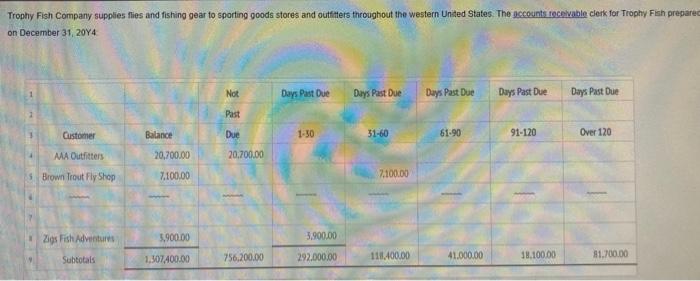

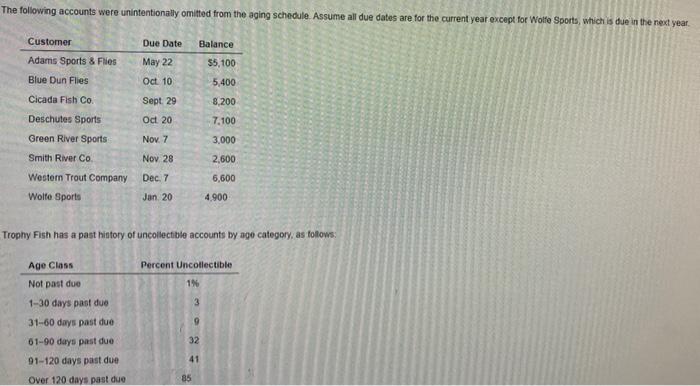

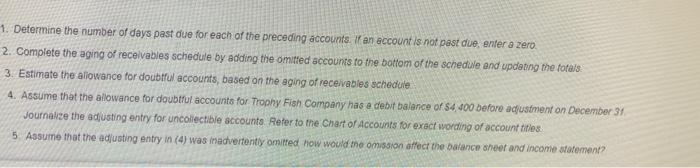

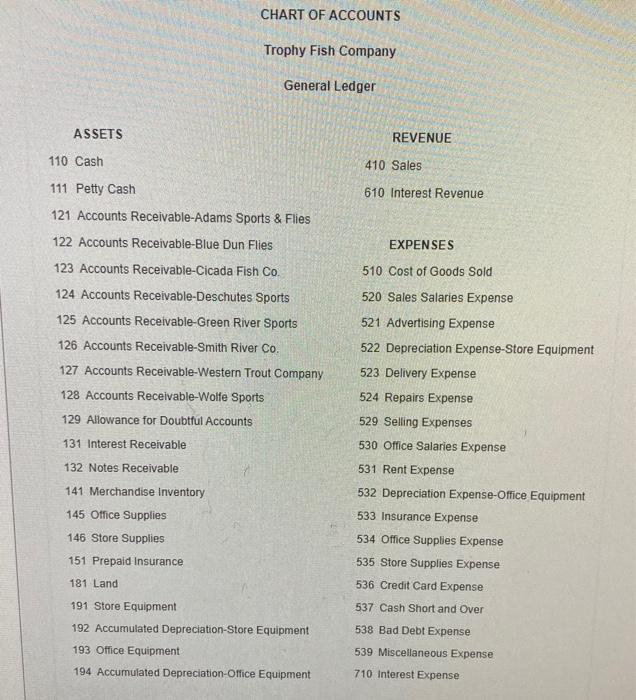

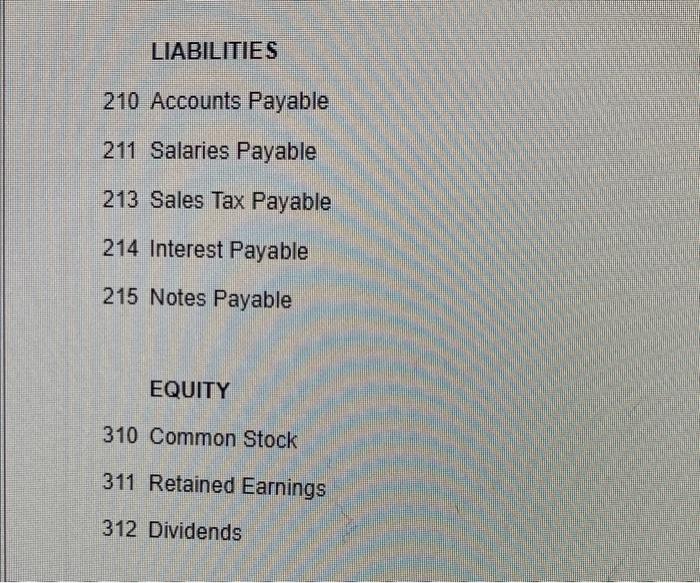

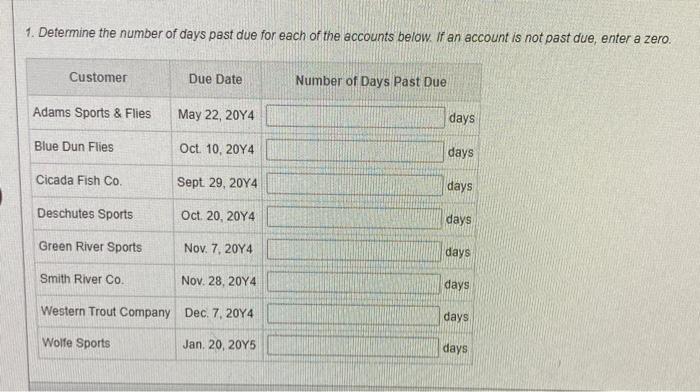

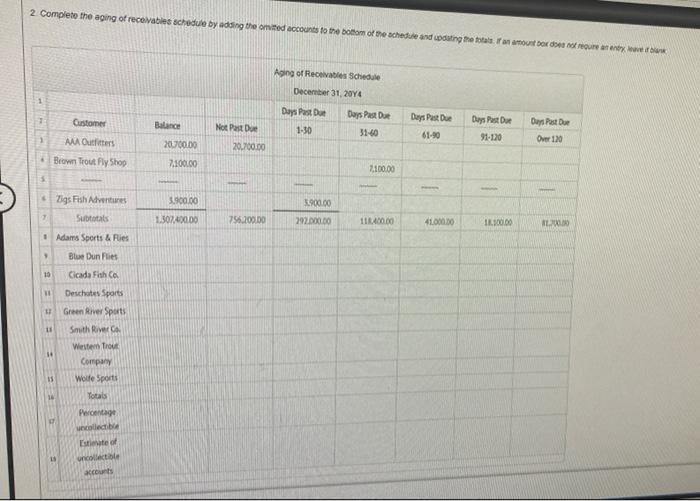

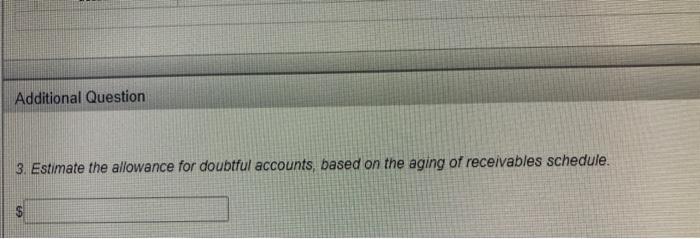

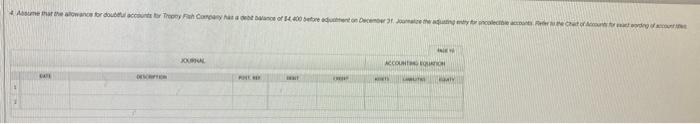

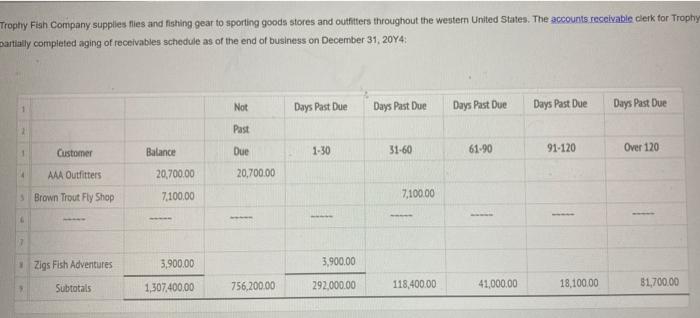

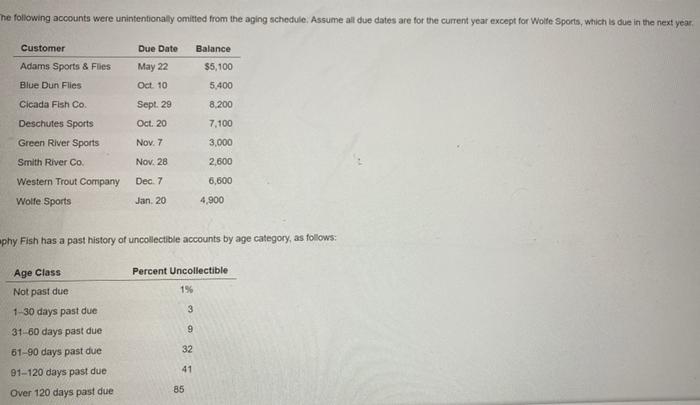

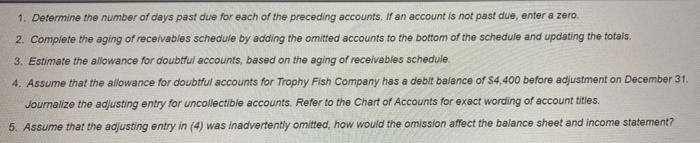

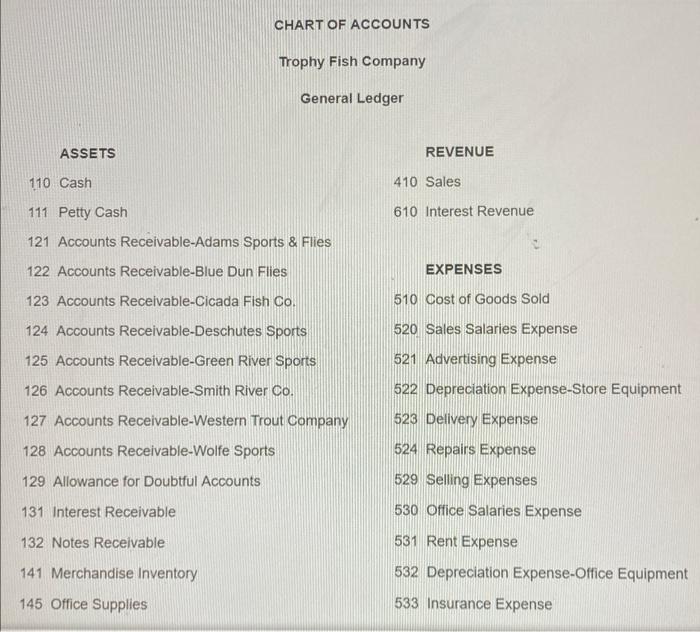

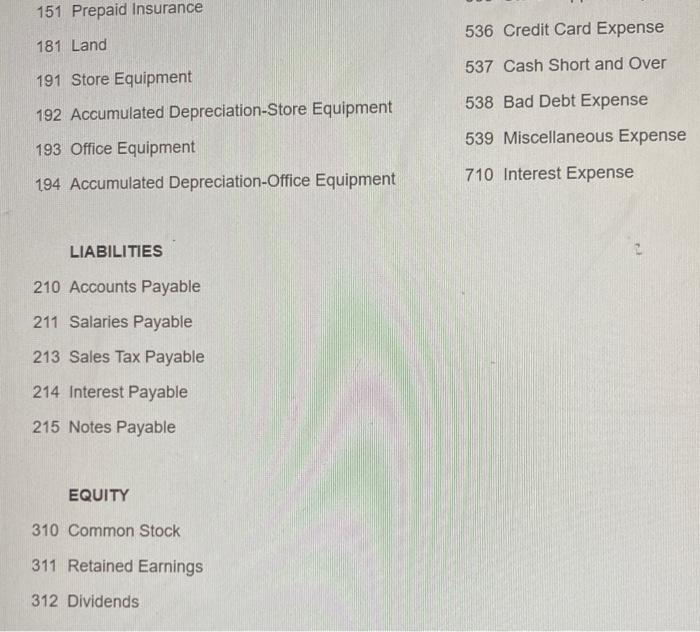

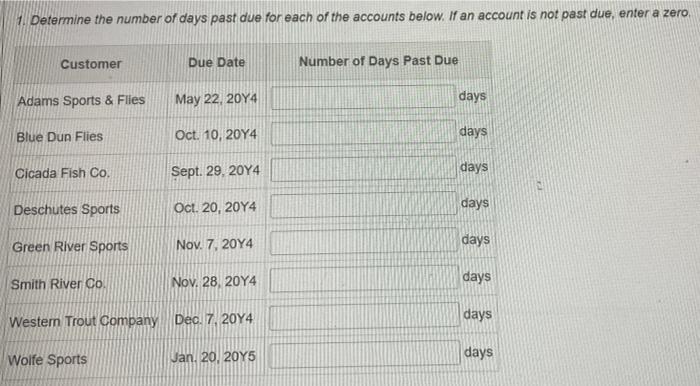

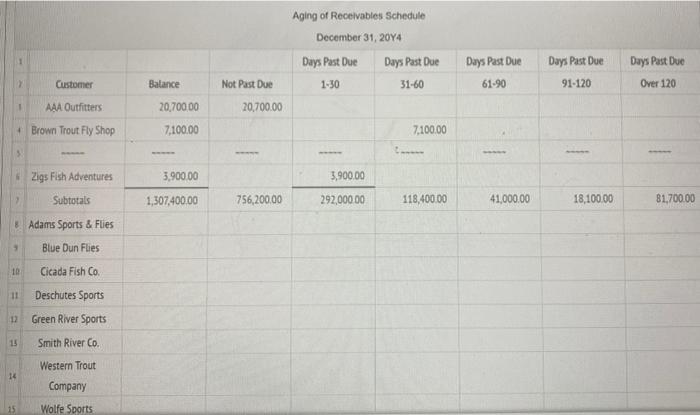

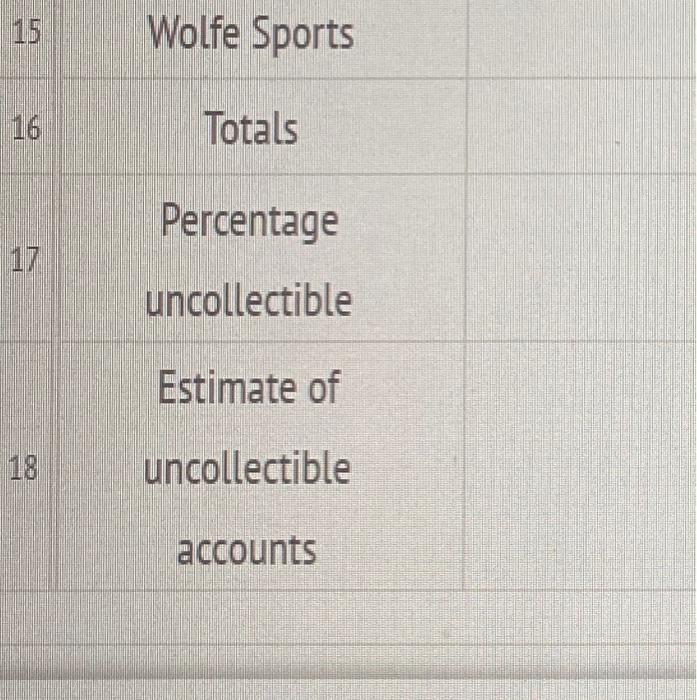

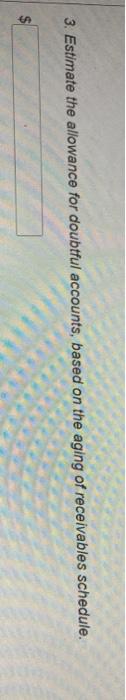

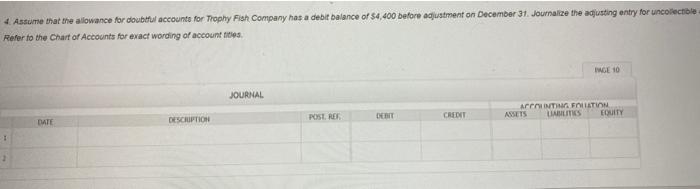

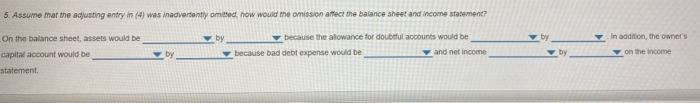

Trophy Fish Company supplies flies and fishing gear to sporting goods stores and outfitters throughout the western United States. The accounts receivable clerk for Trophy Fish prepare on December 31, 2014 Not Days Past Due Days Past Due Days Past Due Days Past Due Days Past Due Past Gustomer Balance Due 1-30 31-60 61-90 91-120 Over 120 20,700,00 20.700.00 MA Outfitters 5 Brown Trout Fly Shop 7,100.00 7.100.00 Zig Fish Adventures 5,900.00 5.900.00 Subtotals 1,307,400.00 756,200.00 292.000.00 111400.00 41.000.00 81.700.00 18.100.00 The following accounts were unintentionally omitted from the aging schedule. Assume all due dates are for the current year except for Wolfe Sports, which is due in the next