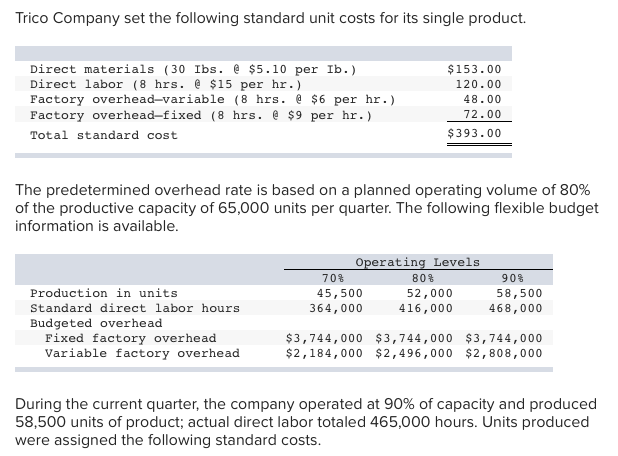

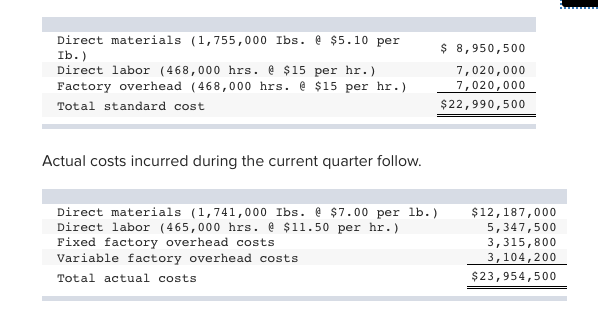

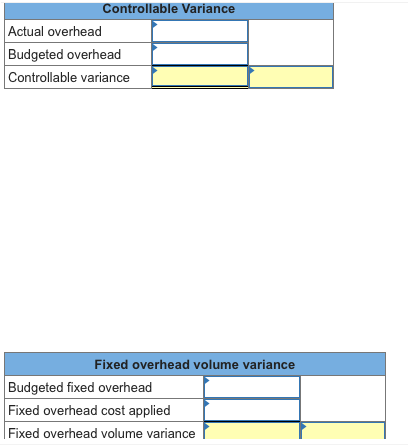

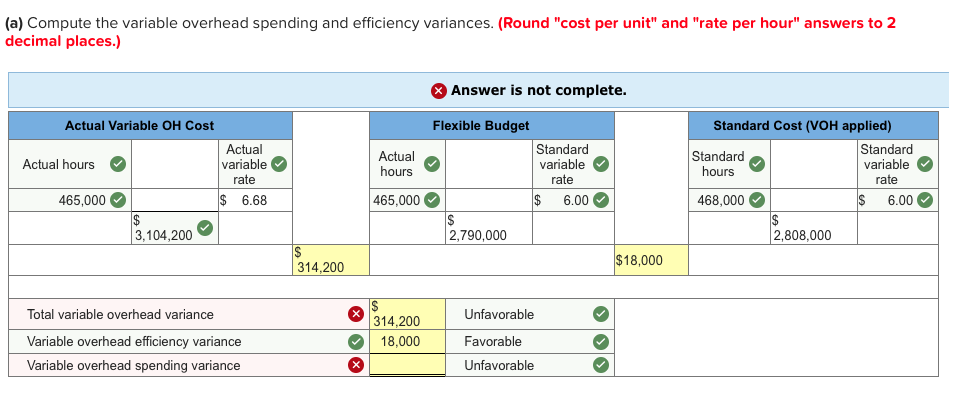

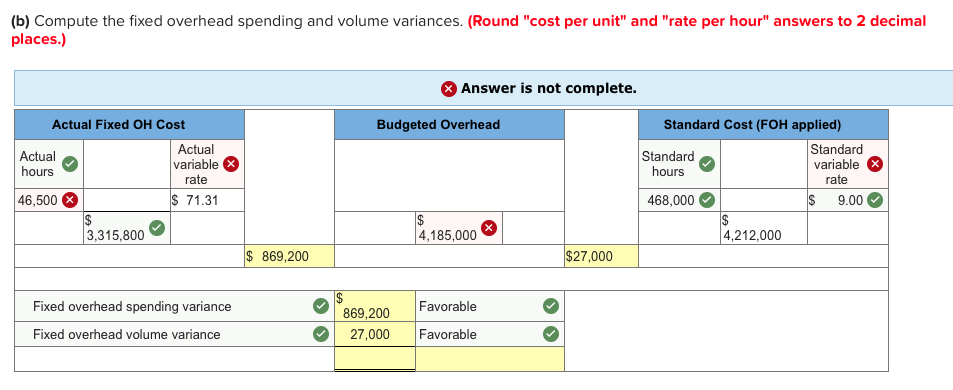

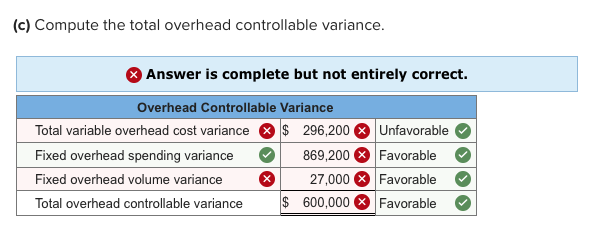

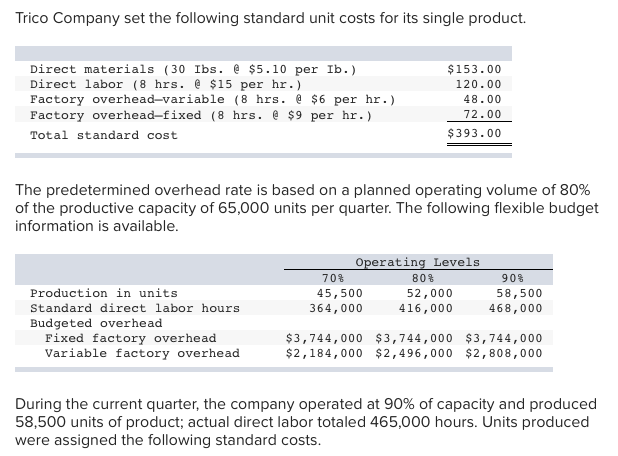

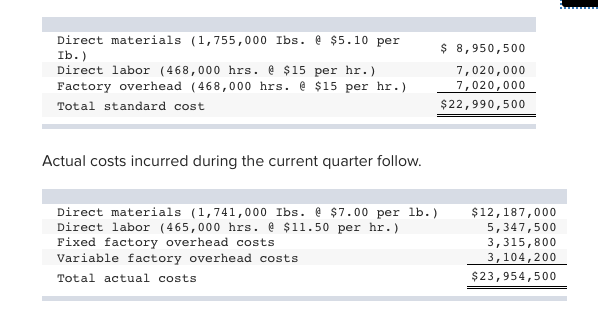

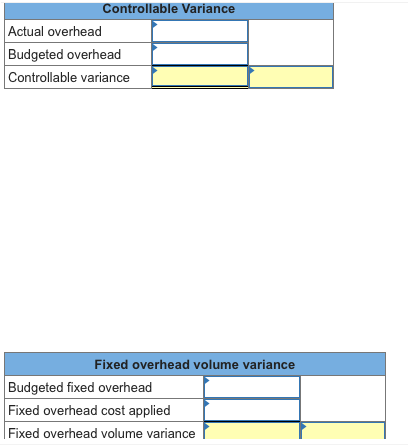

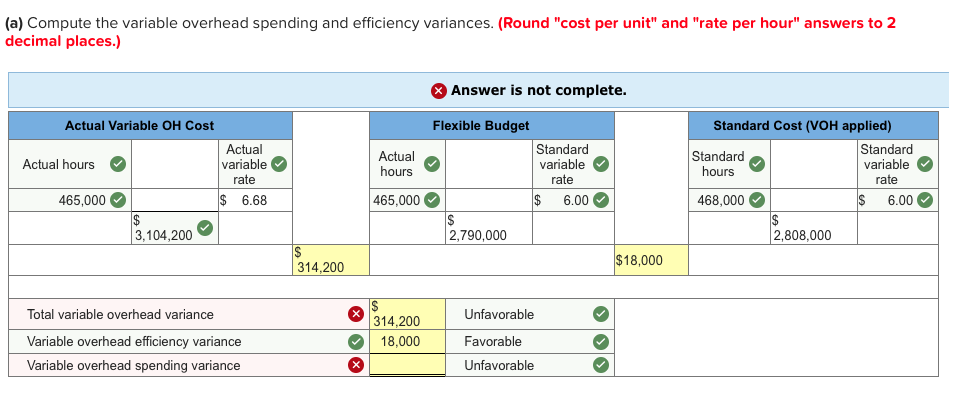

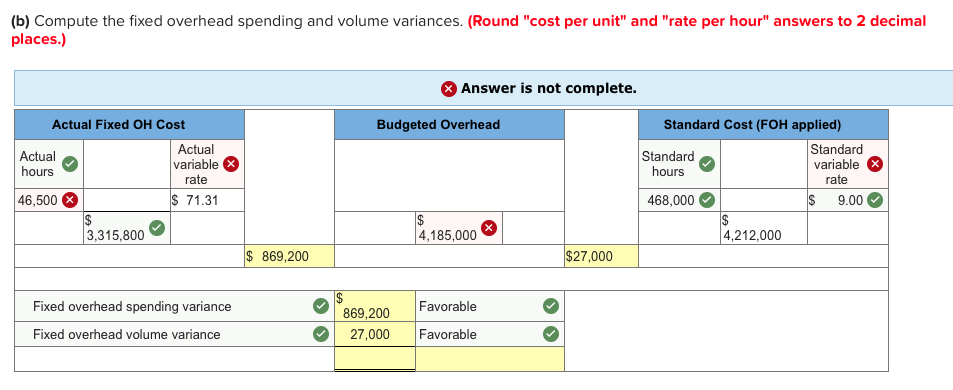

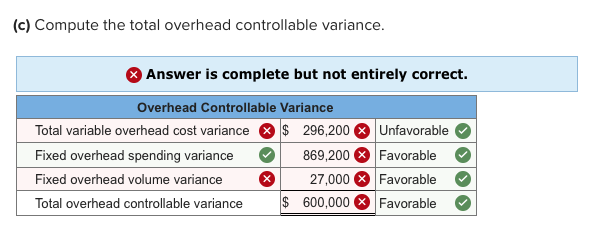

Trico Company set the following standard unit costs for its single product. Direct materials (30 Ibs. $5.10 per Ib.) Direct labor (8 hrs. $15 per hr.) Factory overhead-variable (8 hrs. $6 per hr.) Factory overhead-fixed (8 hrs. $9 per hr.) Total standard cost $153.00 120.00 48.00 72.00 $393.00 The predetermined overhead rate is based on a planned operating volume of 80% of the productive capacity of 65,000 units per quarter. The following flexible budget information is available Operating Levels 70% 45,500 364,000 80% 52,000 416,000 90% Production in units Standard direct labor hours Budgeted overhead 58,500 468,000 Fixed factory overhead Variable factory