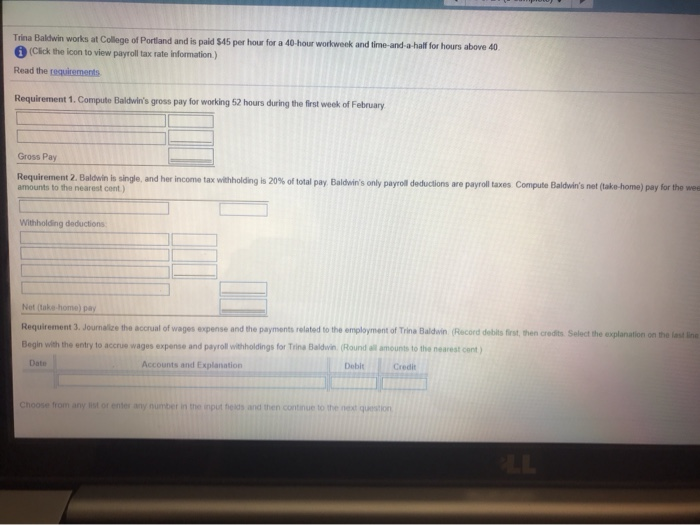

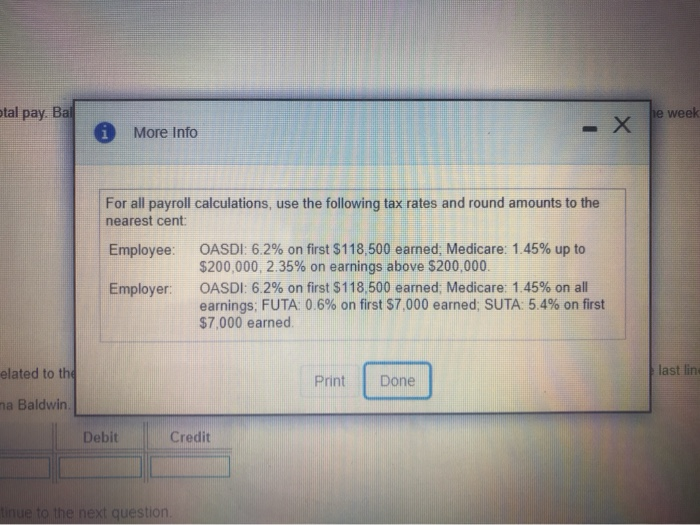

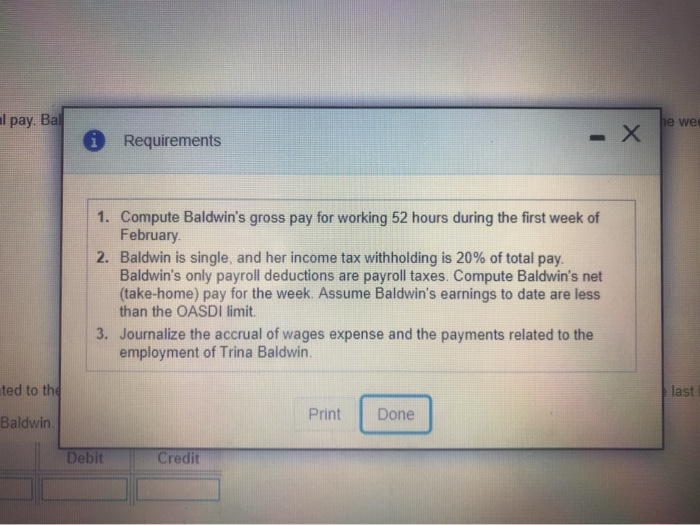

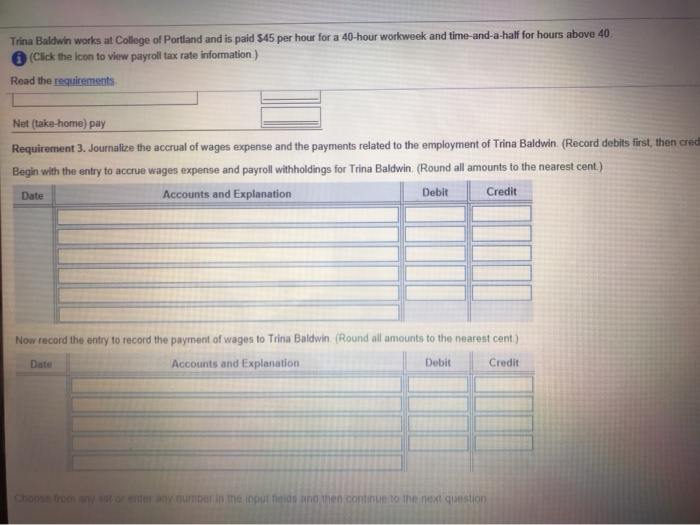

Trina Baldwin works at College of Portland and is paid $45 per hour for a 40-hour workweek and time-and-a-half for hours above 40 (Click the icon to view payroll tax rate information) Read the requirements Requirement 1. Compute Baldwin's gross pay for working 52 hours during the first week of February Gross Pay Requirement 2. Baldwin is single, and her income tax withholding is 20% of total pay Baldwin's only payroll deductions are payroll taxes Compute Baldwin's not take home) pay for the wee amounts to the nearest cont.) Withholding deductions Net (take-home) pay Requirement 3. Journalize the accrual of wages expense and the payments related to the employment of Trina Baldwin (Record debits first, then credits Select the explanation on the last line Begin with the entry to accrue wages expense and payroll withholdings for Trina Baldwin (Round all amounts to the nearest cent) Accounts and explanation Debit Credit Choose from any list of enter any number in the inputted and then continue to the end question otal pay. Bal 1e week i More Info For all payroll calculations, use the following tax rates and round amounts to the nearest cent: Employee: OASDI: 6.2% on first $118.500 earned, Medicare: 1.45% up to $200,000, 2.35% on earnings above $200,000. Employer: OASDI: 6.2% on first $118 500 earned, Medicare: 1.45% on all earnings: FUTA: 0.6% on first $7,000 earned: SUTA: 5.4% on first $7,000 earned elated to the last lin Print Done ma Baldwin Debit Credit tinue to the next question. I pay. Ba he wel i Requirements 1. Compute Baldwin's gross pay for working 52 hours during the first week of February 2. Baldwin is single, and her income tax withholding is 20% of total pay. Baldwin's only payroll deductions are payroll taxes. Compute Baldwin's net (take-home) pay for the week. Assume Baldwin's earnings to date are less than the OASDI limit. 3. Journalize the accrual of wages expense and the payments related to the employment of Trina Baldwin. last ted to the Baldwin Print Done Debit Credit Trina Baldwin works at College of Portland and is paid $45 per hour for a 40-hour workweek and time-and-a-half for hours above 40. (Click the icon to view payroll tax rate information.) Read the requirements Net (take-home) pay Requirement 3. Journalize the accrual of wages expense and the payments related to the employment of Trina Baldwin (Record debits first, then cred Begin with the entry to accrue wages expense and payroll withholdings for Trina Baldwin (Round all amounts to the nearest cent.) Accounts and Explanation Debit Credit Now record the entry to record the payment of wages to Trina Baldwin (Round all amounts to the nearest cent) Accounts and Explanation Debit Credit Ch a ntelny number in the input fields and then continue to the next