year Due Date Balance May 22 $5,100 Customer Adams Sports & Flies Blue Dun Flies Cicada Fish Co. Oct 10 5,400 Sept 29 8,200 Oct 20 7,100 Deschutes Sports Green River Sports Nov. 7 3.000 2,600 Smith River Co. Nov 28 Western Trout Company Dec. 7 6,600 Wolfe Sports Jan 20 4.900 Trophy Fish has a past history of uncollectible accounts by ago category, as follows: Percent Uncollectible 1 3 Age Class Not past due 1-30 days past duo 31-60 days past due 61-90 days past due 91-120 days past due 9 32 41 Over 120 days past due 85 1. Determine the number of days past due for each of the preceding accounts. If an account is not past due, enter a zero. 2. Complete the aging of receivables schedule by adding the omitted accounts to the bottom of the schedule and updating the fofas. 3. Estimate the allowance for doubtful accounts, based on the aging of receivables schedule 4. Assume that the allowance for doubtful accounts for Trophy Fish Company has a debit balance of $4 400 before adjustment on December 31 Journalize the adjusting entry for uncollectible accounts Refer to the Chart of Accounts for exact wording of accountitles 5. Assume that the adjusting entry in (4) was inadvertently omitted how would the omission affect the balance sheet and income statement? CHART OF ACCOUNTS Trophy Fish Company General Ledger ASSETS REVENUE 110 Cash 410 Sales 610 Interest Revenue EXPENSES 510 Cost of Goods Sold 111 Petty Cash 121 Accounts Receivable-Adams Sports & Flies 122 Accounts Receivable-Blue Dun Flies 123 Accounts Receivable-Cicada Fish Co. 