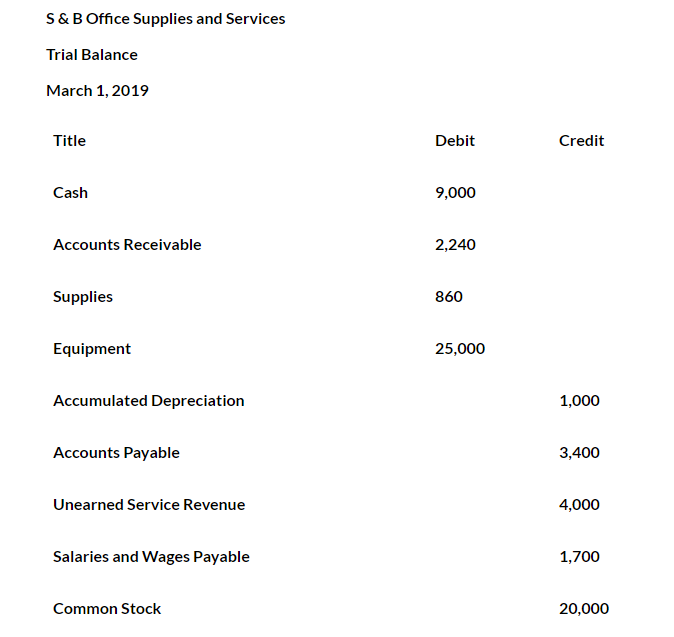

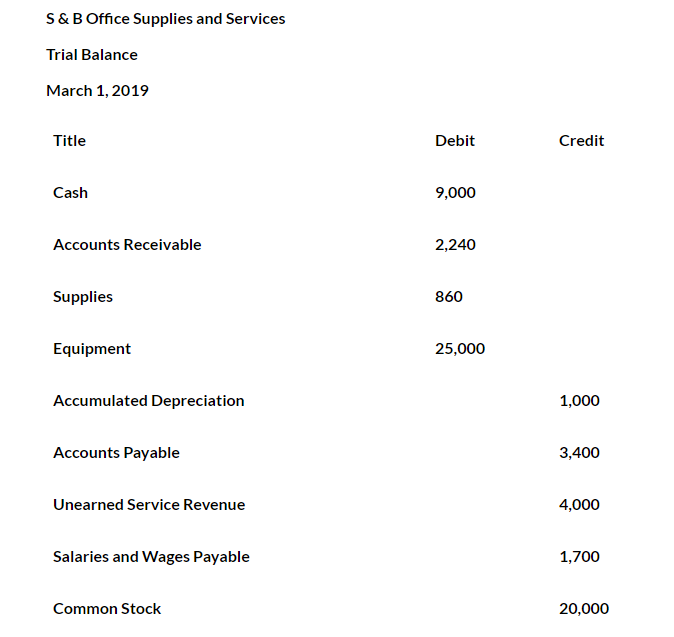

Trial Balance

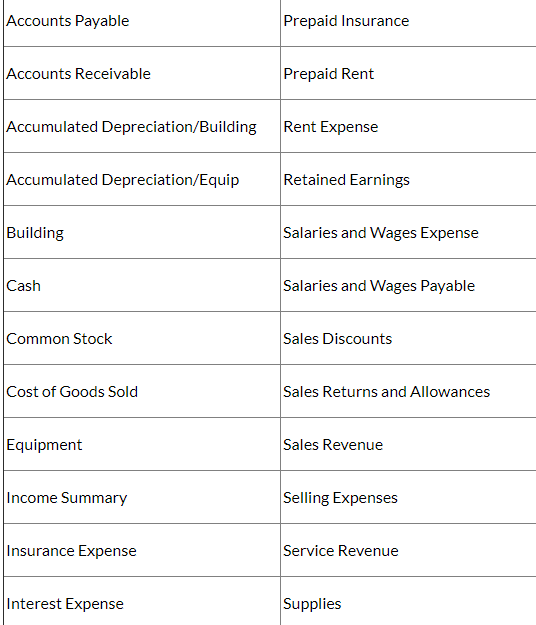

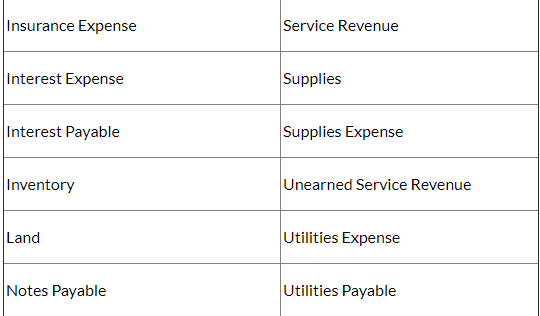

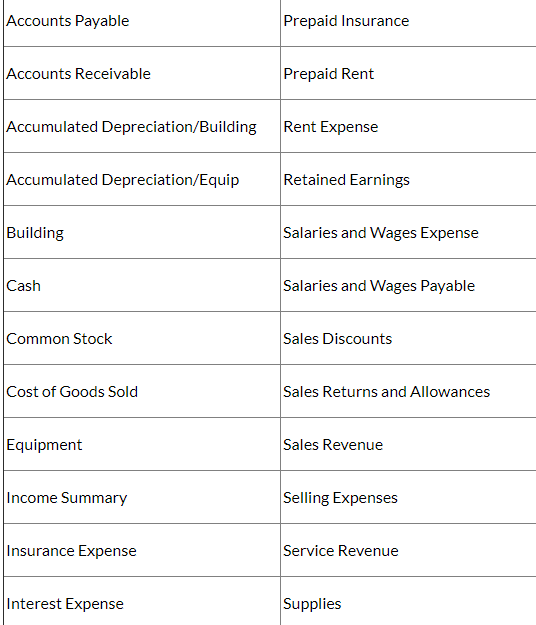

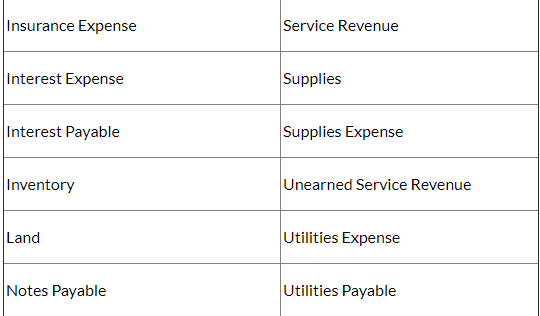

List of Account Titles to use.

