Question

Trish and Michael want to build a third floor onto their home that will contain a true master bedroom along with an office.They settled on

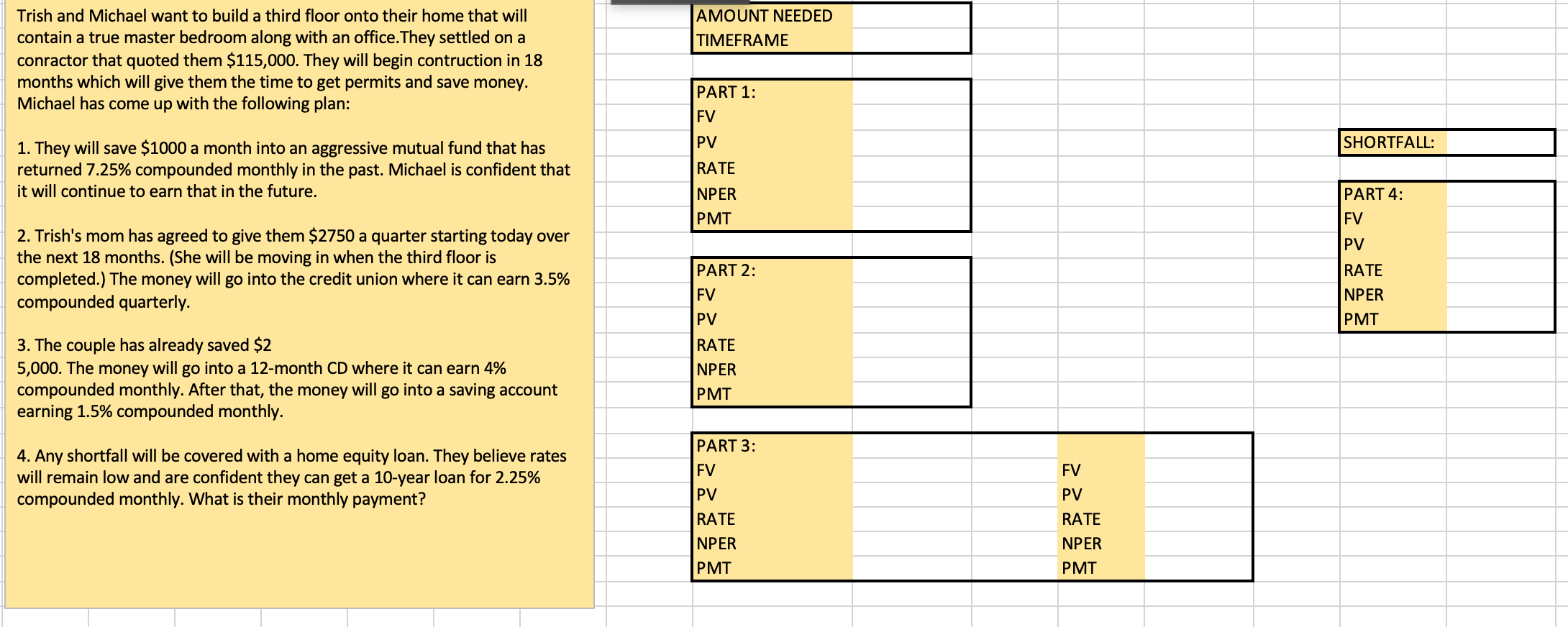

Trish and Michael want to build a third floor onto their home that will contain a true master bedroom along with an office.They settled on a conractor that quoted them $115,000. They will begin contruction in 18 months which will give them the time to get permits and save money. Michael has come up with the following plan: 1. They will save $1000 a month into an aggressive mutual fund that has returned 7.25% compounded monthly in the past. Michael is confident that it will continue to earn that in the future. 2. Trish's mom has agreed to give them $2750 a quarter starting today over the next 18 months. (She will be moving in when the third floor is completed.) The money will go into the credit union where it can earn 3.5% compounded quarterly. 3. The couple has already saved $2 5,000. The money will go into a 12-month CD where it can earn 4% compounded monthly. After that, the money will go into a saving account earning 1.5% compounded monthly. 4. Any shortfall will be covered with a home equity loan. They believe rates will remain low and are confident they can get a 10-year loan for 2.25% compounded monthly. What is their monthly payment?

Trish and Michael want to build a third floor onto their home that will contain a true master bedroom along with an office.They settled on a conractor that quoted them $115,000. They will begin contruction in 18 months which will give them the time to get permits and save money. Michael has come up with the following plan: 1. They will save $1000 a month into an aggressive mutual fund that has returned 7.25% compounded monthly in the past. Michael is confident that it will continue to earn that in the future. 2. Trish's mom has agreed to give them $2750 a quarter starting today over the next 18 months. (She will be moving in when the third floor is completed.) The money will go into the credit union where it can earn 3.5% compounded quarterly. 3. The couple has already saved $2 5,000. The money will go into a 12-month CD where it can earn 4% compounded monthly. After that, the money will go into a saving account earning 1.5% compounded monthly. 4. Any shortfall will be covered with a home equity loan. They believe rates will remain low and are confident they can get a 10-year loan for 2.25% compounded monthly. What is their monthly payment?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started