124 Accounts Receivable-Deschutes Sports 125 Accounts Receivable-Green River Sports 126 Accounts Receivable-Smith River Co. 127 Accounts Receivable-Western Trout Company 128 Accounts Receivable-Wolfe Sports 129 Allowance for Doubtful Accounts 131 Interest Receivable 520 Sales Salaries Expense 521 Advertising Expense 522 Depreciation Expense-Store Equipment 523 Delivery Expense 524 Repairs Expense 529 Selling Expenses 530 Office Salaries Expense 531 Rent Expense 532 Depreciation Expense-Office Equipment 533 Insurance Expense 534 Office Supplies Expense 535 Store Supplies Expense 536 Credit Card Expense 537 Cash Short and Over 132 Notes Receivable 141 Merchandise Inventory 145 Office Supplies 146 Store Supplies 151 Prepaid Insurance 181 Land 191 Store Equipment 192 Accumulated Depreciation Store Equipment 193 Office Equipment 194 Accumulated Depreciation Office Equipment 538 Bad Debt Expense 539 Miscellaneous Expense 710 Interest Expense LIABILITIES 210 Accounts Payable 211 Salaries Payable 213 Sales Tax Payable 214 Interest Payable 215 Notes Payable EQUITY 310 Common Stock 311 Retained Earnings 312 Dividends 1. Determine the number of days past due for each of the accounts below. If an account is not past due, enter a zero. Customer Due Date Number of Days Past Due Adams Sports & Flies May 22, 2014 days Blue Dun Flies Oct 10, 2014 days Cicada Fish Co. Sept 29, 2014 days Deschutes Sports Oct 20, 2014 days Green River Sports Nov. 7. 2014 days Smith River Co. Nov. 28, 2014 days Western Trout Company Dec. 7. 