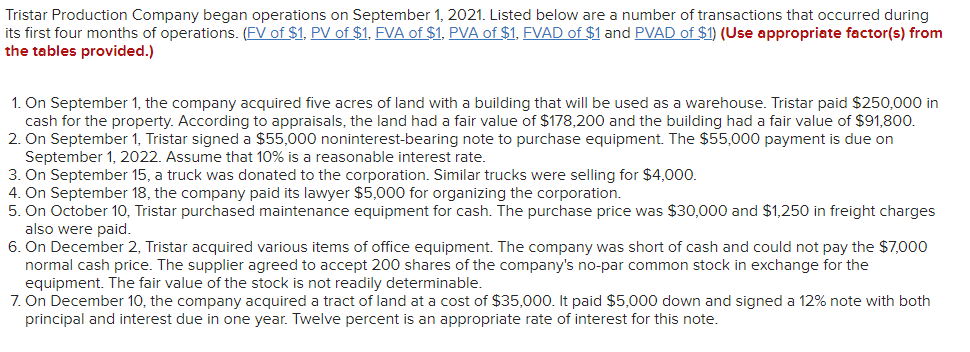

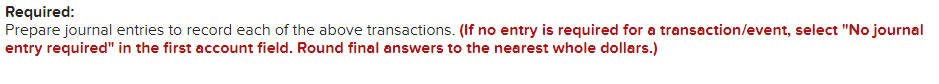

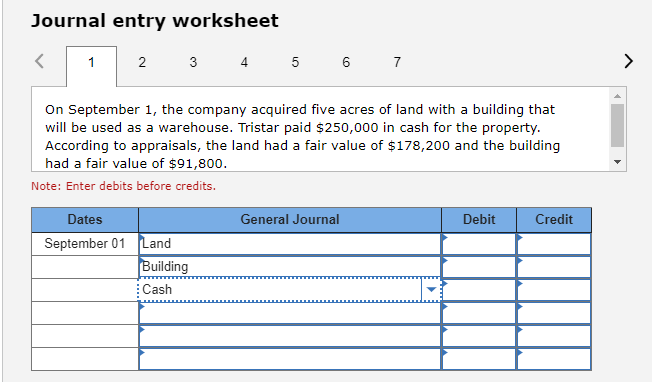

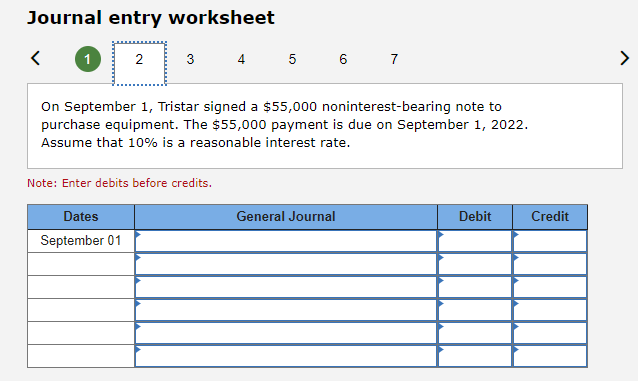

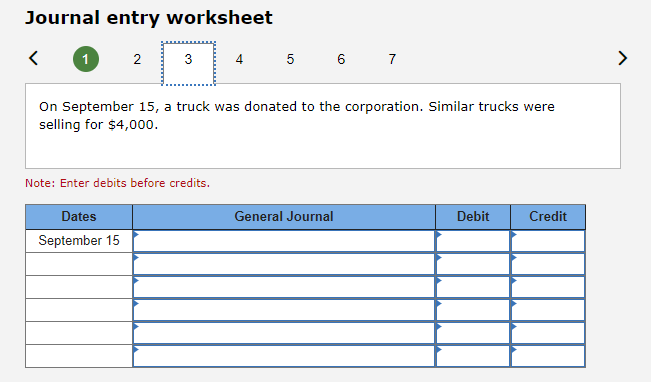

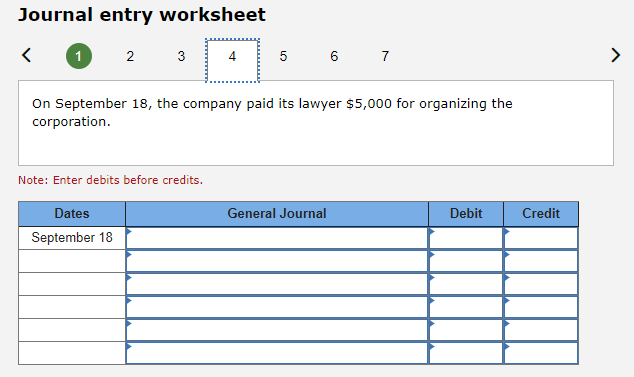

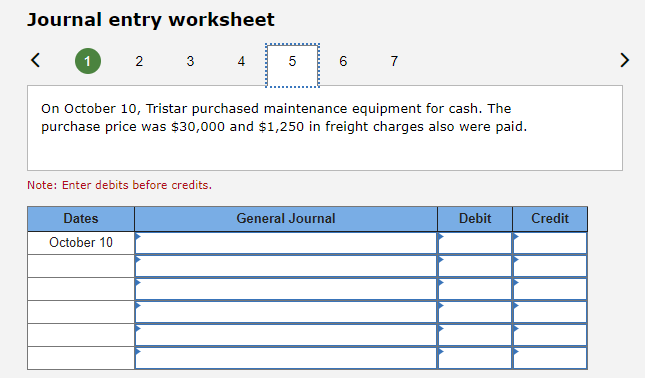

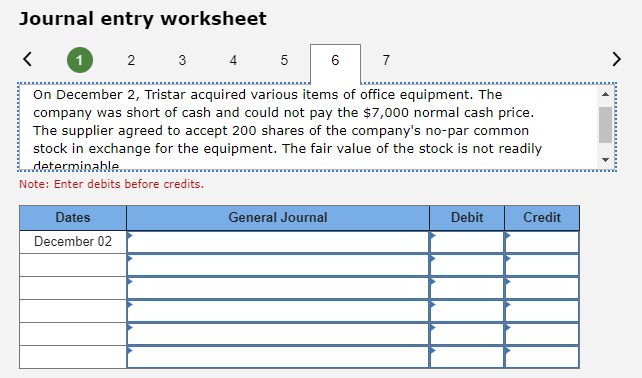

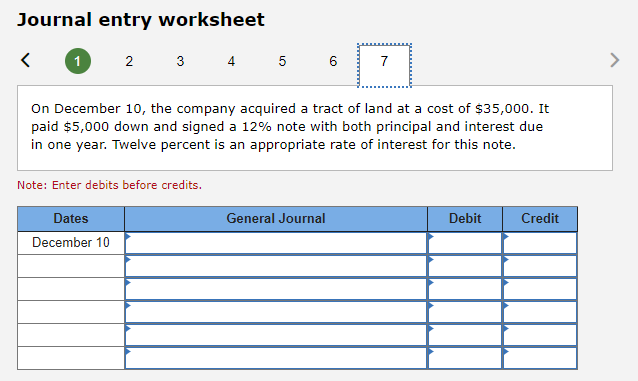

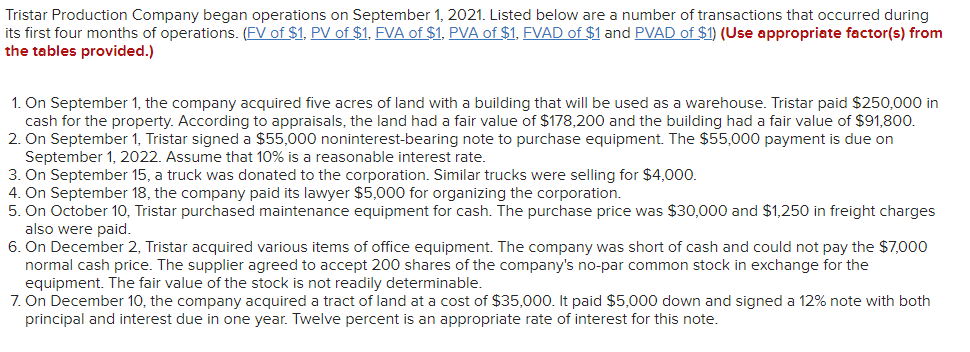

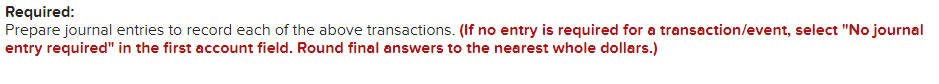

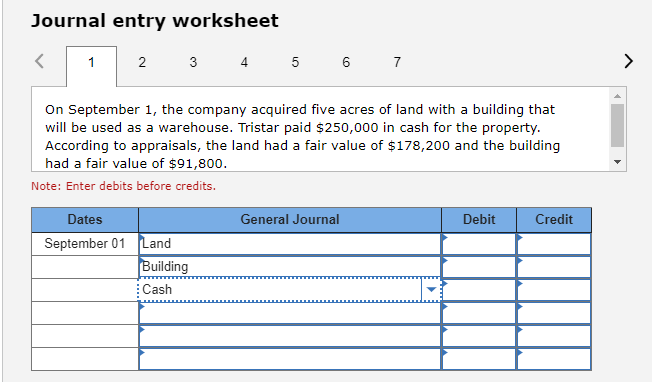

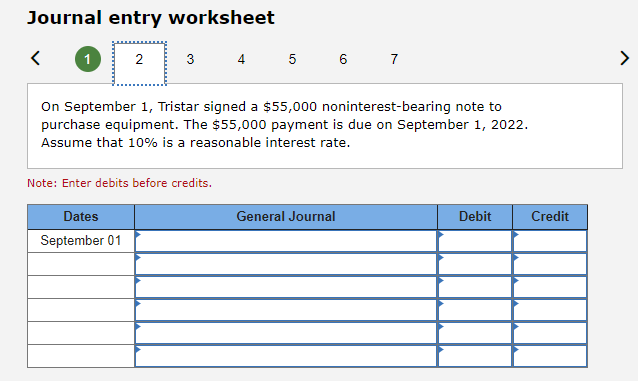

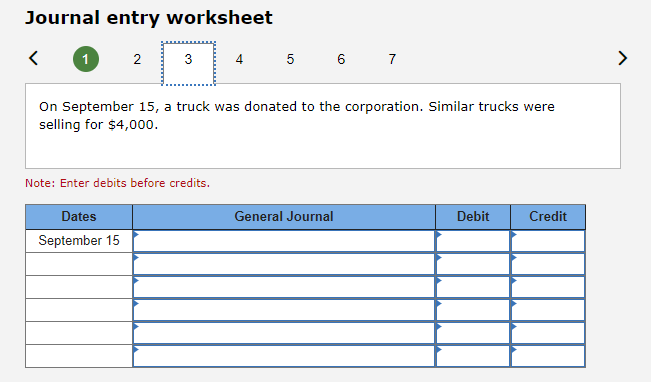

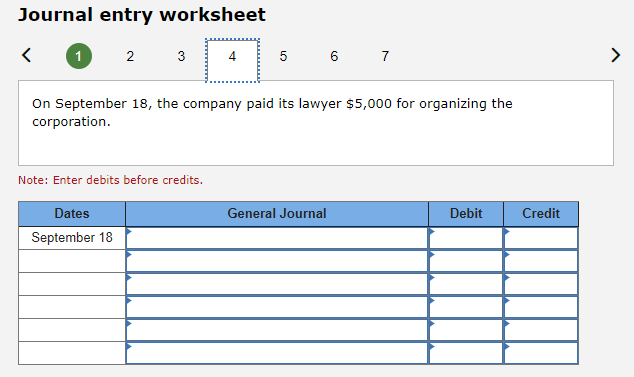

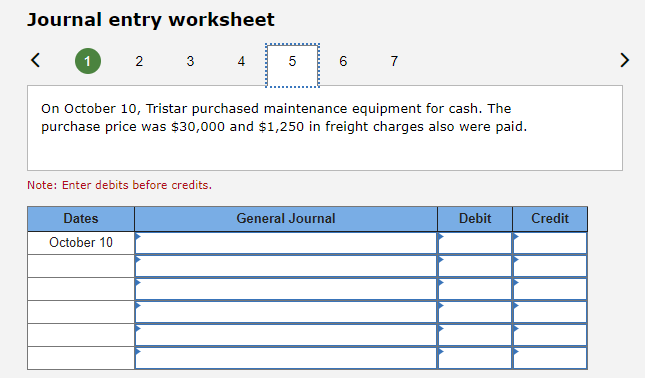

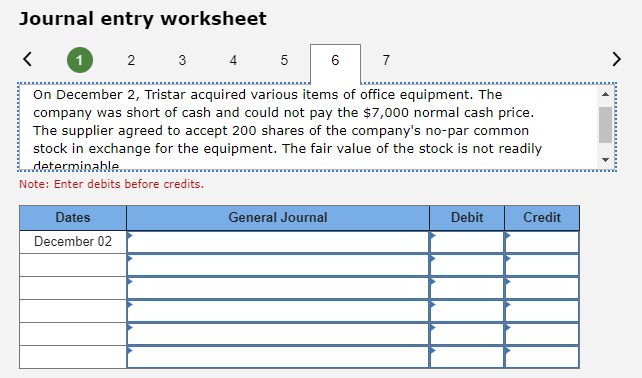

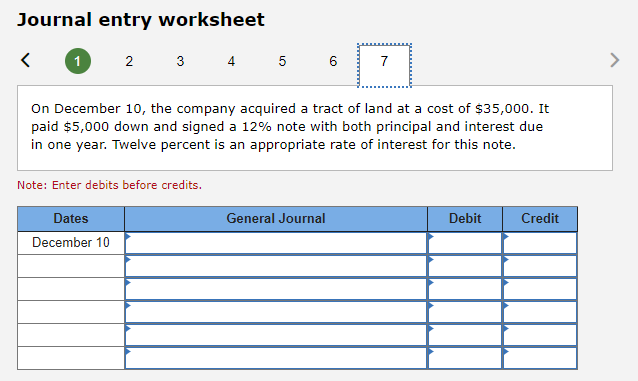

