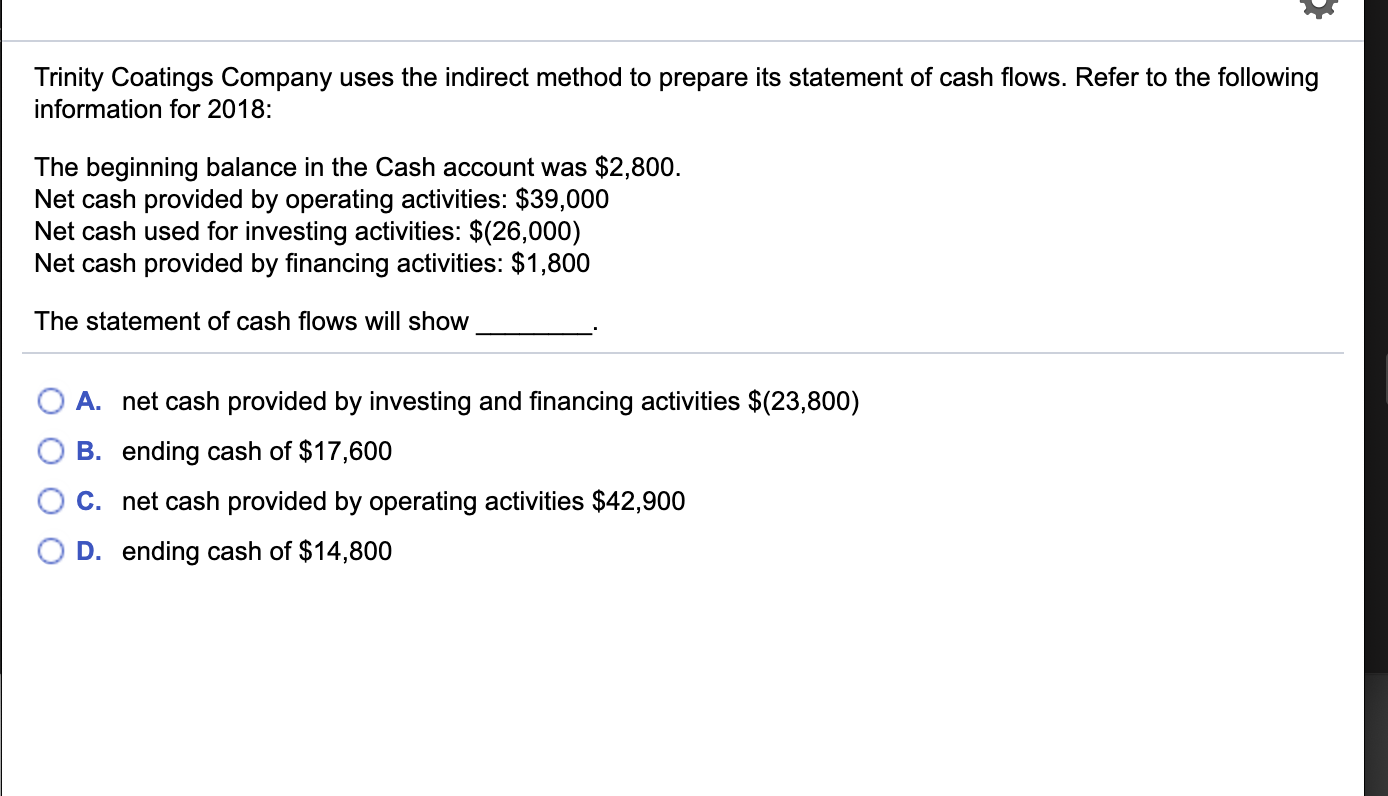

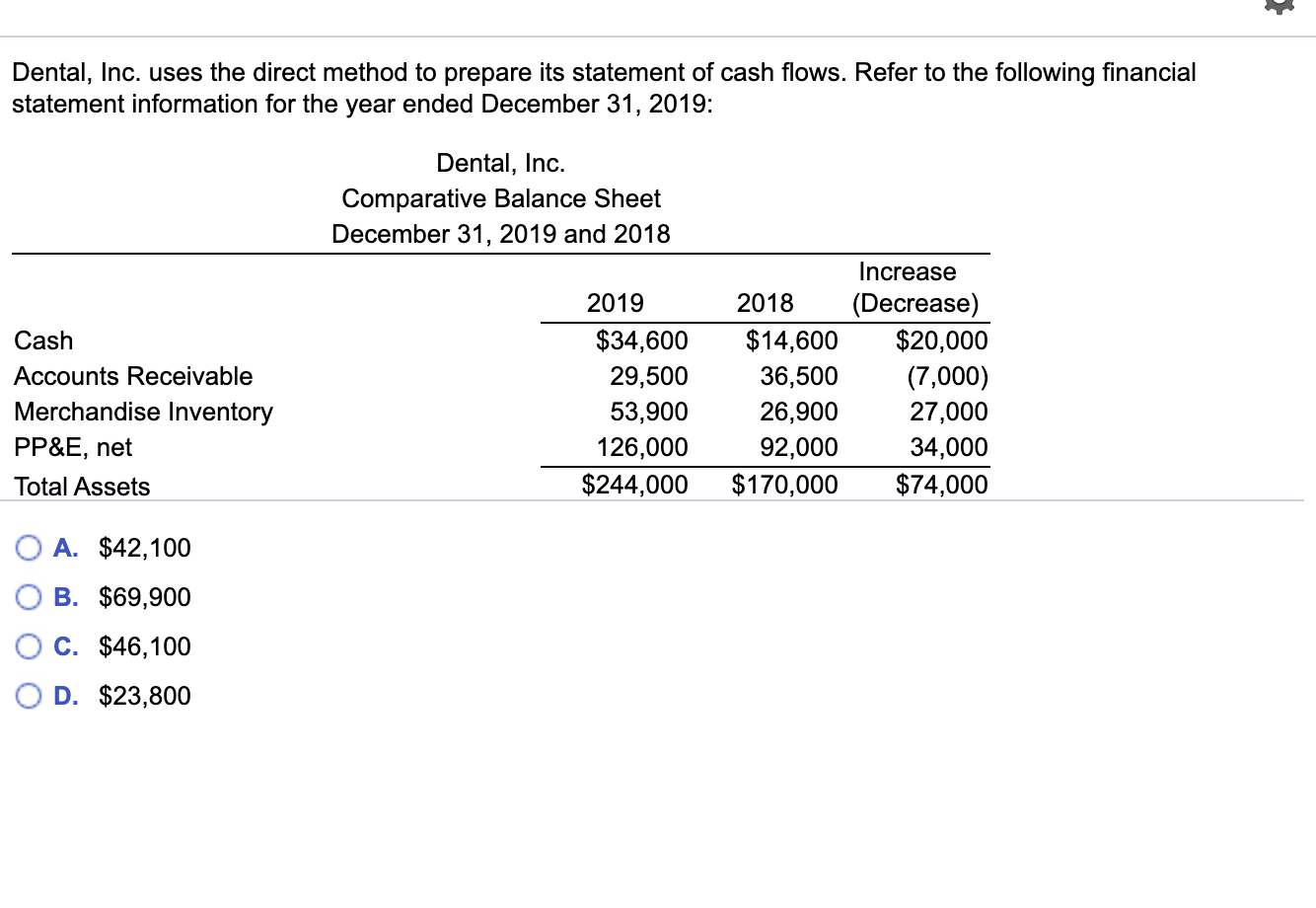

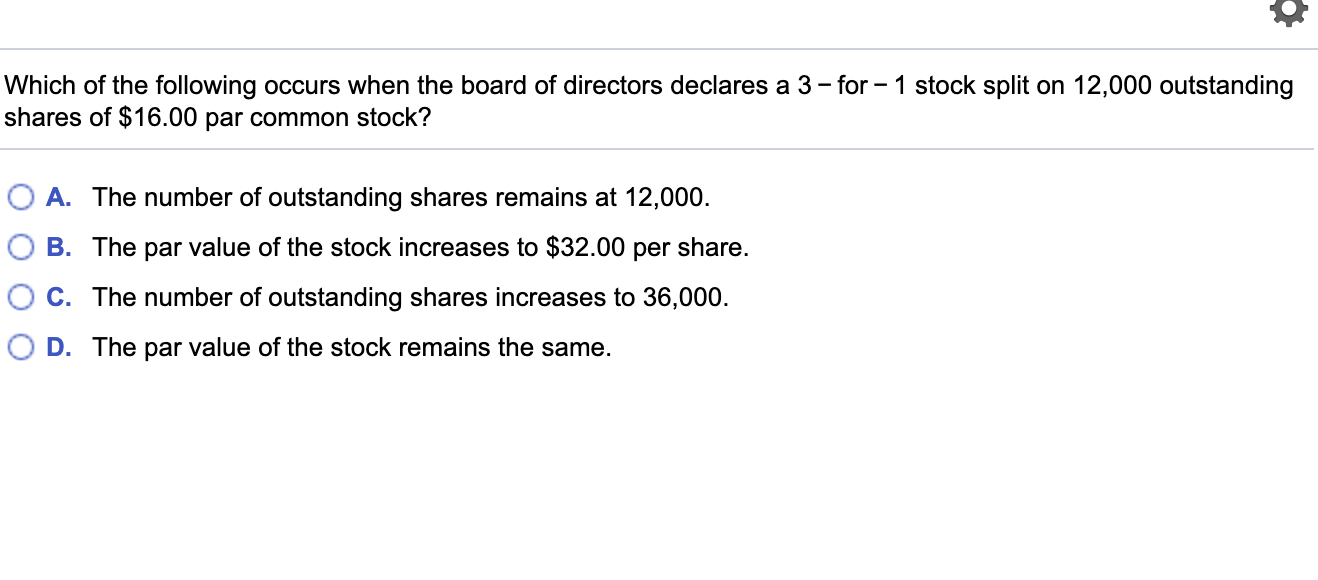

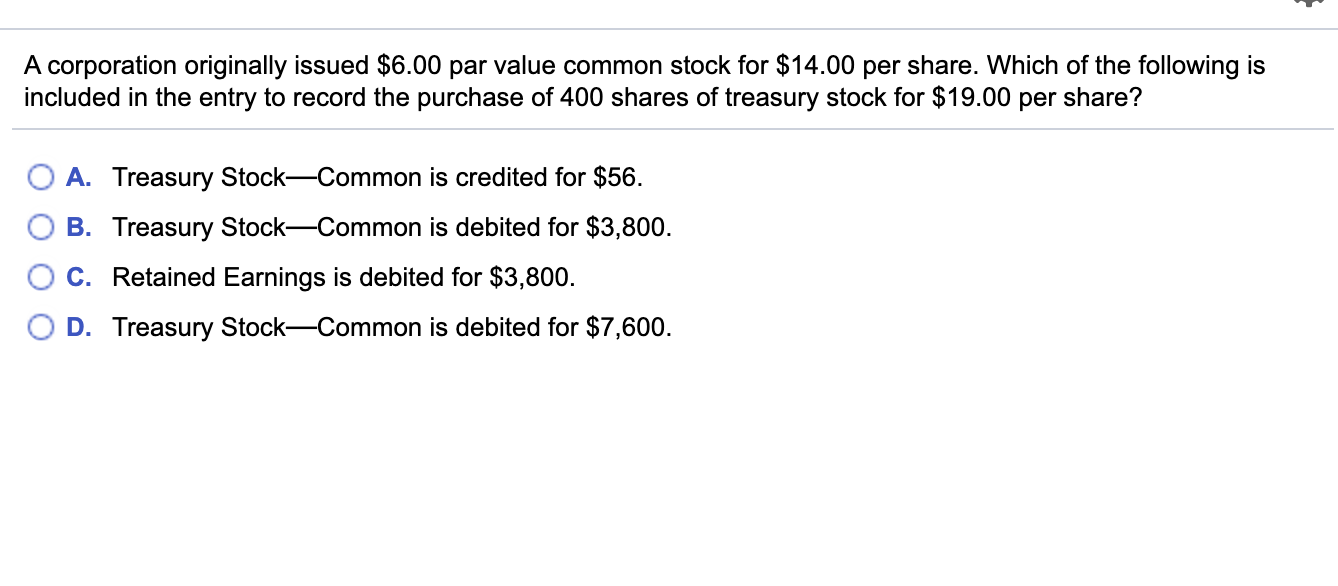

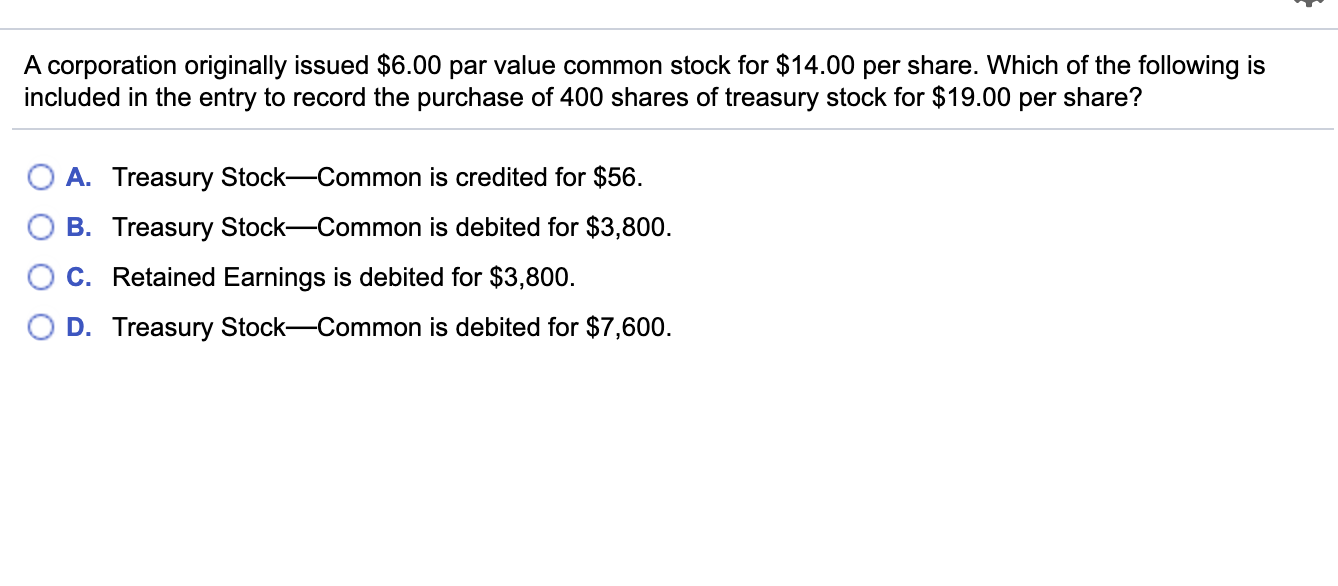

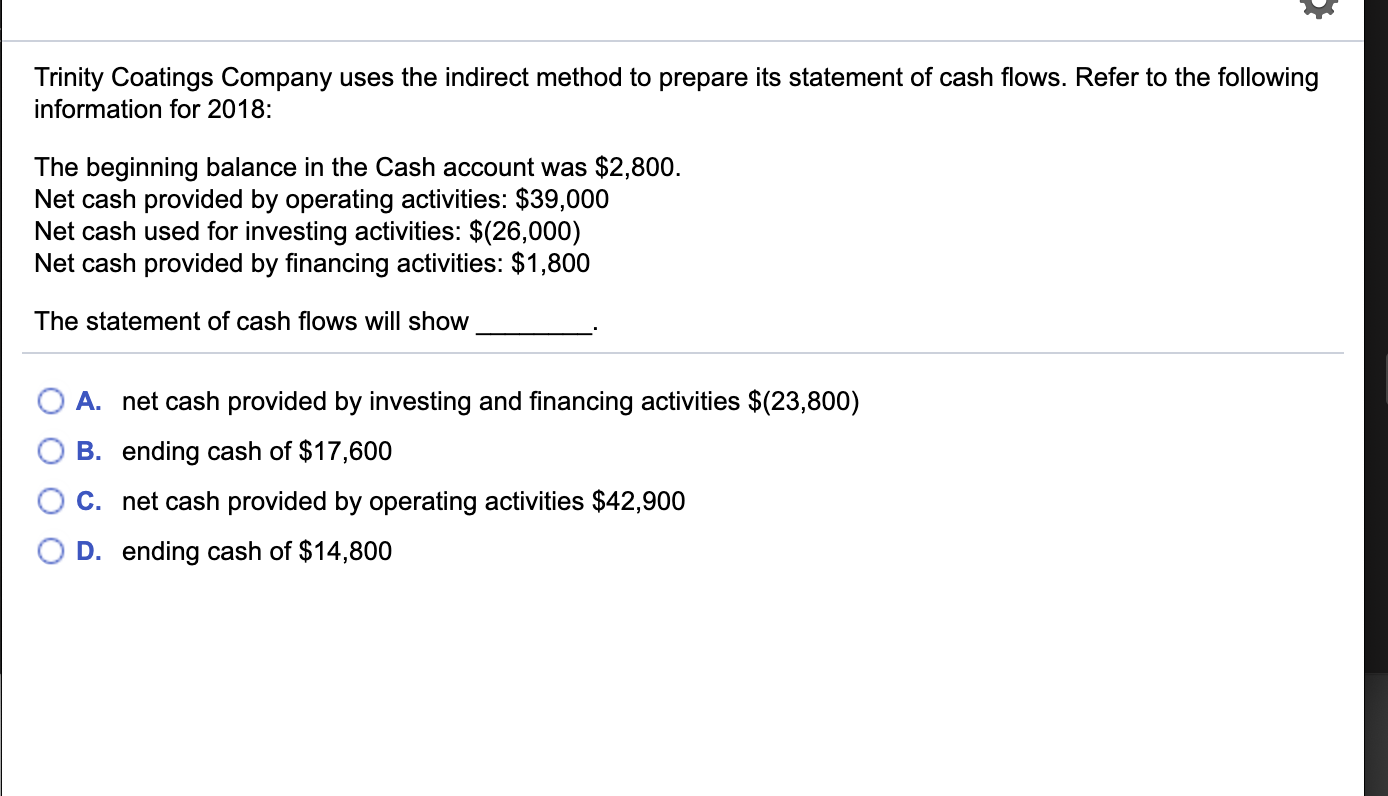

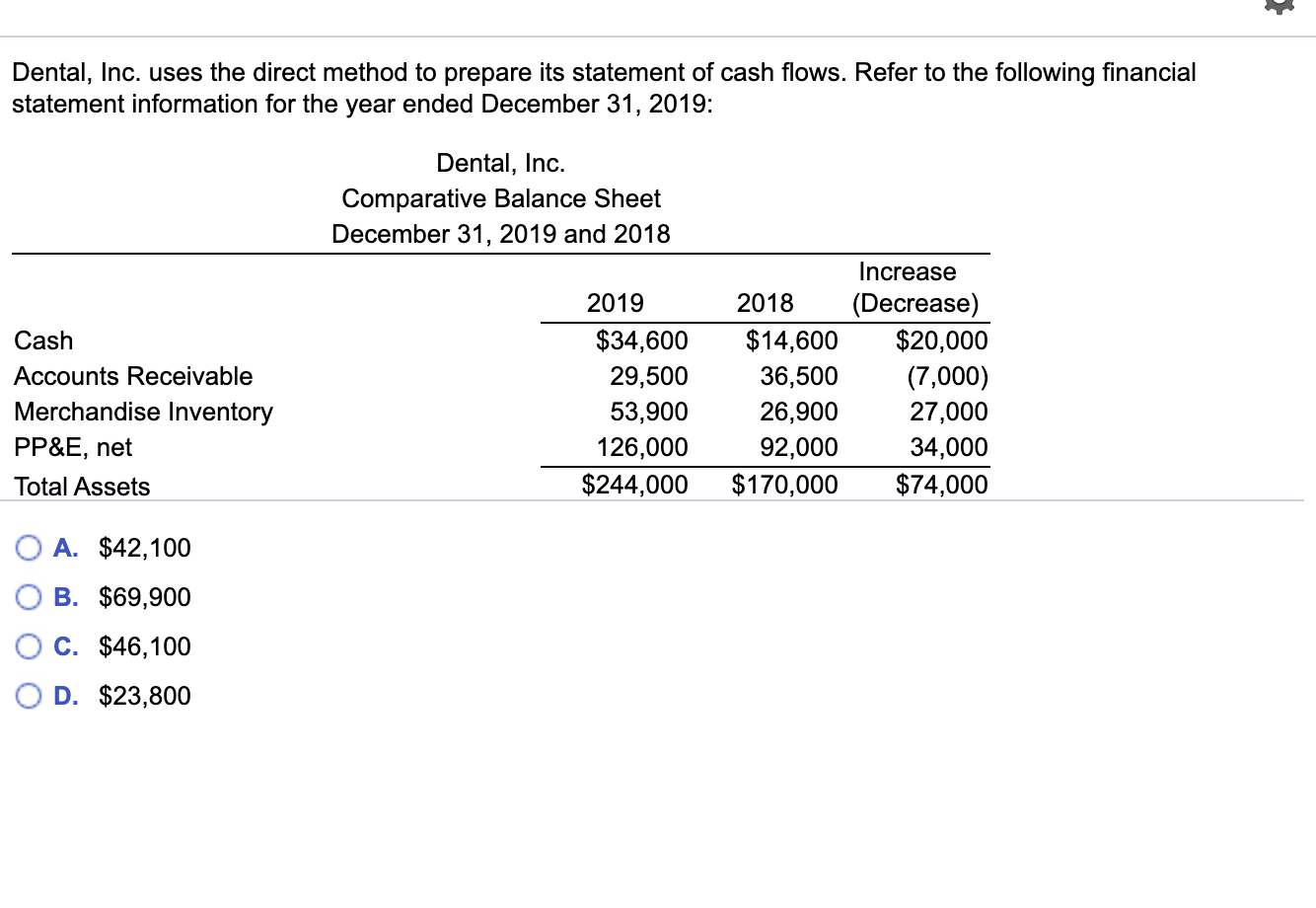

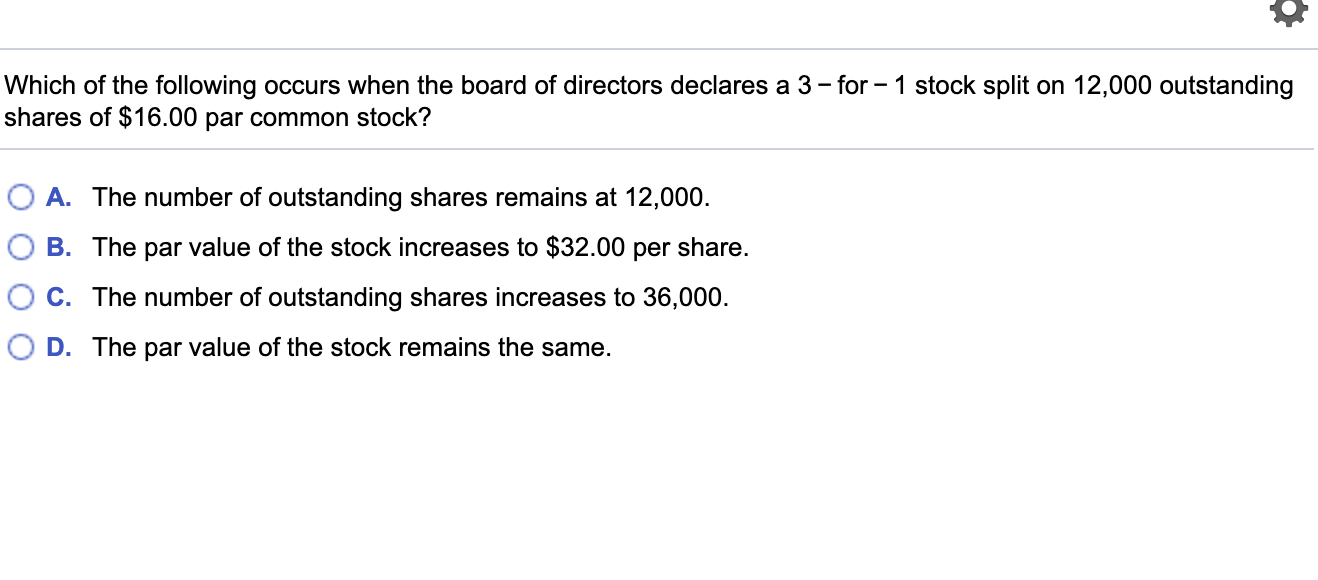