2014 days Wolfe Sports Jan 20, 2015 days 2. Complete the aging of receivables schedule by adding the omitted accounts to the bottom of the schedule and updating the total amount of our style Aging of Receivables Schedule December 31, 2014 1 Days Post Du 1 Balance Days Pastor 31-60 1-30 Customer AMA Outfitters Brown Trout Fly Shop Days Past Due 61.90 Not Pastor 20.700.00 Days Post Du 91-120 OnPast Doe Over 120 20.700.00 7,100.00 2.100.00 5.900.00 Zig Fish Adventures Subtotals 5.900.00 1.307.400.00 756,200.00 292.000.00 IRADO DO 41.000.00 11.300.00 AL Adams Sports & Flies 3 10 11 Blue Dunes Cicada Fish Ca Deschtes Sports Green River Sports Smith River Western Troue Company Woite Sports Totals 15 Percentage cibe state of collectie accounts Additional Question 3. Estimate the allowance for doubtful accounts, based on the aging of receivables schedule. *Asume the low or double berry Company of 400 eur wyciech Acco FREE Auto On ben we VW be Trophy Fish Company supplies flies and fishing gear to sporting Goods stores and outfitters throughout the western United States. The accounts receivable clerk for Trophy artially completed aging of receivables schedule as of the end of business on December 31, 2014 1 Not Days Past Due Days Past Due Days Past Due Days Past Due Days Past Due Past Customer Balance Due 1 1-30 31-60 61-90 Over 120 91-120 4 AAA Outfitters 20,700.00 20.700.00 3 Brown Trout Fly Shop 7,100.00 7,100.00 Zigs Fish Adventures 3,900.00 3,900.00 Subtotals 1,307,400.00 756,200.00 292,000.00 118,400.00 41,000.00 18,100.00 31,700.00 The following