Answered step by step

Verified Expert Solution

Question

1 Approved Answer

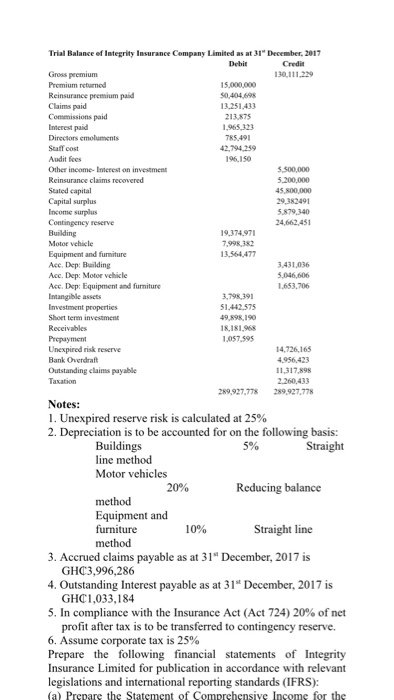

Trial Balance of Integrity Insurance Company Limited as at 31st December, 2017 Debit Credit Gross premium 130,111,229 Premium returned 15,000,000 Reinsurance premium paid 50,404,698 Claims

Trial Balance of Integrity Insurance Company Limited as at 31st December, 2017

Debit

Credit

Gross premium

130,111,229

Premium returned

15,000,000

Reinsurance premium paid

50,404,698

Claims paid

13,251,433

Commissions paid

213,875

Interest paid

1,965,323

Directors emoluments

785,491

Staff cost

42,794,259

Audit fees

196,150

Other income- Interest on investment

5,500,000

Reinsurance claims recovered

5,200,000

Stated capital

45,800,000

Capital surplus

29,382491

Income surplus

5,879,340

Contingency reserve

24,662,451

Building

19,374,971

Motor vehicle

7,998,382

Equipment and furniture

13,564,477

Acc. Dep: Building

3,431,036

Acc. Dep: Motor vehicle

5,046,606

Acc. Dep: Equipment and furniture

1,653,706

Intangible assets

3,798,391

Investment properties

51,442,575

Short term investment

49,898,190

Receivables

18,181,968

Prepayment

1,057,595

Unexpired risk reserve

14,726,165

Bank Overdraft

4,956,423

Outstanding claims payable

11,317,898

Taxation

2,260,433

289,927,778

289,927,778

Notes:

1. Unexpired reserve risk is calculated at 25%

2. Depreciation is to be accounted for on the following basis:

Buildings 5%Straight line method

Motor vehicles 20%Reducing balance method

Equipment and furniture10%Straight line method

3. Accrued claims payable as at 31st December, 2017 is GH3,996,286

4. Outstanding Interest payable as at 31st December, 2017 is GH1,033,184

5. In compliance with the Insurance Act (Act 724) 20% of net profit after tax is to be transferred to contingency reserve.

6. Assume corporate tax is 25%

Prepare the following financial statements of Integrity Insurance Limited for publication in accordance with relevant legislations and international reporting standards (IFRS):

(a) Prepare the Statement of Comprehensive Income for the year ended 31st December, 2017

(b) Prepare the Statement of Changes in Equity for the ended 31st December, 2017

(c) Prepare the Statement of Financial Position as at 31st December, 2017.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started