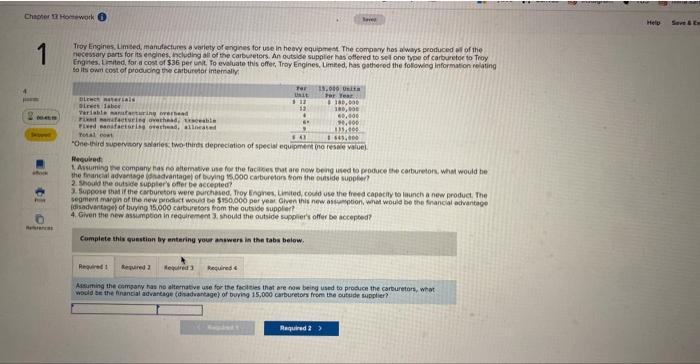

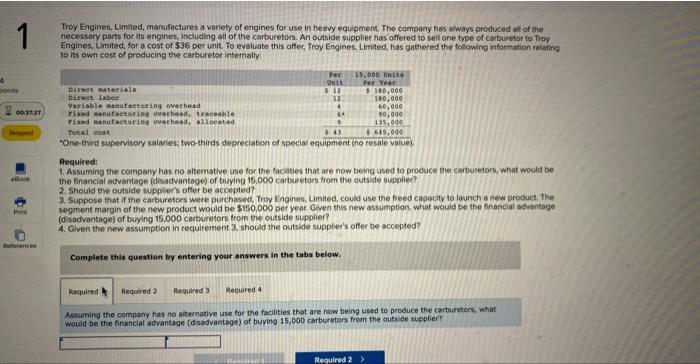

Trigy Engines, Limsed, manufectures a varlety of engines for use in heary equpmeat. The compary has aways produced al of the necessary parts for its encines, including all of the carbuelors. An outside supplier has othered to sel ono type of carburetor to Troy Crigites. L-itad, for a cost of $36 per unt. Fo evaluate this effer, Tray Engines, Limied, has gathered the followicg information relating to its owm cost of procuong the carturver intemaly, Reculeat 1. Arsumirg the compary has no altemative use for the facipes that are now being uted to proouce Bre carbureton, what would be the fiancial advantsge (sogarantagei of bying ts 000 carburetors form the oraside suopfer? 2. Shoide the outside suphler's offer be accepted? 7. Fuppose thad if the carburetors were purchesed. Troy Engnes, Linied, coud use the fresa capecify to launch a new product. The segment margin of the new podact wosed be 5950,060 per year Given inis new astymption, what would be the Snancial advantage (idsadventages of birying 15,000 carburetors from the outsice suppler? 4. Given the new assiampoion in reculrement 3, should the outside supplier's offer be accepted? Cumplete this gunstinn by entering your answars in the tabs below. Asiuming the compary has ne alternative use for the faclejes that are fow being used to procuce the carburetion, whot wocla se the francal adrartage (dinaduantage) of buring 15,060 carburetors from the cutude supplier? Trey Engines, Limited, manutoctures a variety of engines for use in heavy equipmert. The compary has alweys produced all of the necessary parts for its enghes, incluting al of the carburetors. An citside supplar nas ctlered to sell one type of casburvati to froy Engines, Limited, for a cost of $36 per unt. To evaluate this ofles, Troy Engines, Limilted, has gathered the foliowing inforourion reating to its own cest of producing the carburetor intemally. Reguired: 1. Assuming the company has no alternathe use for the facitses that are now being used to produce the carburetorn, what anosiag bee the firancial advantage ddisadvantage) of buylng 15,000 catberetors from the outside supplier? 2. Shauld the outside wippiler's offer be accepted? 3. Suppose that if the carburetors were purchased, Troy Eryaines. Limited, could use the fieed capacity to launch a new product fre segment margin of the new product would be $150,000 per yes. Geven this new ossunption, what would be the trincial advantage (diadvantagej of buyeng 15.000 carburetors from the outside supplier? 4. Cwen the new assumption in requrement 3 , should the outside suppliers offer be accepted? Cempiete this question by entering yeur answers in the tabs belew, Should the outside supplier's atter be accested? Trey Engines. Umited, indnyfactures a variety of engines for use in heavy squipment. The compary Bas alwegs produced all of the Engines. Limited, for a cost of 536 per unt. To evaluate this effer, Troy Engines, Umbed, has gathered the folowing crformation relpting to its own cost of producing the carburetor intemaly? Required: 2. Should the outside suppler's ofler be accepled? 3. Suppose that if the carburefors were prochesed. Trey fromes. Limeted, could use the bred capacify to launch a new product. The segment margin of the new peoduct woudd be 5 mo. 000 per yem, Geven this new astumption, what aoud be the financial advirtage ud sadvartagel of buying fi.000 carbufetors bom the outside suppler? 4. Gyen the Rew assumption in recurement 3. should fie cotside suppters offer bo sccepted: Complete this question by tatering your anweers in the tabs belien. Suppose that if the carturetoes were furchased, Troy tneines, tanzed, could use the freed caqeaty to launch a new product. The srumeet marpin of the new product wonid be 5190,005 per year. Civen tis new atsumptian, what woult he the fiescial Troy Engines, Limited, manufactutes a variety of engines for use in hewry equpment. The certparty has always produced al af the necessary parts for its engines, incluaing al of the cadburetors. An outsice supplee has oflered to seti gne ivpe of carburelar to Troy Engries, Limeed, for a cost of $35 per unt. To ewaluate this offer, Troy Engines, Limited, has pathered the fotowing riformation reiating 60 as own cost of producing the cerburetor internaly: Required: 5. Assurning the compary has no attemative use for the facities that are now being used fo produce the carburetors, what wosid be the financial advantoge (disadvantagel of boylvg 15.000 caburetors from the outuse supplie? 2. Should the outside mipplier offer be accepled? 3. Suppose that if the carberetorn were purchased. Troy frones, Limbed, could une the freed capacity to launch a new product. The Idisadvantagej of buying 15,000 carbureters from the outade suppler? 4. Ghen the new assumpeion in reguremers 3, thould the out ide sunclie's offer be acceptedi Complete this quewtian toy entering your anwwers in the tatis below. Given the new assuinption in requiremet 3 , should the outaide wopler's cller be accephed? Troy Engines, Limited, manufactures a variety of engines for use in be ovy equipment. The company has always produced alt of the necessary parts for its engines, including all of the carburetors. An outside supplier has offered to seif ane type of carburetor to Troy Engines. Limited, for a cost of $36 per unit. To evaluate this offer, Troy Engines, Limited, has gathered the folowing information relating to its own cost of producing the carburetor internally: Requiredi 1. Assuming the company has no alternative use for the facilities that are now being used to produce the carburetors, what would be the financial advantage (disadvantege) of buring 15,000 carburetors from the outside supplier? 