overhead $3,744,000 $3,744,000 $3,744,000 $2,184,000 $2,496,000 $2, 808,000 During the current quarter, the company operated at 90% of capacity and produced 58,500 units of product; actual direct labor totaled 465,000 hours. Units produced were assigned the following standard costs pirect materials (1,755,000 Ibs. e $5.10 per Ib. Direct labor (468,000 hrs. $15 per hr.) Factory overhead (468,000 hrs.$15 per hr.)_7,020,000 Total standard cost 8,950,500 7,020,000 $22,990,500 Actual costs incurred during the current quarter follow Direct materials (1,741,000 Ibs. $7.00 per lb.) $12,187,000 Direct labor (465,000 hrs. $11.50 per hr.) Fixed factory overhead costs Variable factory overhead costs Total actual costs 5,347,500 3,315,800 3,104,200 $23,954,500 Controllable Variance Actual overhead Budgeted overhead Controllable variance Fixed overhead volume variance Budgeted fixed overhead Fixed overhead cost applied Fixed overhead volume variance (a) Compute the variable overhead spending and efficiency variances. (Round "cost per unit" and "rate per hour" answers to 2 decimal places.) Answer is not complete Actual Variable OH Cost Flexible Budget Standard Cost (VOH applied) Standard variable rate Actual Standard Actual hours variable rate Actual hours variable rate Standard hours 465,000 $ 6.68 465,000 $ 6.00 468,000 6.00 3,104,200 2,790,000 2,808,000 $18,000 314,200 Total variable overhead variance Variable overhead efficiency variance Variable overhead spending variance Unfavorable 314,200 18, 000 Favorable Unfavorable (b) Compute the fixed overhead spending and volume variances. (Round "cost per unit" and "rate per hour" answers to 2 decimal places.) Answer is not complete Actual Fixed OH Cost Budgeted Overhead Standard Cost (FOH applied) Actual variable rate 71.31 Standard variable rate Actual hours Standard hours 46,500 468,000 9.00 3,315,800 4,185,000 4,212,000 $869,200 $27,000 869,200Favorable 27,000 Favorable Fixed overhead spending variance Fixed overhead volume variance (c) Compute the total overhead controllable variance. Answer is complete but not entirely correct. Overhead Controllable Variance Total variable overhead cost variance S 296,200 Unfavorable Fixed overhead spending variance 869,200Favorable Fixed overhead volume variance Total overhead controllable variance 60,000 Favorable 27,000 Favorable