trial balance

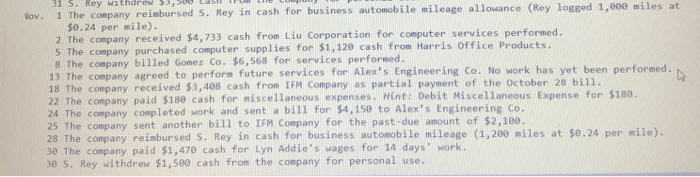

S. Rey invested $46,000 cash, a $22,000 computer system, and $8,000 of office equipment in the company. 311 5Rey withdrew , SUULISI TULI LU puny Nov. 1 The company reimbursed S. Rey in cash for business automobile mileage allowance (Rey logged 1,000 miles at $0.24 per mile). 2 The company received $4,733 cash from Liu Corporation for computer services performed. 5 The company purchased computer supplies for $1,120 cash from Harris Office Products. 8 The company billed Gomez Co. $6,568 for services performed 13 The company agreed to perform future services for Alex's Engineering Co. No work has yet been performed. 18 The company received $3,408 cash from IFM Company as partial payment of the October 28 bill 22 The company paid $180 cash for miscellaneous expenses. Mint: Debit Miscellaneous Expense for $180 24 The company completed work and sent a bill for $4,150 to Alex's Engineering Co. 25 The company sent another bill to IFM Company for the past due amount of $2,100. 28 The company reimbursed s. Rey in cash for business automobile mileage (1,200 miles at $0.24 per mile). 30 The company paid $1,470 cash for Lyn Addie's wages for 14 days work. 30 S. Rey withdrew $1,500 cash from the company for personal use. S. Rey invested $46,000 cash, a $22,000 computer system, and $8,000 of office equipment in the company. 311 5Rey withdrew , SUULISI TULI LU puny Nov. 1 The company reimbursed S. Rey in cash for business automobile mileage allowance (Rey logged 1,000 miles at $0.24 per mile). 2 The company received $4,733 cash from Liu Corporation for computer services performed. 5 The company purchased computer supplies for $1,120 cash from Harris Office Products. 8 The company billed Gomez Co. $6,568 for services performed 13 The company agreed to perform future services for Alex's Engineering Co. No work has yet been performed. 18 The company received $3,408 cash from IFM Company as partial payment of the October 28 bill 22 The company paid $180 cash for miscellaneous expenses. Mint: Debit Miscellaneous Expense for $180 24 The company completed work and sent a bill for $4,150 to Alex's Engineering Co. 25 The company sent another bill to IFM Company for the past due amount of $2,100. 28 The company reimbursed s. Rey in cash for business automobile mileage (1,200 miles at $0.24 per mile). 30 The company paid $1,470 cash for Lyn Addie's wages for 14 days work. 30 S. Rey withdrew $1,500 cash from the company for personal use