Answered step by step

Verified Expert Solution

Question

1 Approved Answer

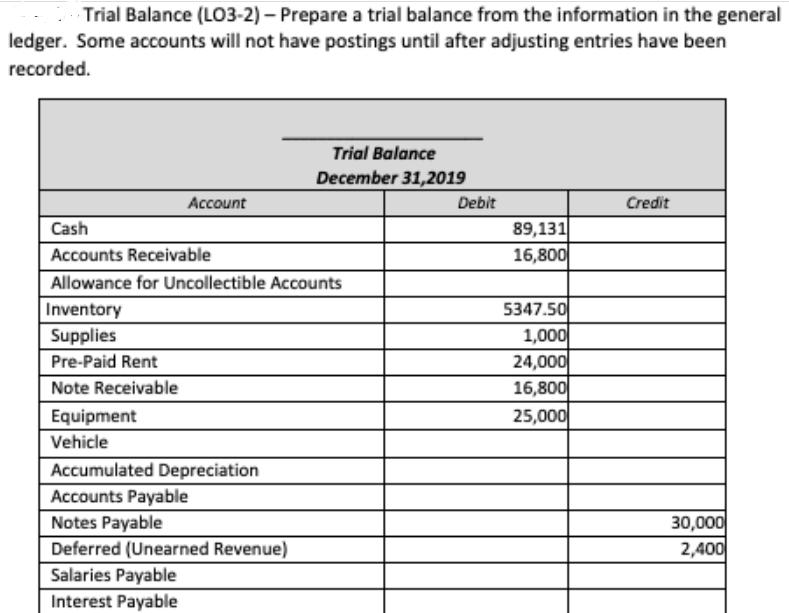

Trial Balance (LO3-2) - Prepare a trial balance from the information in the general ledger. Some accounts will not have postings until after adjusting