accounts were unintentionally omitted from the aging schedule, Assume alt due dates are for the current year except for Wolfe Sports, which is due in the next year Due Date Customer Adams Sports & Flies May 22 Balance $5,100 5.400 Blue Dun Flies Oct 10 8.200 Cicada Fish Co. Deschutes Sports Green River Sports Sept. 29 Oct. 20 7,100 3.000 Nov. 7 Nov. 28 2,600 Smith River Co. Western Trout Company Wolfe Sports Dec. 7 6,600 Jan. 20 4,900 aphy Fish has a past history of uncollectible accounts by age category, as follows: Age Class Percent Uncollectible 19 Not past due 3 1-30 days past due 31-60 days past due 9 61-90 days past due 32 41 91-120 days past due 85 Over 120 days past due 1. Determine the number of days past due for each of the preceding accounts. If an account is not past due, enter a zero 2. Complete the aging of receivables schedule by adding the omitted accounts to the bottom of the schedule and updating the totals. 3. Estimate the allowance for doubtful accounts, based on the aging of receivables schedule 4. Assume that the allowance for doubtful accounts for Trophy Fish Company has a debit balance of $4,400 before adjustment on December 31 Journalize the adjusting entry for uncollectible accounts. Refer to the Chart of Accounts for exact wording of account titles. 5. Assume that the adjusting entry in (4) was inadvertently omitted, how would the omission affect the balance sheet and income statement? CHART OF ACCOUNTS Trophy Fish Company General Ledger ASSETS REVENUE 110 Cash 410 Sales 610 Interest Revenue 