2. Should the outside suppler's offer be accepted? 3. Suppose that if the carburetors were purchased, Troy Lingines, Limited, could use the freed casacity to launch a few product. The segment margin of the new product would be $150,000 pec year. Given this new assumption, what would be the financial advantage (d sadvantage) of biying 15,000 carburetors trom the outside supplier? 4. Given the new assumption in requirement 3, should the outside supplier's offer be accepted? Complete this question by entering your answers in the tabs below. Assuming the company has no aiternative use for the facilities that are now being used to produce the carburetorn, what would be the financial advantage (disadyantage) of buying 15,000 carburetors from the outsiae supplier? Tray Engines, Limsed, manufactures a variety of engines for use in heavy equipment. The compary has always produced all of the necessary parts for its engines, including al of the carburetors. An outside suppier has offered to sel one type of carburetse to Troy Engines. Limieed, for a cost of $36 per unit. To evaluste this offer, Troy Engines, Limited, has gathered the following infocmution refting to its own cost of prottucing the carburetor inteenally: Required: 1. Assuming the company has no alternative use for the fachtces that are now being used to produce the carburetors, what wbuld be Vie financial advantege (disadventage) of buying 15,000 carburetors frem the outside supplien? 2. Should the outsde supplier's affor be acceated? 3. Suppose that if the carhuretors were purchated, Froy Engines, Umited, could use the freed capocity to iaunch a new product. The Segment margin of the new product would be $150.000 per year. Given this now assumption, what would be the financial advantage (disadvantage) of buying 15.000 carburetors from the outside supplier? 4. Given the new assumption in requirement 3, should the outside supplier's offer be accepted? Complete this question by entering your answers in the tabs below. Required 2 Should the outside suppuers orter be acceated? Troy Engines, Limited, manufactures a variety of engines for ise in heavy equipment. The company has always preduced al of the piecessary ports for lits engines, including as of the carburetees. An eutshte supplier has offered to sel one fype of corbureice to Troy Engines, Lerted, for a cost of $36 per unit. To evaluate this ofler, Troy Engines, Limhed, has gmthered the folowing information reiating to z5 own cost of producing the carburetor internally. Pequired: 1. Asstaming the cempary has no alternative use for the faciities that are now being used to produce the carburetors, what would be the financal advantage (disadvantage) of buying 15,000 carburetors from the outside supplier? 2. Should the outside supplier's offer be accepted? 3. Suppose that if the carburetors were puechased, Froy fngrves, Limted, could use the freed capacity to launch a new product The segment margin of the new prodiuct would be $150000 per year. Civent this new assumptian, what would be the financial ndvantage (disadyantege) of buying 15.000 carburetors fram the outside supplier? 4. Given the new assumption in requirement 3, should the outside supplier's offer he accepted? Complete this auestion by entering your anwwers in the tabs below. Suppose Ehat if the carburetors were perchased, Troy Engines, Limited, could use the freed capacity to launch a new product The sepment margin of the new product wosid be 1150,000 per yeer. Given this new aswarnekion, what wosed be the finatial advantage (disadvantage) of buping 15,000 carburetors from the outide susplier? Troy Engines, Uinited, manufactures a variety of engines for use in heavy equipment. The company has always probuced al of the necessary parts for its engines, including all of the carburetors. An outside supplier has offered to sell one type of carburator to Troy Enginos, Limited, for a cost of $36 per unit. To evaluote this offer, Troy Engines, Limited, has gathered the following information reiating to its own cost of producing the carburelor internally. Aeguired: A Assuming the compony has na alternative use for the faciinies that are now being used to produce the carburetors, what wouli be the financial advantoge (disadvantoge) of buying 15.000 carburetors from the outsale supplier? 2. Should the outside suppler's offer be accepted? 3. Suppose that if the carburetors were purchased. Troy Engines, Limited, could use the freed capacity to launch a new product. The segment margin of the new product would be $150.000 per yeac Given this new assumption, whit would be the financial advantage (disadvantege) of buying 15.000 carburetors from the outside supplier? 4. Given the new assumption in requirement 3 , should the outside suppler's offer be accepted? Complete this question by entering your answers in the tabs below, Given the new assumption in requirement 3, should the outside supplier's offer be accepted