Answered step by step

Verified Expert Solution

Question

1 Approved Answer

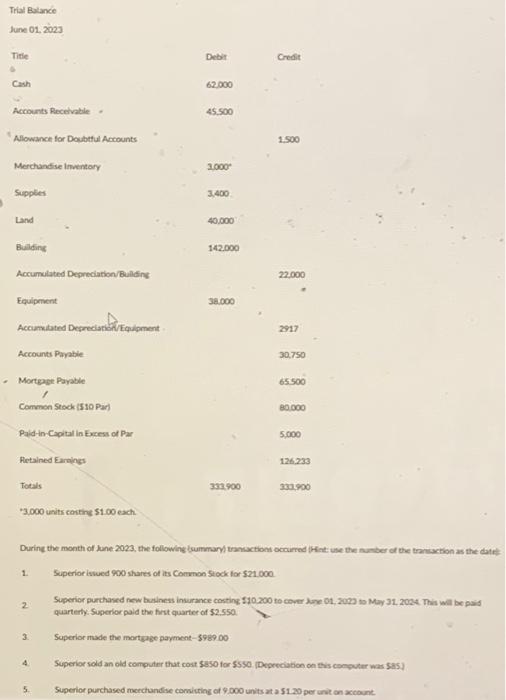

Trial Balance June 01, 2023 B Title 0 Cash Accounts Receivable Allowance for Doubtful Accounts Merchandise Inventory Supplies Land Building Accumulated Depreciation/Building Equipment Accumulated Depreciation/Equipment.

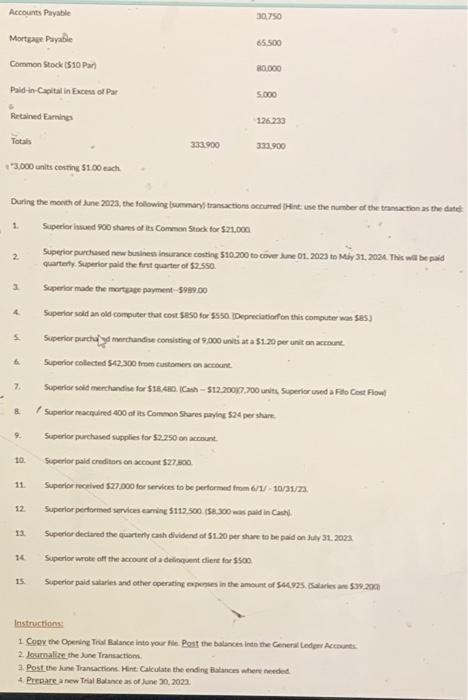

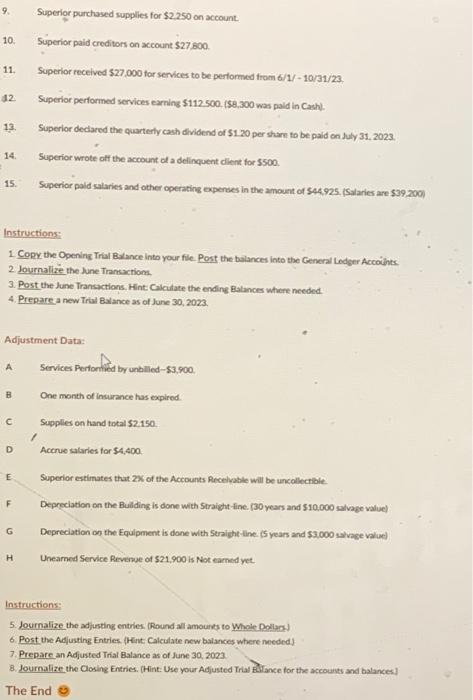

Trial Balance June 01, 2023 B Title 0 Cash Accounts Receivable Allowance for Doubtful Accounts Merchandise Inventory Supplies Land Building Accumulated Depreciation/Building Equipment Accumulated Depreciation/Equipment. Equipment Accounts Payable Mortgage Payable Common Stock ($10 Par) Paid-in-Capital in Excess of Par Retained Earnings Totals *3,000 units costing $1.00 each. 1. 2. 3. 4. Debit 5. 62,000 45,500 3,000* 3,400 40,000 142,000 38,000 333,900 Superior issued 900 shares of its Common Stock for $21,000. Credit 1.500 Superior made the mortgage payment-$989.00 22,000 2917 During the month of June 2023, the following (summary) transactions occurred (Hint: use the number of the transaction as the date): 30,750 65,500 80,000 5,000 126,233 333,900 Superior purchased new business insurance costing $10,200 to cover June 01, 2023 to May 31, 2024. This will be paid quarterly. Superior paid the first quarter of $2,550. Superior sold an old computer that cost $850 for $550. (Depreciation on this computer was $85.) Superior purchased merchandise consisting of 9,000 units at a $1.20 per unit on account.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started