111 Petty Cash 121 Accounts Receivable-Adams Sports & Flies 122 Accounts Receivable-Blue Dun Flies EXPENSES 123 Accounts Receivable-Cicada Fish Co. 510 Cost of Goods Sold 124 Accounts Receivable-Deschutes Sports 125 Accounts Receivable-Green River Sports 126 Accounts Receivable-Smith River Co. 127 Accounts Receivable-Western Trout Company 520 Sales Salaries Expense 521 Advertising Expense 522 Depreciation Expense-Store Equipment 523 Delivery Expense 524 Repairs Expense 529 Selling Expenses 530 Office Salaries Expense 128 Accounts Receivable-Wolfe Sports 129 Allowance for Doubtful Accounts 131 Interest Receivable 132 Notes Receivable 531 Rent Expense 141 Merchandise Inventory 532 Depreciation Expense-Office Equipment 145 Office Supplies 533 Insurance Expense 151 Prepaid Insurance 536 Credit Card Expense 181 Land 537 Cash Short and Over 191 Store Equipment 192 Accumulated Depreciation-Store Equipment 193 Office Equipment 194 Accumulated Depreciation Office Equipment 538 Bad Debt Expense 539 Miscellaneous Expense 710 Interest Expense LIABILITIES 210 Accounts Payable 211 Salaries Payable 213 Sales Tax Payable 214 Interest Payable 215 Notes Payable EQUITY 310 Common Stock 311 Retained Earnings 312 Dividends 1. Determine the number of days past due for each of the accounts below. If an account is not past due, enter a zero Customer Due Date Number of Days Past Due Adams Sports & Files May 22, 2014 days Blue Dun Flies Oct. 10, 2014 days Cicada Fish Co. Sept. 29. 