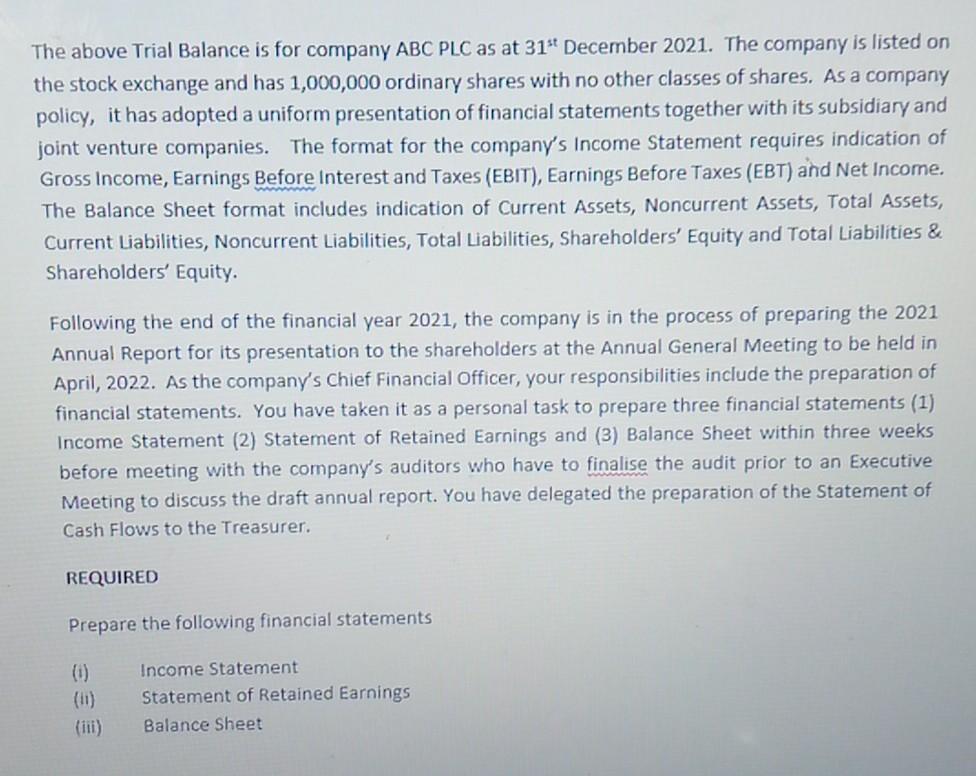

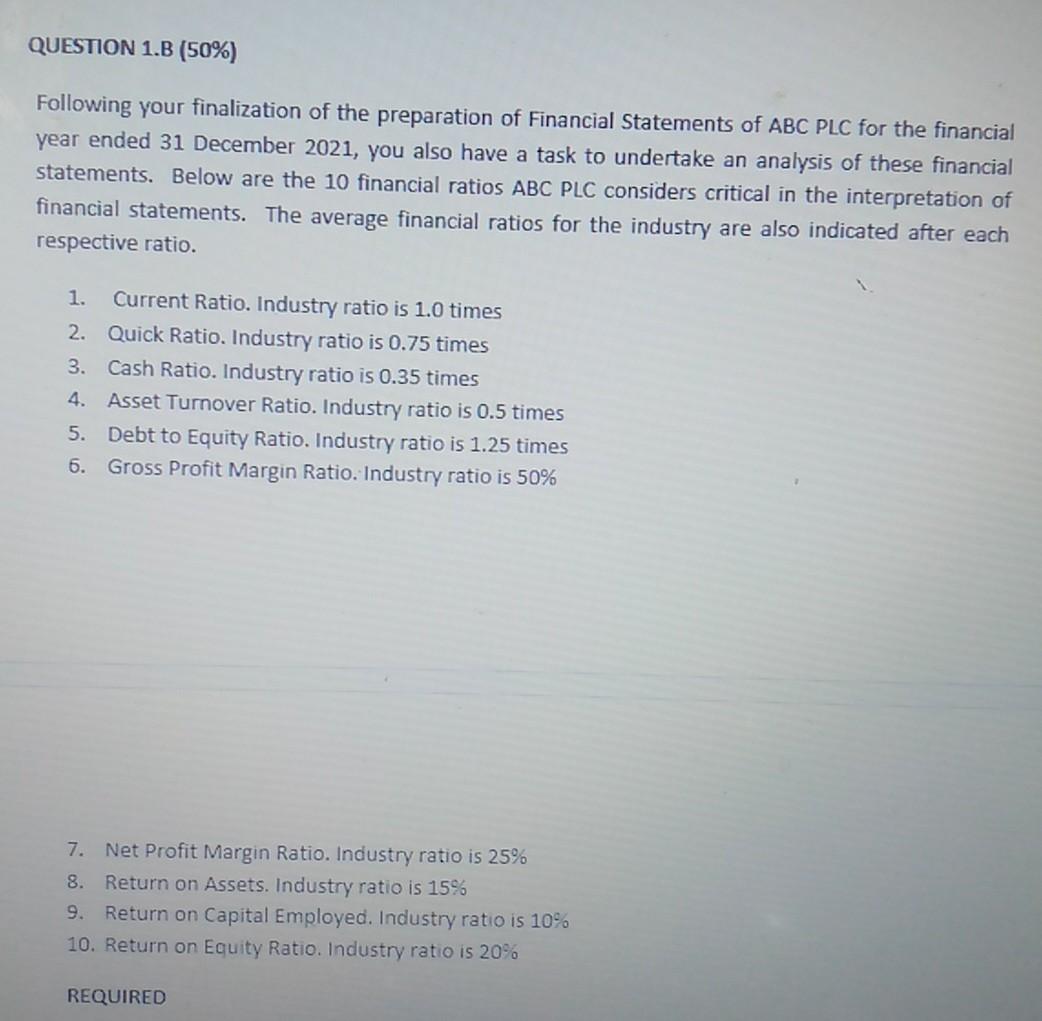

TRIAL BALANCE AS AT 31ST DECEMBER 2021 Is Debit US$ 000 Credi US$ 000 29,100 3,500 33,000 5,000 28,000 12,000 3,500 5,000 3,500 2,500 5,000 7,000 2,000 2,000 Net Sales Cash Property, Plant, Equipment Trade and Other Payables Long Term Borrowings Share Capital Short Term Securities Trade Receivables Current Borrowings Current Portion of Long Term Borrowings Goodwill Inventories Current Tax Payable Retained Earnings Selling expenses General and Administrative expenses Research and Development expenses Interest expense Other expenses Other Current Assets Other Intangible Assets Accrued Liabilities Noncurrent Investments (subsidiaries, joint ventures) Unearned Revenue Noncurrent Tax Payable Other Noncurrent Liabilities Cost of Goods Sold Dividends Income Tax Expense 3,500 2,500 1,200 50 300 2,000 3,000 1,000 11,000 2,000 5,500 1,500 10,550 1,000 2,000 94,100 94,100 The above Trial Balance is for company ABC PLC as at 31 December 2021. The company is listed on the stock exchange and has 1,000,000 ordinary shares with no other classes of shares. As a company policy, it has adopted a uniform presentation of financial statements together with its subsidiary and joint venture companies. The format for the company's Income Statement requires indication of Gross Income, Earnings Before Interest and Taxes (EBIT), Earnings Before Taxes (EBT) and Net Income. The Balance Sheet format includes indication of Current Assets, Noncurrent Assets, Total Assets, Current Liabilities, Noncurrent Liabilities, Total Liabilities, Shareholders' Equity and Total Liabilities & Shareholders' Equity. Following the end of the financial year 2021, the company is in the process of preparing the 2021 Annual Report for its presentation to the shareholders at the Annual General Meeting to be