Answered step by step

Verified Expert Solution

Question

1 Approved Answer

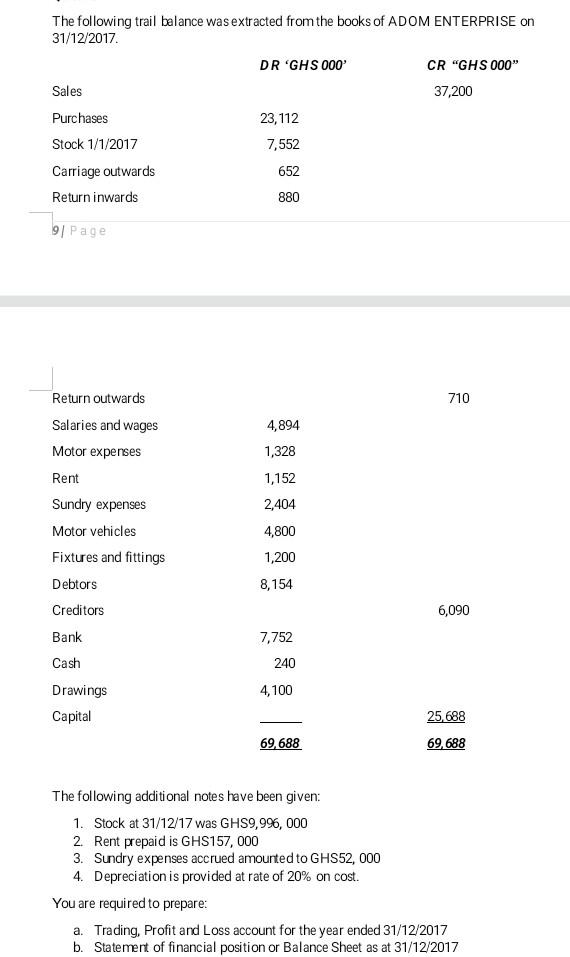

*trial balance. The following trail balance was extracted from the books of ADOM ENTERPRISE on 31/12/2017 DR 'GHS 000 CR GHS 000 Sales 37,200 Purchases

*trial balance.

The following trail balance was extracted from the books of ADOM ENTERPRISE on 31/12/2017 DR 'GHS 000 CR "GHS 000" Sales 37,200 Purchases 23,112 Stock 1/1/2017 7,552 Carriage outwards 652 Return inwards 880 9/ Page 710 4,894 1,328 1,152 Return outwards Salaries and wages Motor expenses Rent Sundry expenses Motor vehicles Fixtures and fittings Debtors Creditors 2,404 4,800 1,200 8,154 6,090 Bank 7,752 240 Cash Drawings Capital 4,100 25, 688 69.688 69,688 The following additional notes have been given: 1. Stock at 31/12/17 was GHS9,996, 000 2. Rent prepaid is GHS157, 000 3. Sundry expenses accrued amounted to GHS52, 000 4. Depreciation is provided at rate of 20% on cost. You are required to prepare: a. Trading, Profit and Loss account for the year ended 31/12/2017 b. Statement of financial position or Balance Sheet as at 31/12/2017Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started