Answered step by step

Verified Expert Solution

Question

1 Approved Answer

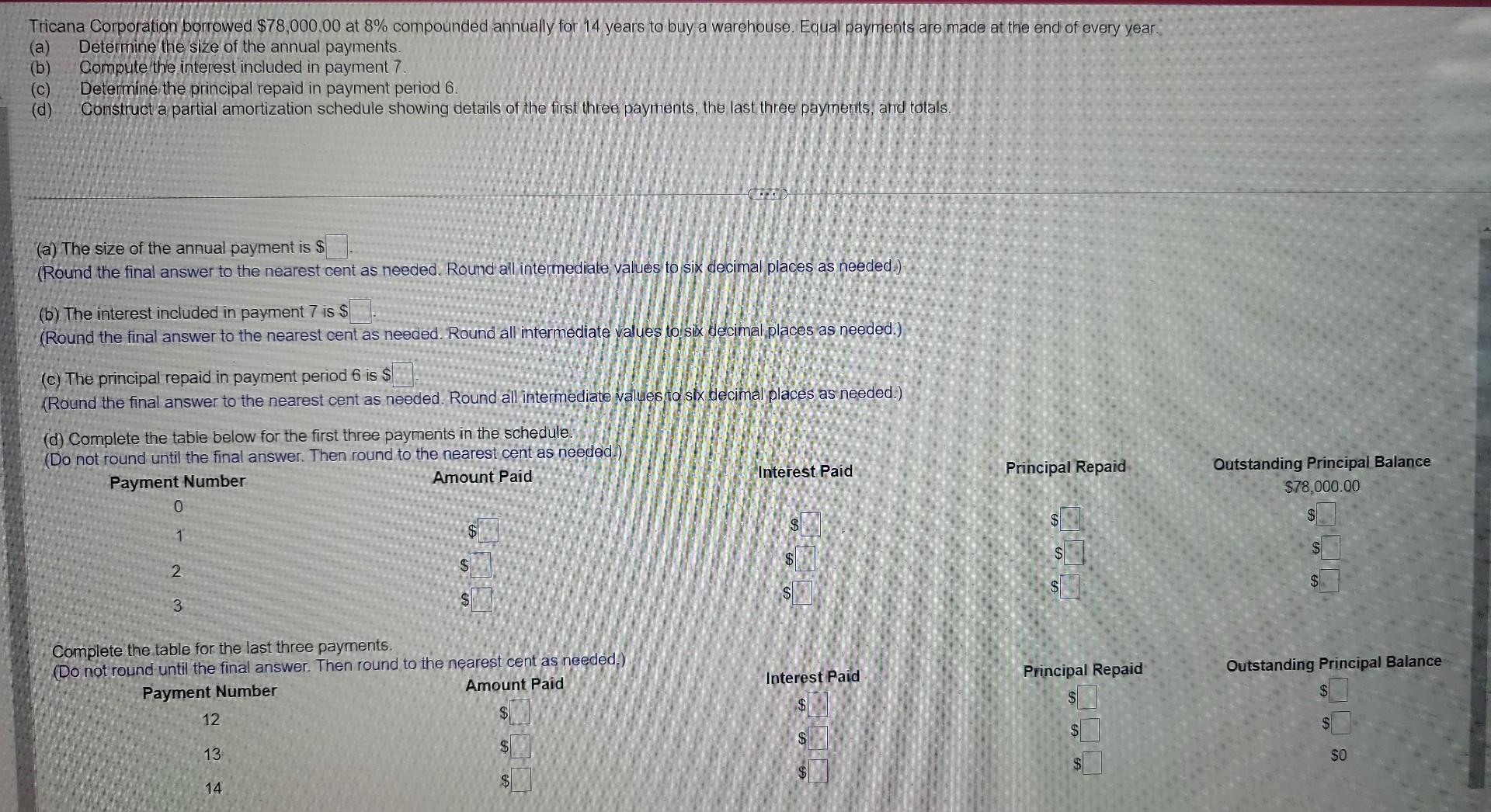

Tricana Corporation borrowed $78,000.00 at 8% compounded annually for 14 years to buy a warehouse. Equal payments are made at the end of every year.

