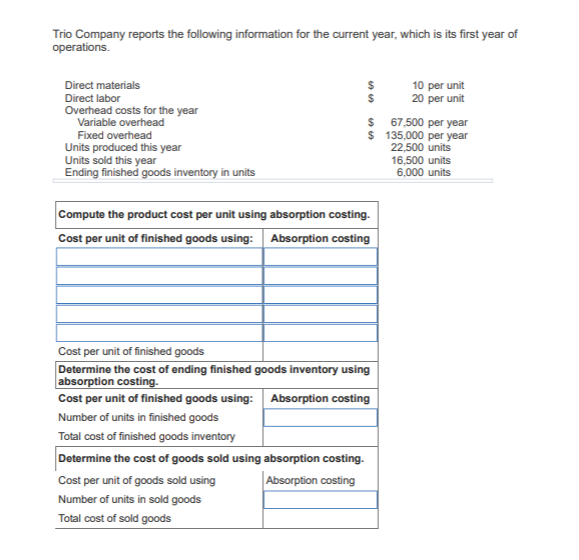

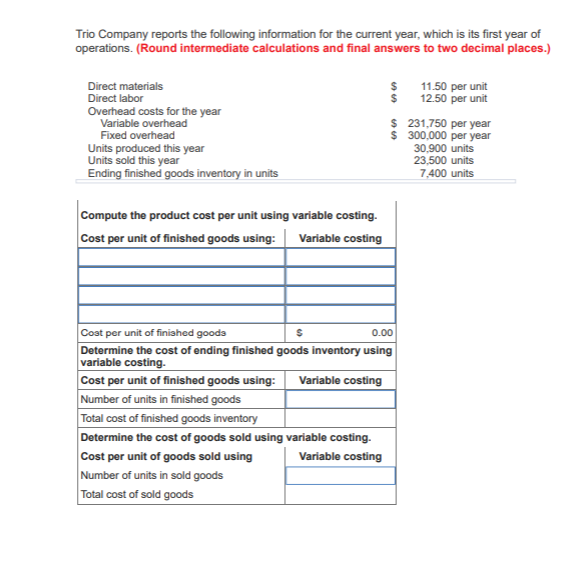

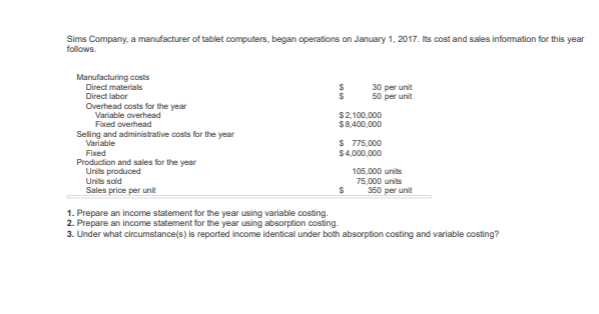

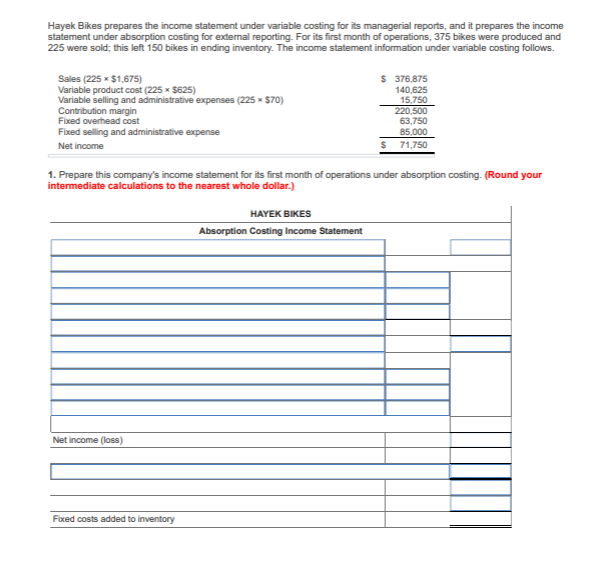

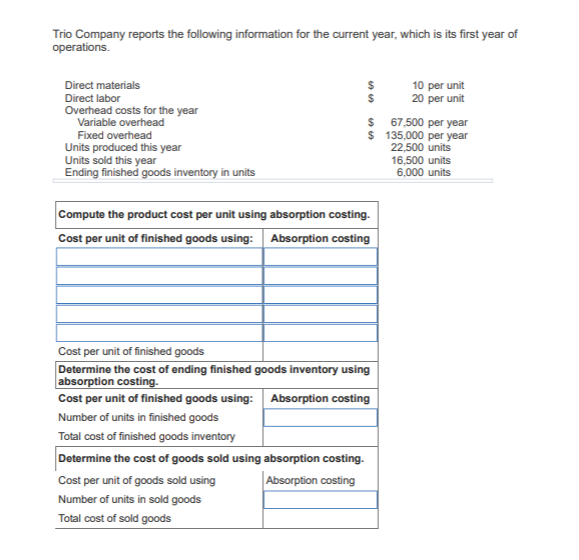

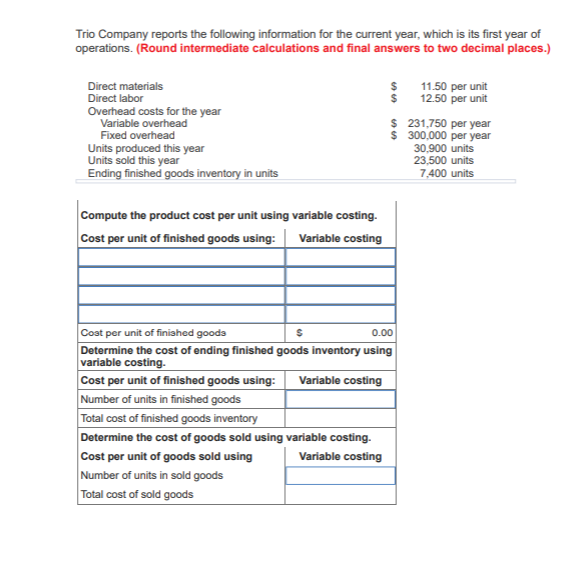

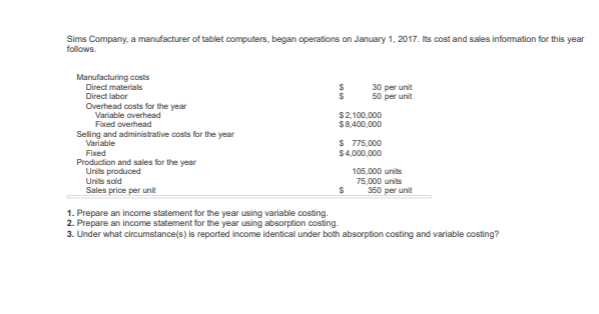

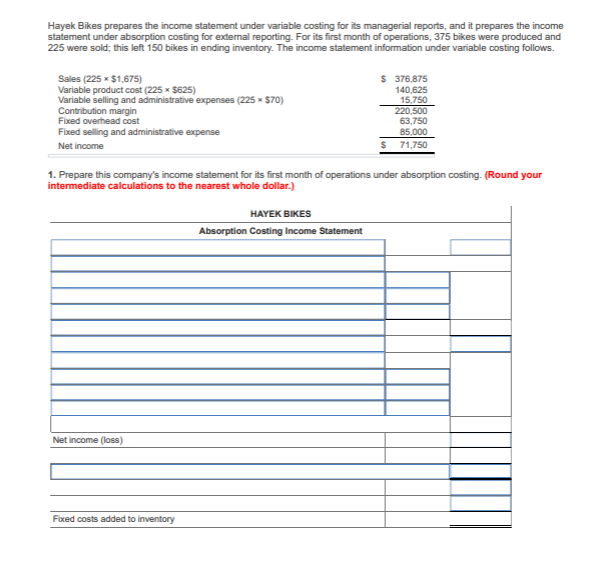

Trio Company reports the following information for the current year, which is its first year of operations. $ 10 per unit 20 per unit $ Direct materials Direct labor Overhead costs for the year Variable overhead Fixed overhead Units produced this year Units sold this year Ending finished goods inventory in units $ $ 67,500 per year 135,000 per year 22,500 units 16.500 units 6,000 units Compute the product cost per unit using absorption costing. Cost per unit of finished goods using: Absorption costing Cost per unit of finished goods Determine the cost of ending finished goods inventory using absorption costing. Cost per unit of finished goods using: Absorption costing Number of units in finished goods Total cost of finished goods inventory Determine the cost of goods sold using absorption costing. Cost per unit of goods sold using Absorption costing Number of units in sold goods Total cost of sold goods Trio Company reports the following information for the current year, which is its first year of operations. (Round intermediate calculations and final answers to two decimal places.) $ $ 11.50 per unit 12.50 per unit Direct materials Direct labor Overhead costs for the year Variable overhead Fixed overhead Units produced this year Units sold this year Ending finished goods inventory in units $ 231,750 per year $ 300,000 per year 30.900 units 23.500 units 7,400 units Compute the product cost per unit using variable costing. Cost per unit of finished goods using: Variable costing Cost per unit of finished goods Determine the cost of ending finished goods inventory using variable