Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Tripods, Inc. makes and sells two models of tripods for the commercial photography market. The first model, Stable Eyes, is heavier and is most

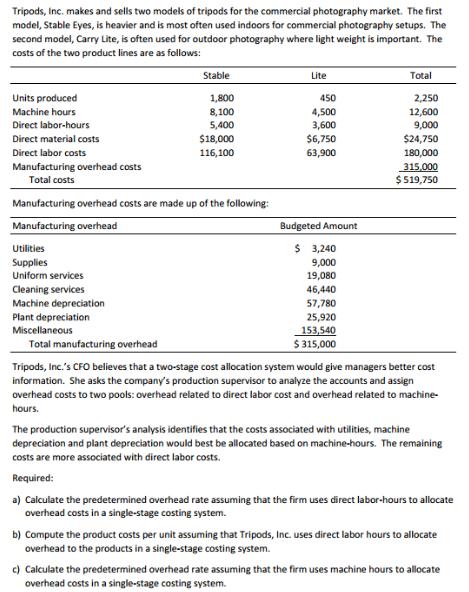

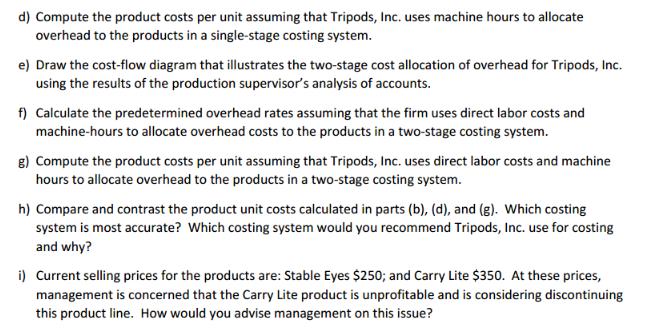

Tripods, Inc. makes and sells two models of tripods for the commercial photography market. The first model, Stable Eyes, is heavier and is most often used indoors for commercial photography setups. The second model, Carry Lite, is often used for outdoor photography where light weight is important. The costs of the two product lines are as follows: Units produced Machine hours Direct labor-hours Direct material costs Direct labor costs Manufacturing overhead costs Total costs Utilities Supplies Uniform services Cleaning services Machine depreciation Plant depreciation Manufacturing overhead costs are made up of the following: Manufacturing overhead Miscellaneous Stable Total manufacturing overhead 1,800 8,100 5,400 $18,000 116,100 Lite 450 4,500 3,600 $6,750 63,900 Budgeted Amount $ 3,240 9,000 19,080 46,440 57,780 25,920 153,540 $ 315,000 Total 2,250 12,600 9,000 $24,750 180,000 315,000 $ 519,750 Tripods, Inc.'s CFO believes that a two-stage cost allocation system would give managers better cost information. She asks the company's production supervisor to analyze the accounts and assign overhead costs to two pools: overhead related to direct labor cost and overhead related to machine- hours. The production supervisor's analysis identifies that the costs associated with utilities, machine depreciation and plant depreciation would best be allocated based on machine-hours. The remaining costs are more associated with direct labor costs. Required: a) Calculate the predetermined overhead rate assuming that the firm uses direct labor-hours to allocate overhead costs in a single-stage costing system. b) Compute the product costs per unit assuming that Tripods, Inc. uses direct labor hours to allocate overhead to the products in a single-stage costing system. c) Calculate the predetermined overhead rate assuming that the firm uses machine hours to allocate overhead costs in a single-stage costing system. d) Compute the product costs per unit assuming that Tripods, Inc. uses machine hours to allocate overhead to the products in a single-stage costing system. e) Draw the cost-flow diagram that illustrates the two-stage cost allocation of overhead for Tripods, Inc. using the results of the production supervisor's analysis of accounts. f) Calculate the predetermined overhead rates assuming that the firm uses direct labor costs and machine-hours to allocate overhead costs to the products in a two-stage costing system. g) Compute the product costs per unit assuming that Tripods, Inc. uses direct labor costs and machine hours to allocate overhead to the products in a two-stage costing system. h) Compare and contrast the product unit costs calculated in parts (b), (d), and (g). Which costing system is most accurate? Which costing system would you recommend Tripods, Inc. use for costing and why? i) Current selling prices for the products are: Stable Eyes $250; and Carry Lite $350. At these prices, management is concerned that the Carry Lite product is unprofitable and is considering discontinuing this product line. How would you advise management on this issue?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Calculate the predetermined overhead rate assuming that the firm uses direct laborhours to allocate overhead costs in a singlestage costing system Predetermined Overhead Rate Total Manufacturing Ove...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started