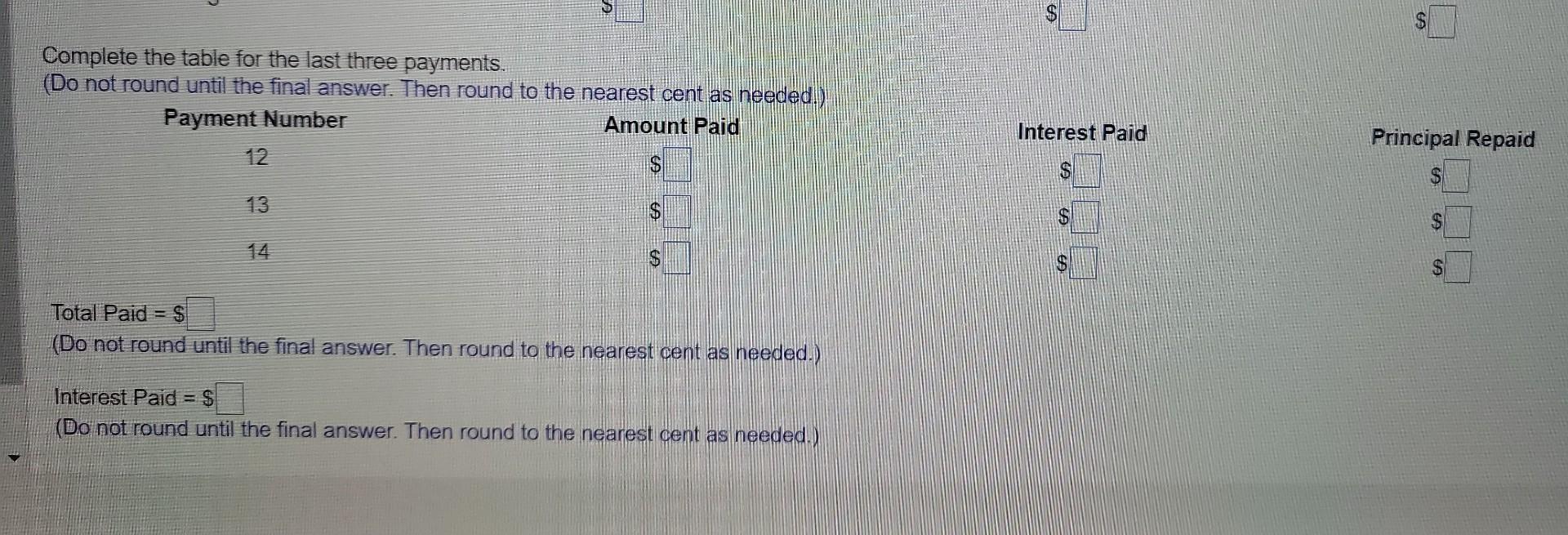

Tricana Corporation borrowed $78,000.00 at 8% compounded annually for 14 years to buy a warehouse. Equal payments are made at the end of every year. (a) Determine the size of the annual payments. (b) Compute the interest included in payment 7. (c) Determine the principal repaid in payment period 6. (d) Construct a partial amortization schedule showing details of the first three payments, the last three payments; and totals. (a) The size of the annual payment is $ (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed). (b) The interest included in payment 7 is $ (Round the final answer to the nearest cent as needed. Round all intermediate values tois dix decimal places as needed.) (c) The principal repaid in payment period 6 is $ (Round the final answer to the nearest cent as needed. Round all intermediate values to sly decimall places as needed.) Complete the table for the last three payments. (Do not round until the final answer. Then round to the nearest cent as needed.) Payment Number 121314 Total Paid =$ (Do not round until the final answer. Then round to the nearest cent as needed.) Interest Paid =$ (Do not round until the final answer. Then round to the nearest cent as needed.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started