Question

Trish Himple owns a retail family clothing store. Her store is located at 4321 Heather Drive, Henderson, NV 89002. Her employer identification number is 95-

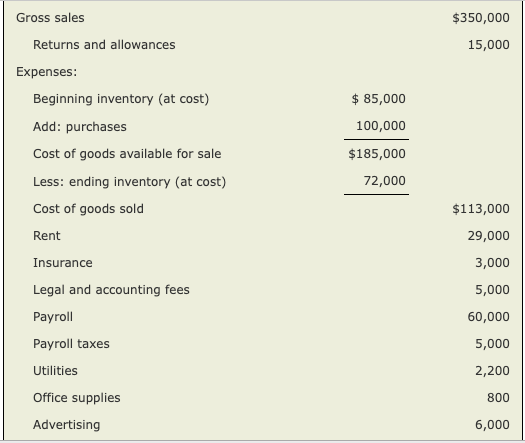

Trish Himple owns a retail family clothing store. Her store is located at 4321 Heather Drive, Henderson, NV 89002. Her employer identification number is 95- 1234321 and her Social Security number is 123-45-6789. Trish keeps her books on the cash basis. The income and expenses for the year are:

The truck is not considered a passenger automobile for purposes of the luxury automobile limitations.

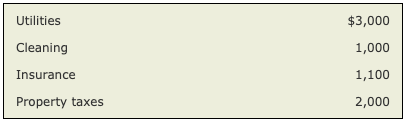

Trish also has a qualified home office of 250 sq. ft. Her home is 2,000 sq. ft. Her 2017 purchase price and basis in the home, not including land, is $100,000 (the homes market value is $150,000). She incurred the following costs in 2022 related to the entire home:

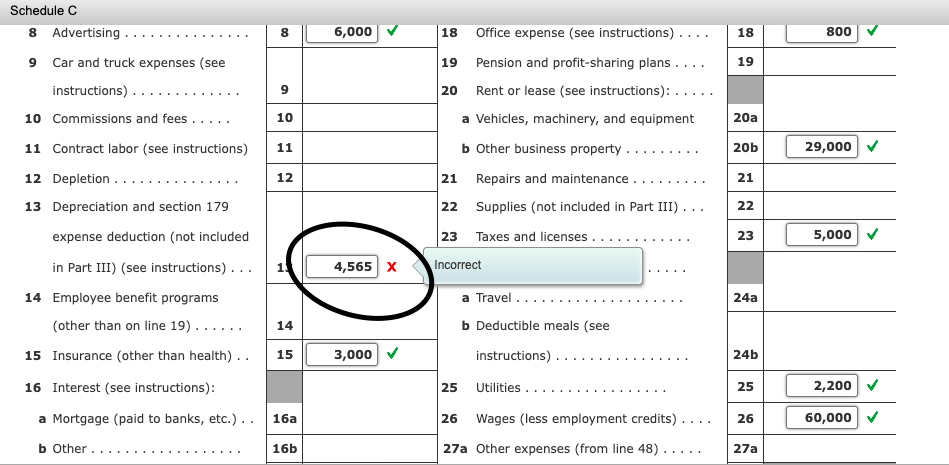

Required: For tax purposes, Trish elected out of bonus depreciation in all years except 2022. She did not elect immediate expensing in any year. The tax lives of the assets are the same as the book lives shown in the fixed asset schedule above. Complete Trishs Schedule C, Form 8829, and Form 4562.

- Make realistic assumptions about any missing data.

- Enter all amounts as positive numbers.

- If an amount box does not require an entry or the answer is zero, enter "0".

- If required round any dollar amount to the nearest dollar.

Gross sales Returns and allowances Expenses: \begin{tabular}{lr} Beginning inventory (at cost) & $85,000 \\ Add: purchases & 100,000 \\ \cline { 2 - 2 } Cost of goods available for sale & $185,000 \\ Less: ending inventory (at cost) & 72,000 \\ \hline \end{tabular} $350,000 15,000 Cost of goods sold Rent Insurance Legal and accounting fees Payroll Payroll taxes Utilities Office supplies Advertising $113,000 29,000 3,000 5,000 60,000 5,000 2,200 800 6,000 \begin{tabular}{|lr|} \hline Utilities & $3,000 \\ Cleaning & 1,000 \\ Insurance & 1,100 \\ Property taxes & 2,000 \\ \hline \end{tabular} Schedule C 8 Advertising 9 Car and truck expenses (see instructions) . . . . . . . 10 Commissions and fees..... 11 Contract labor (see instructions) 12 Depletion............ 13 Depreciation and section 179 expense deduction (not included in Part III) (see instructions) . . . 14 Employee benefit programs (other than on line 19) . . . . . 15 Insurance (other than health) . . 16 Interest (see instructions): a Mortgage (paid to banks, etc.) . . b Other

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started