held in April, 2022. As the company's Chief Financial Officer, your responsibilities include the preparation of financial statements. You have taken it as a personal task to prepare three financial statements (1) Income Statement (2) Statement of Retained Earnings and (3) Balance Sheet within three weeks before meeting with the company's auditors who have to finalise the au prior an Executive Meeting to discuss the draft annual report. You have delegated the preparation of the Statement of Cash Flows to the Treasurer. REQUIRED Prepare the following financial statements (1) Income Statement Statement of Retained Earnings Balance Sheet QUESTION 1.B (50%) Following your finalization of the preparation of Financial Statements of ABC PLC for the financial year ended 31 December 2021, you also have a task to undertake an analysis of these financial statements. Below are the 10 financial ratios ABC PLC considers critical in the interpretation of financial statements. The average financial ratios for the industry are also indicated after each respective ratio. 1. Current Ratio. Industry ratio is 1.0 times 2. Quick Ratio. Industry ratio is 0.75 times 3. Cash Ratio. Industry ratio is 0.35 times 4. Asset Turnover Ratio. Industry ratio is 0.5 times 5. Debt to Equity Ratio. Industry ratio is 1.25 times 6. Gross Profit Margin Ratio. Industry ratio is 50% 7. Net Profit Margin Ratio. Industry ratio is 25% 8. Return on Assets. Industry ratio is 15% 9. Return on Capital Employed. Industry ratio is 10% 10. Return on Equity Ratio. Industry ratio is 20% REQUIRED REQUIRED (i) Calculate each of the ratios listed above. Explain your understanding of each of the above listed ratios on the operations of the company. Indicate how ABC PLC's performance compares with other companies in the same industry

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started