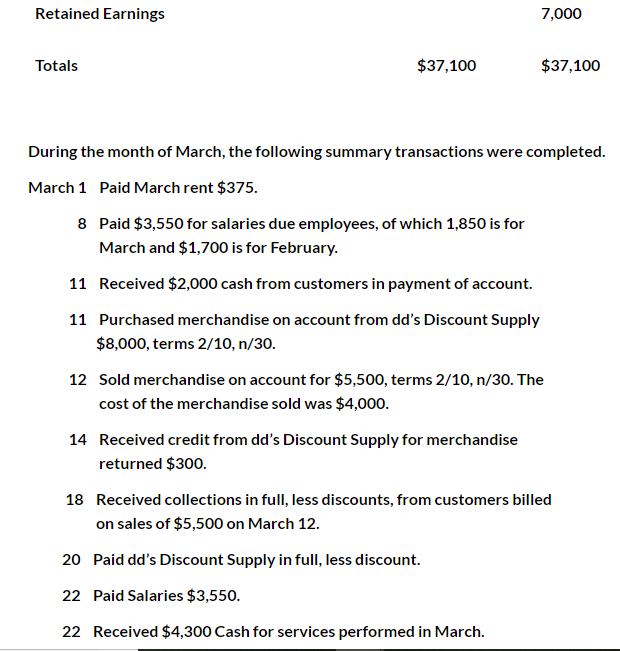

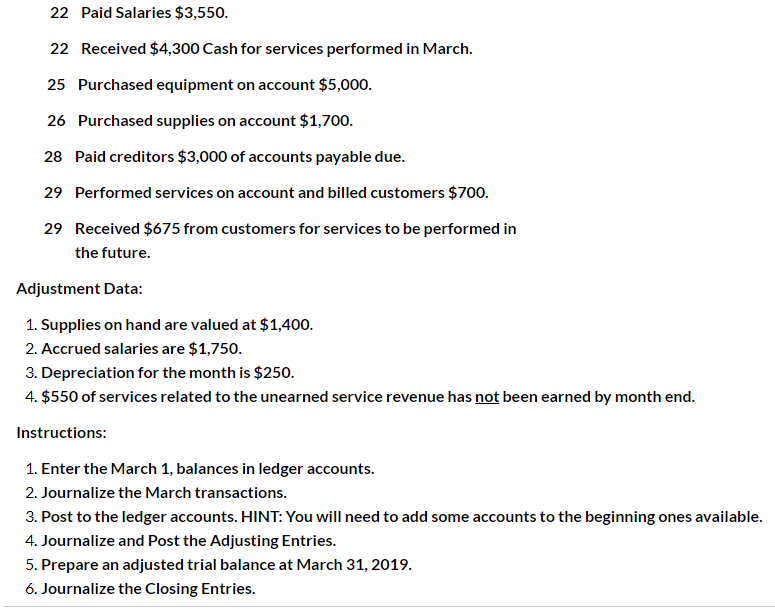

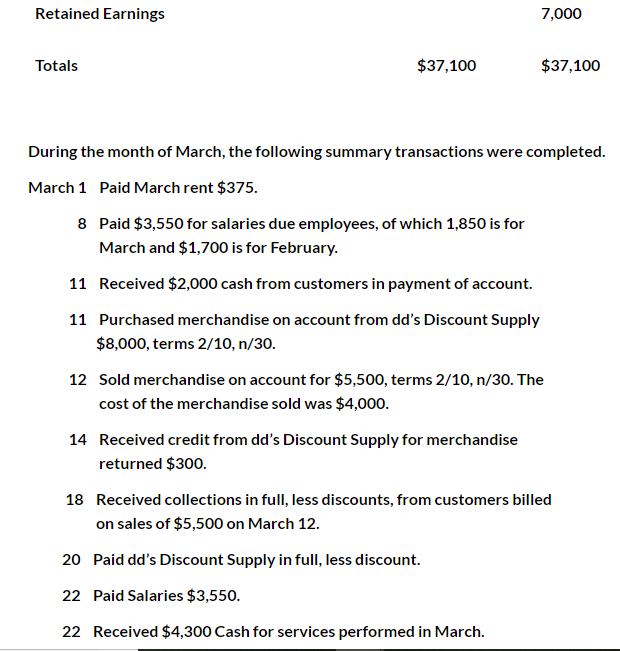

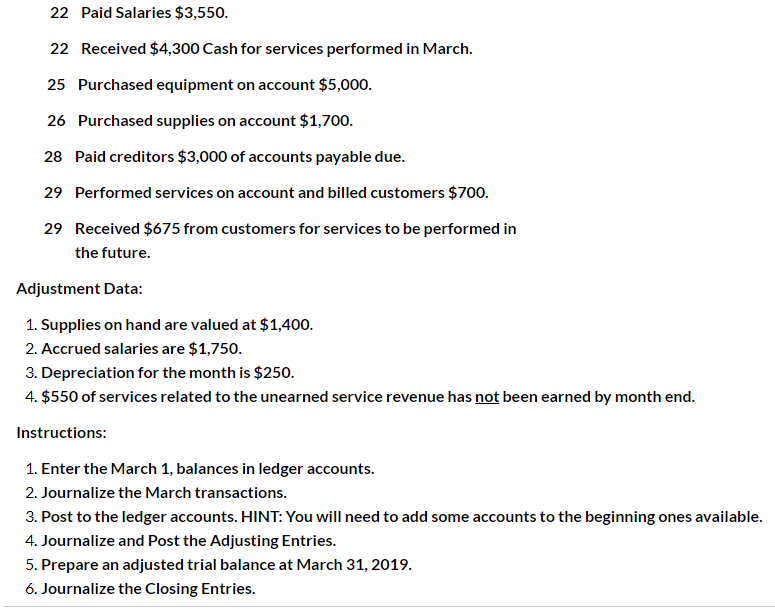

S & B Office Supplies and Services Trial Balance March 1, 2019 Title Debit Credit 9,000 Cash Accounts Receivable 2,240 Supplies 860 25,000 Equipment Accumulated Depreciation 1,000 Accounts Payable 3,400 Unearned Service Revenue 4,000 Salaries and Wages Payable 1,700 20,000 Common Stock Retained Earnings 7,000 $37,100 Totals $37,100 During the month of March, the following summary transactions were completed. Paid March rent $375. March 1 Paid $3,550 for salaries due employees, of which 1,850 is for 8 March and $1,700 is for February. Received $2,000 cash from customers in payment of account. 11 11 Purchased merchandise on account from dd's Discount Supply $8,000, terms 2/10, n/30. Sold merchandise on account for $5,500, terms 2/10, n/30. The 12 cost of the merchandise sold was $4,000. Received credit from dd's Discount Supply for merchandise 14 returned $300. 18 Received collections in full, less discounts, from customers billed on sales of $5,500 on March 12. 20 Paid dd's Discount Supply in full, less discount. 22 Paid Salaries $3,550. 22 Received $4,300 Cash for services performed in March 22 Paid Salaries $3,550. 22 Received $4,300 Cash for services performed in March 25 Purchased equipment on account $5,000. 