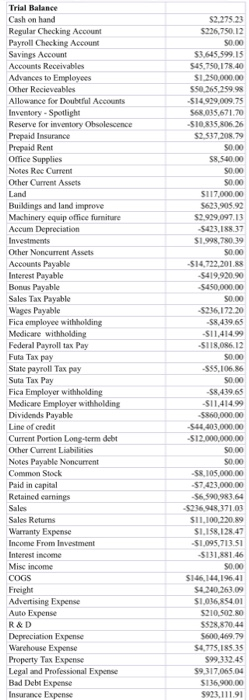

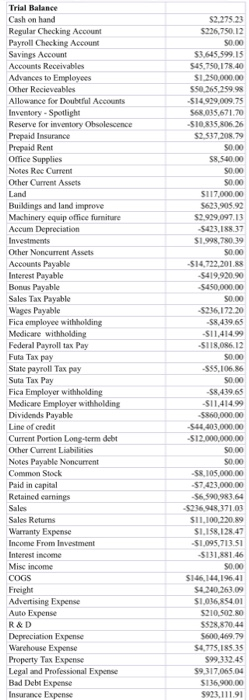

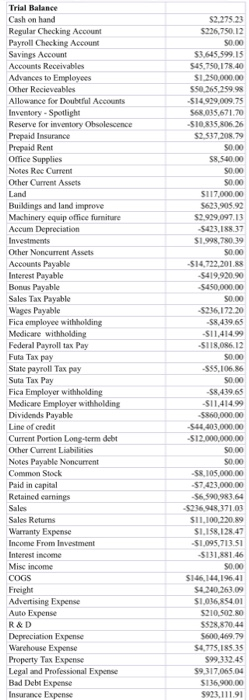

trial balance

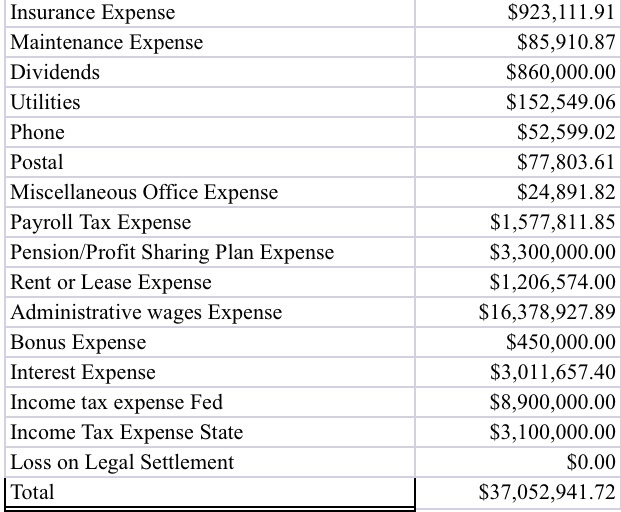

Income Statement

Question:

How to create a statement of owner's equity?

S2.275.23 $216,750,12 50.00 $3.645 599,15 $45.750,178.40 SI 30,000.00 550.265.259.98 S1492900975 568 035.671.70 -$10.835.806.26 $2.537208.79 $0.00 Trial Balance Cash on hand Regular Checking Account Payroll Checking Account Savings Account Accounts Receivables Advances to Employees Other Recieveables Allowance for Doubtful Accounts Inventory - Spotlight Reserve for inventory Obsolescence Prepaid Insurance Prepaid Rent Office Supplies Notes Ree Current Other Current Assets Land Buildings and land improve Machinery equip office furniture Accum Depreciation Investments Other Noncurrent Assets Accounts Payable Interest Payable Bonus Payable Sales Tax Payable Wages Payable Fica employee withholding Medicare withholding Federal Payroll tax Pay Futa Taxpay State payroll Tax pay Suta Tax Pay Fica Employer withholding Medicare Employer withholding Dividends Payable Line of credit Current Portion Long-term debt Other Current Liabilities Notes Payable Noncurrent Common Stock Paid in capital Retained earnings Sales Sales Returns Warranty Expense Income From Investment Interest in me Mise income COGS Freight Advertising Expense Auto Expense R& D Depreciation Expense Warehouse Expense Property Tax Expense Legal and Professional Expense Bad Debt Expense Insurance Expense S850.00 S0.00 $0.00 S117,000.00 $623.905 92 $2.919,097.13 542318837 $1.998 780.39 S0.00 $1472.2013 -$419.920.90 -$450,000.00 S0.00 -$236.172.20 58 419.65 $11.41499 -SHIRO26.12 S0.00 -555.106.86 SO 00 -58,439.65 $11.41499 $850,000.00 564.403,000.00 $12.000.000,00 S0.00 $0.00 S8105.000.00 -57.423.000.00 $6.390983.64 -$21694, 171,03 SI1.100.220.89 SIISRI247 $1.095,713.SI S131881.46 $0.00 $146.144.1964 $420.263.09 S1016,15400 5210 502.50 SS28.870.44 S600.469.79 $4.775,185.35 599,332.45 59117.065.04 $136.900.00 5923.111.91 Insurance Expense Maintenance Expense Dividends Utilities Phone Postal Miscellaneous Office Expense Payroll Tax Expense Pension/Profit Sharing Plan Expense Rent or Lease Expense Administrative wages Expense Bonus Expense Interest Expense Income tax expense Fed Income Tax Expense State Loss on Legal Settlement Total $923,111.91 $85,910.87 $860,000.00 $152,549.06 $52,599.02 $77,803.61 $24,891.82 $1,577,811.85 $3,300,000.00 $1,206,574.00 $16,378,927.89 $450,000.00 $3,011,657.40 $8,900,000.00 $3,100,000.00 $0.00 $37,052,941.72 Income Statement Sales Sales Returns Net Sales Revenue Cost of Goods Sold (COGS) Gross Profit -236,948,371.03 11.100.220.89 -248,048,591.92 146,144,196.41 -394,192,788.33 Operating Expenses (OE): Warranty Expense Freight Advertising Expense Auto Expenses Research & Development Depreciation Expense Warehouse Salaries Property Tax Expense Legal and Professional Expense Bad Debt Expense Insurance Expense Maintenance Expense Dividends Utilities 1,158,128.47 4,240,263.09 1,036,854.01 210,502.8 528,870.44 600,469.79 4,775,185.35 99,332.45 9,317,065.04 13,690,000 923.111.91 85,910.87 860,000 152,549.06 52,599.02 77,803.61 24,891.82 1,577,811.85 3,300,000 1.206,574 16,378,927.89 450,000 8.900.000 3.100.000 72,746,851.47 Phone Postal Miscellaneous Office Expense Payroll Tax Expense Pension Profit-Sharing Plan Ex Rent or Lease Expense Administrative Wages Expense Bonus Expense Income Tax Expense-Federal Income Tax Expense-State Total OE Income from Operations -466.939,639.8 Other Revenue and Expense Income from investments Interest Income Interest Expense Miscellaneous Income Loss on Legal Settlement -1,095,713.51 -131,881.46 3,011,657.4 1,784,062.43 Net Income -465,155,577.37