costing. Cost per unit of finished goods using: Variable costing Number of units in finished goods Total cost of finished goods inventory Determine the cost of goods sold using variable costing. Cost per unit of goods sold using Variable costing Number of units in sold goods Total cost of sold goods Sims Company, a manufacturer of tablet computers, began operations on January 1, 2017. Its cost and sales information for this year follows $ $ 30 per unit 50 per unit Manufacturing costs Direct materials Direct labor Overhead costs for the year Variable overhead Fived overhead Seling and administrative costs for the year Variable $2.100.000 $8.400.000 $ 775.000 $4.000.000 Production and sales for the year Units produced Unis sold Sales price per unit 105.000 units 75 000 units 350 per unit $ 1. Prepare an income statement for the year using variable costing 2. Prepare an income statement for the year using absorption costing 3. Under what circumstance(s) is reported income identical under both absorption costing and variable costing? Hayek Bikes prepares the income statement under variable costing for its managerial reports, and it prepares the income statement under absorption costing for external reporting. For its first month of operations, 375 bikes were produced and 225 were sold; this left 150 bikes in ending inventory. The income statement information under variable costing follows. $ Sales (225 x $1.675) Variable product cost (225 x $625) Variable selling and administrative expenses (225 * $70) Contribution margin Fixed overhead cost Fixed selling and administrative expense Net income 376.875 140.625 15.750 220.500 63.750 85.000 71,750 $ 1. Prepare this company's income statement for its first month of operations under absorption costing. (Round your intermediate calculations to the nearest whole dollar.) HAYEK BIKES Absorption Costing Income Statement Net income (loss) Fixed costs added to inventory