Answered step by step

Verified Expert Solution

Question

1 Approved Answer

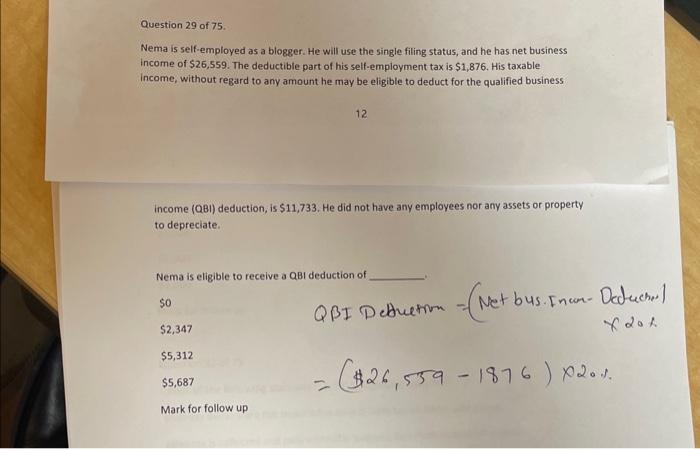

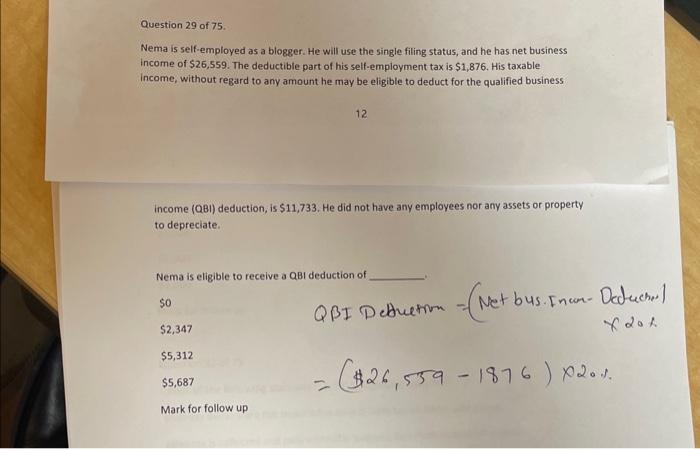

tried to do it thru formula but 4937 option is not there Question 29 of 75. Nema is self-employed as a blogger. He will use

tried to do it thru formula but 4937 option is not there

Question 29 of 75. Nema is self-employed as a blogger. He will use the single filing status, and he has net business income of $26,559. The deductible part of his self-employment tax is $1,876. His taxable income, without regard to any amount he may be eligible to deduct for the qualified business 12 income (QBI) deduction, is $11,733. He did not have any employees nor any assets or property to depreciate. Nema is eligible to receive a QBI deduction of 50 $2,347 QBJ Peduetin - (eetbus. Incon- Decuche) $5,312 in 2% $5,687 =($26,5591876)20 Mark for follow up

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started