2014 days Deschutes Sports Oct. 20, 2014 days days Green River Sports Nov. 7, 2014 Smith River Co. Nov. 28, 2014 days Westem Trout Company Dec. 7. 20Y4 days Uan. 20, 2045 days Wolfe Sports Aging of Receivables Schedule December 31, 2014 Days Past Due Days Past Due 1-30 31-60 Days Past Due Days Past Due Days Past Due 91-120 Customer Balance Not Past Due 61-90 Over 120 AAA Outfitters 20,700.00 20.700.00 + Brown Trout Fly Shop 7,100.00 7,100.00 5 tu 3,900.00 3,900.00 292,000.00 1,507,400.00 756,200.00 118,400.00 41,000.00 18,100.00 81,700.00 Zigs Fish Adventures Subtotals Adams Sports & Flies Blue Dun Flies 10 Cicada Fish Co. 11 Deschutes Sports Green River Sports 12 15 Smith River Co. Western Trout 14 Company 15 Wolfe Sports 15 Wolfe Sports 16 Totals Percentage 17 uncollectible Estimate of 18 uncollectible accounts 3. Estimate the allowance for doubtful accounts, based on the aging of receivables schedule. $ 4. Assume that the allowance for doubtful accounts for Trophy Fish Company has a debit balance of 54,400 before adjustment on December 31. Journalize the adjusting entry for uncollectie Refer to the Chart of Accounts for exact wording of accounties INGE 10 JOURNAL ARCTI FILATION ADSETS LABILITIES OUTY DET CREDIT POSL REK DATE DESCRIPTION 1 5. Assume that the adjusting entry in (4) was inadvertently omitted now would the omission affect the balance sheet and income statement? by On the balance sheet, assets would be capital account would be statement by because the alowance for doubtful accounts would be because bad debt expense would be and net income In addition, the owner's on the income