Answered step by step

Verified Expert Solution

Question

1 Approved Answer

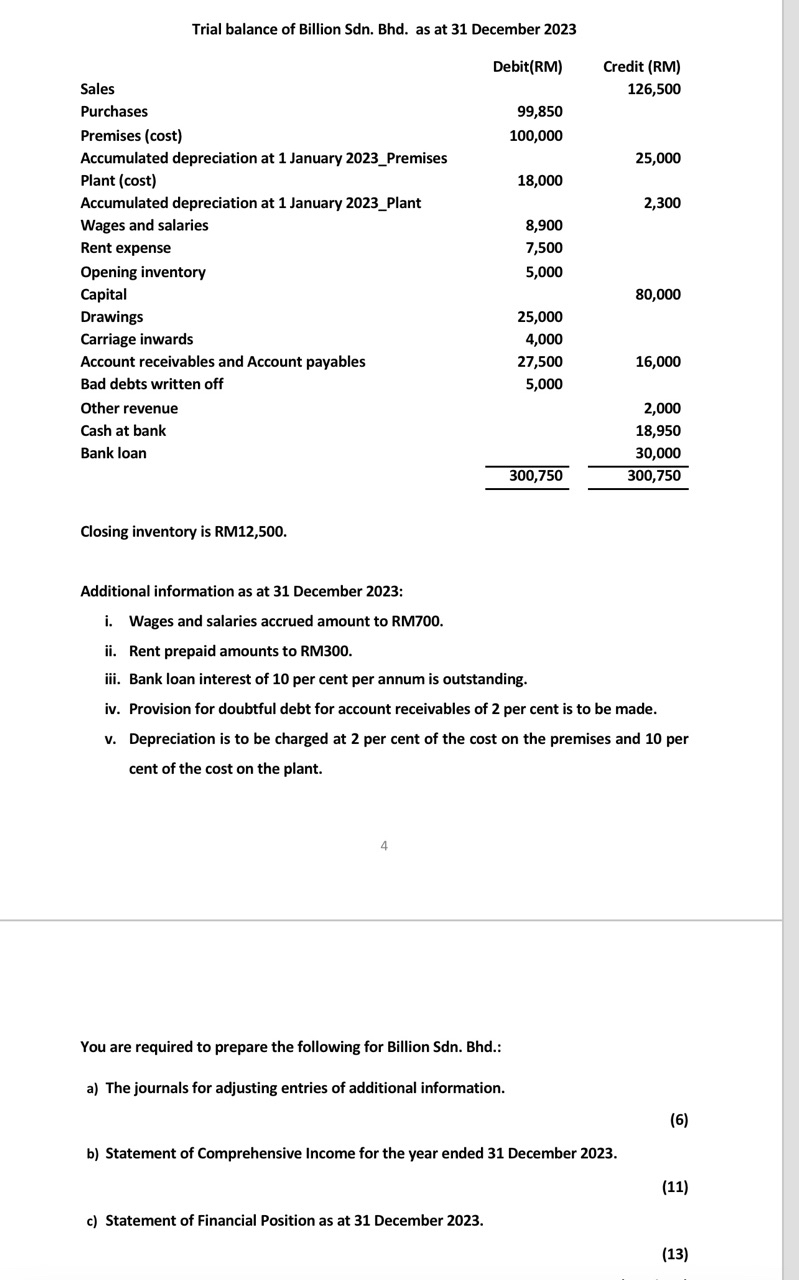

Trial balance of Billion Sdn. Bhd. as at 31 December 2023 Debit(RM) Credit (RM) Sales 126,500 Purchases 99,850 Premises (cost) 100,000 Accumulated depreciation at

Trial balance of Billion Sdn. Bhd. as at 31 December 2023 Debit(RM) Credit (RM) Sales 126,500 Purchases 99,850 Premises (cost) 100,000 Accumulated depreciation at 1 January 2023_Premises 25,000 Plant (cost) 18,000 Accumulated depreciation at 1 January 2023_Plant 2,300 Wages and salaries 8,900 Rent expense 7,500 Opening inventory 5,000 Capital 80,000 Drawings 25,000 Carriage inwards 4,000 Account receivables and Account payables 27,500 16,000 Bad debts written off 5,000 Other revenue 2,000 Cash at bank 18,950 Bank loan 30,000 300,750 300,750 Closing inventory is RM12,500. Additional information as at 31 December 2023: i. Wages and salaries accrued amount to RM700. ii. Rent prepaid amounts to RM300. iii. Bank loan interest of 10 per cent per annum is outstanding. iv. Provision for doubtful debt for account receivables of 2 per cent is to be made. v. Depreciation is to be charged at 2 per cent of the cost on the premises and 10 per cent of the cost on the plant. You are required to prepare the following for Billion Sdn. Bhd.: a) The journals for adjusting entries of additional information. (6) b) Statement of Comprehensive Income for the year ended 31 December 2023. (11) c) Statement of Financial Position as at 31 December 2023. (13)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

c Statement of Financial Position as at 31 December ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started