26 Purchased supplies on account $1,700. Paid creditors $3,000 of accounts payable due. 28 29 Performed services on account and billed customers $700. 29 Received $675 from customers for services to be performed in the future Adjustment Data: 1. Supplies on hand are valued at $1,400. 2. Accrued salaries are $1,750. 3. Depreciation for the month is $250. 4. $550 of services related to the unearned service revenue has not been earned by month end. Instructions: 1. Enter the March 1, balances in ledger accounts. 2. Journalize the March transactions 3. Post to the ledger accounts. HINT: You will need to add some accounts to the beginning ones available. 4. Journalize and Post the Adjusting Entries 5. Prepare an adjusted trial balance at March 31, 2019 6. Journalize the Closing Entries. Accounts Payable Prepaid Insurance Accounts Receivable Prepaid Rent |Accumulated Depreciation/Building Rent Expense Accumulated Depreciation/Equip Retained Earnings Building Salaries and Wages Expense Cash Salaries and Wages Payable Sales Discounts Common Stock Cost of Goods Sold Sales Returns and Allowances |Equipment Sales Revenue Income Summary Selling Expenses Insurance Expense Service Revenue Interest Expense Supplies Insurance Expense Service Revenue Interest Expense Supplies Supplies Expense Interest Payable Inventory Unearned Service Revenue Utilities Expense Land Utilities Payable Notes Payable