Tristar Production Company began operations on September 1, 2021. Listed below are a number of transactions that occurred during its first four months of operations. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) 1. On September 1, the company acquired five acres of land with a building that will be used as a warehouse. Tristar paid $250,000 in cash for the property. According to appraisals, the land had a fair value of $178,200 and the building had a fair value of $91,800. 2. On September 1, Tristar signed a $55,000 noninterest-bearing note to purchase equipment. The $55,000 payment is due on September 1, 2022. Assume that 10% is a reasonable interest rate. 3. On September 15, a truck was donated to the corporation. Similar trucks were selling for $4,000. 4. On September 18, the company paid its lawyer $5,000 for organizing the corporation. 5. On October 10, Tristar purchased maintenance equipment for cash. The purchase price was $30,000 and $1,250 in freight charges also were paid. 6. On December 2, Tristar acquired various items of office equipment. The company was short of cash and could not pay the $7,000 normal cash price. The supplier agreed to accept 200 shares the company's no-par common stock in exchange for the equipment. The fair value of the stock is not readily determinable. 7. On December 10, the company acquired a tract of land at a cost of $35,000. It paid $5,000 down and signed a 12% note with both principal and interest due in one year. Twelve percent is an appropriate rate of interest for this note. Required: Prepare journal entries to record each of the above transactions. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round final answers to the nearest whole dollars.) Journal entry worksheet 1 2 2 3 4 5 6 7 On September 1, the company acquired five acres of land with a building that will be used as a warehouse. Tristar paid $250,000 in cash for the property. According to appraisals, the land had a fair value of $178,200 and the building had a fair value of $91,800. Note: Enter debits before credits. General Journal Debit Credit Dates September 01 Land Building Cash Journal entry worksheet On September 15, a truck was donated to the corporation. Similar trucks were selling for $4,000. Note: Enter debits before credits. General Journal Debit Credit Dates September 15 Journal entry worksheet On September 18, the company paid its lawyer $5,000 for organizing the corporation. Note: Enter debits before credits. General Journal Debit Credit Dates September 18 Journal entry worksheet