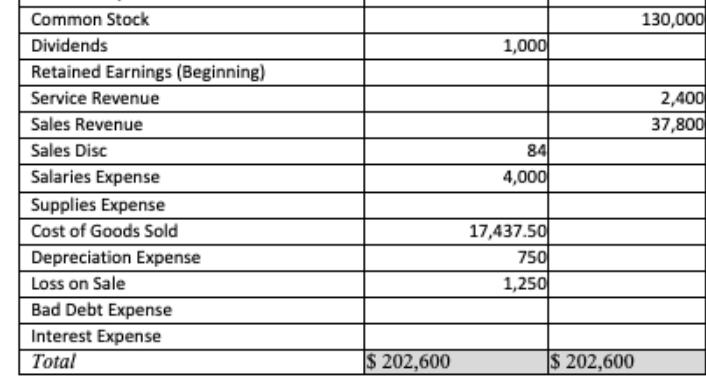

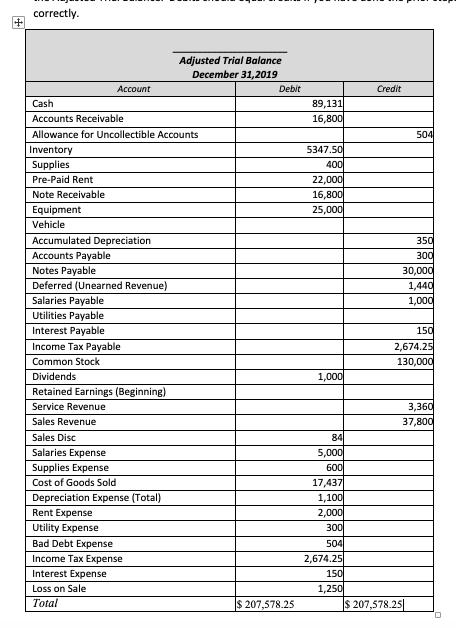

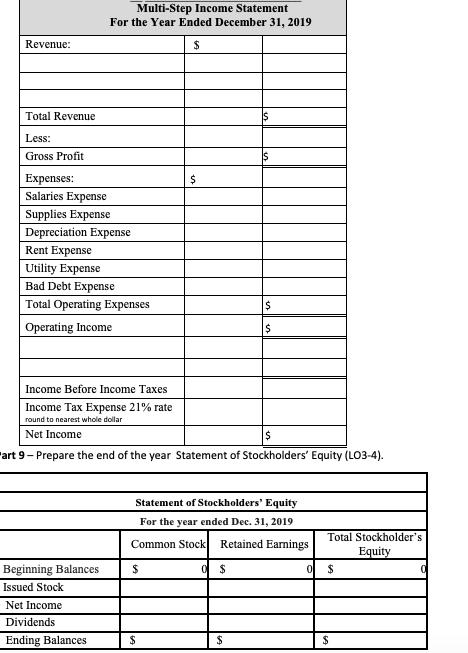

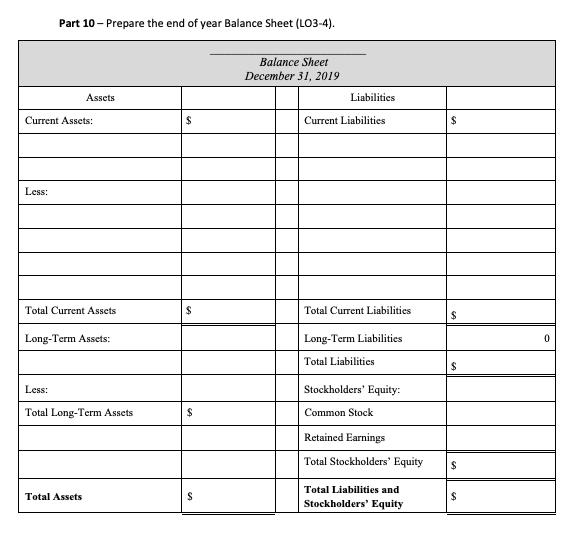

Trial Balance (LO3-2) - Prepare a trial balance from the information in the general ledger. Some accounts will not have postings until after adjusting entries have been recorded. Account Equipment Vehicle Cash Accounts Receivable Allowance for Uncollectible Accounts Inventory Supplies Pre-Paid Rent Note Receivable Trial Balance December 31,2019 Accumulated Depreciation Accounts Payable Notes Payable Deferred (Unearned Revenue) Salaries Payable Interest Payable Debit 89,131 16,800 5347.50 1,000 24,000 16,800 25,000 Credit 30,000 2,400 Common Stock Dividends Retained Earnings (Beginning) Service Revenue Sales Revenue Sales Disc Salaries Expense Supplies Expense Cost of Goods Sold Depreciation Expense Loss on Sale Bad Debt Expense Interest Expense Total $ 202,600 1,000 84 4,000 17,437.50 750 1,250 $ 202,600 130,000 2,400 37,800 + correctly. Equipment Vehicle Account Cash Accounts Receivable Allowance for Uncollectible Accounts Inventory Supplies Pre-Paid Rent Note Receivable Accumulated Depreciation. Accounts Payable Notes Payable Deferred (Unearned Revenue) Salaries Payable Utilities Payable Interest Payable Income Tax Payable Common Stock Dividends Retained Earnings (Beginning) Service Revenue Sales Revenue Sales Disc Salaries Expense Supplies Expense Cost of Goods Sold Depreciation Expense (Total) Rent Expense Utility Expense Bad Debt Expense Adjusted Trial Balance December 31,2019 Income Tax Expense Interest Expense Loss on Sale Total Debit $ 207,578.25 89,131 16,800 5347.50 400 22,000 16,800 25,000 1,000 84 5,000 600 17,437 1,100 2,000 300 504 2,674.25 150 1,250 Credit 504 $207,578.25 350 300 30,000 1,440 1,000 150 2,674.25 130,000 3,360 37,800 D Part 5 - Adjusting journal Entries -(LO3-3)-Record the adjusting entries to the general journal Adj-1 Adj-2 Adj-3 Adj-4 Adj-5 Adj-6 Adj-7 Adj-8 Adj-9 Dec. 31 Dec. 31 Dec. 31 Dec. 31 Dec. 31 Dec. 31 Dec. 31 Dec. 31 Dec. 31 Part 6- GENERAL LEDGER Post Adjusting Journal Entries and Ending balances to the general ledger accounts. Revenue: Total Revenue Less: Gross Profit Expenses: Salaries Expense Supplies Expense Depreciation Expense Multi-Step Income Statement For the Year Ended December 31, 2019 $ Rent Expense Utility Expense Bad Debt Expense Total Operating Expenses Operating Income Beginning Balances Issued Stock Net Income Dividends Ending Balances Income Before Income Taxes Income Tax Expense 21% rate round to nearest whole dollar Net Income $ art 9- Prepare the end of the year Statement of Stockholders' Equity (LO3-4). $ $ $ Statement of Stockholders' Equity For the year ended Dec. 31, 2019 Common Stock Retained Earnings $ 0$ $ $ 0 Total Stockholder's Equity $ $ 0 Part 10 - Prepare the end of year Balance Sheet (LO3-4). Less: Current Assets: Assets Total Current Assets Long-Term Assets: Less: Total Long-Term Assets Total Assets $ $ $ S Balance Sheet December 31, 2019 Liabilities Current Liabilities Total Current Liabilities Long-Term Liabilities Total Liabilities Stockholders' Equity: Common Stock Retained Earnings Total Stockholders' Equity Total Liabilities and Stockholders' Equity $ $ $ $ $ 0

Step by Step Solution

★★★★★

3.26 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Answer 1 2 3 4 5 6 7 8 9 Adjusting EnriesDec 31 General Journal Bad Debt Expense Allowance for Uncol...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started