Trinity Coatings Company uses the indirect method to prepare its statement of cash flows. Refer to the following information for 2018: The beginning balance in the Cash account was $2,800. Net cash provided by operating activities: $39,000 Net cash used for investing activities: $(26,000) Net cash provided by financing activities: $1,800 The statement of cash flows will show A. net cash provided by investing and financing activities $(23,800) B. ending cash of $17,600 C. net cash provided by operating activities $42,900 D. ending cash of $14,800 Dental, Inc. uses the direct method to prepare its statement of cash flows. Refer to the following financial statement information for the year ended December 31, 2019: Dental, Inc. Comparative Balance Sheet December 31, 2019 and 2018 Cash Accounts Receivable Merchandise Inventory PP&E, net Total Assets 2019 $34,600 29,500 53,900 126,000 $244,000 2018 $14,600 36,500 26,900 92,000 $170,000 Increase (Decrease) $20,000 (7,000) 27,000 34,000 $74,000 A. $42,100 B. $69,900 C. $46,100 D. $23,800 Which of the following occurs when the board of directors declares a 3 - for 1 stock split on 12,000 outstanding shares of $16.00 par common stock? A. The number of outstanding shares remains at 12,000. B. The par value of the stock increases to $32.00 per share. C. The number of outstanding shares increases to 36,000. OD. The par value of the stock remains the same. A corporation originally issued $6.00 par value common stock for $14.00 per share. Which of the following is included in the entry to record the purchase of 400 shares of treasury stock for $19.00 per share? A. Treasury Stock- -Common is credited for $56. B. Treasury StockCommon is debited for $3,800. C. Retained Earnings is debited for $3,800. D. Treasury Stock-Common is debited for $7,600. A corporation originally issued $6.00 par value common stock for $14.00 per share. Which of the following is included in the entry to record the purchase of 400 shares of treasury stock for $19.00 per share? A. Treasury Stock- -Common is credited for $56. B. Treasury StockCommon is debited for $3,800. C. Retained Earnings is debited for $3,800. D. Treasury Stock-Common is debited for $7,600