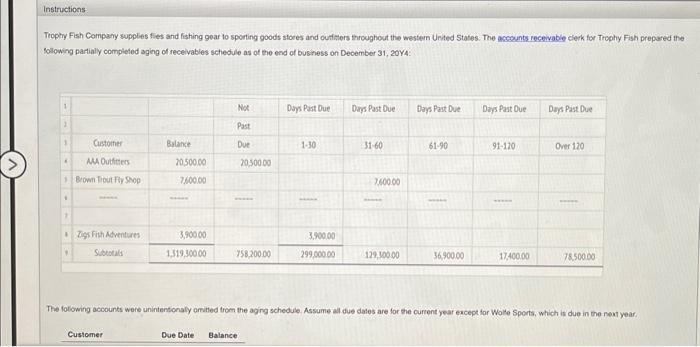

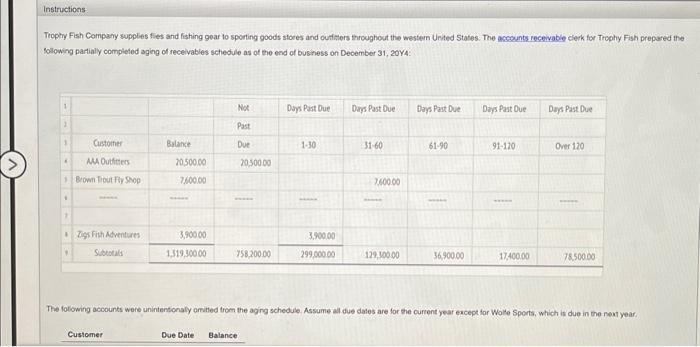

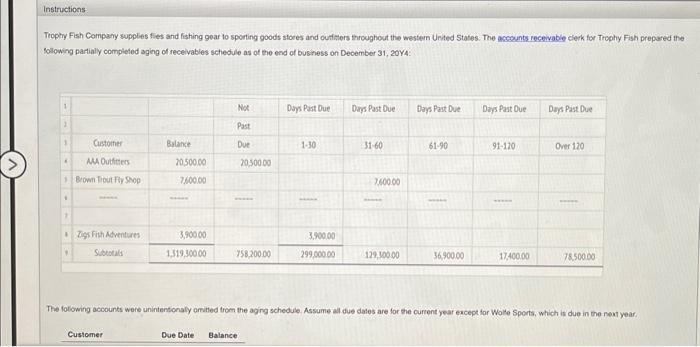

Trophy Fish Company supplies flies and fishing gear to sporting goods stores and outfitters throughout the western United States. The accounts receivable clerk for Trophy Fish prepared the following partially completed aging of receivables schedule as of the end of business on December 31, 20Y4:

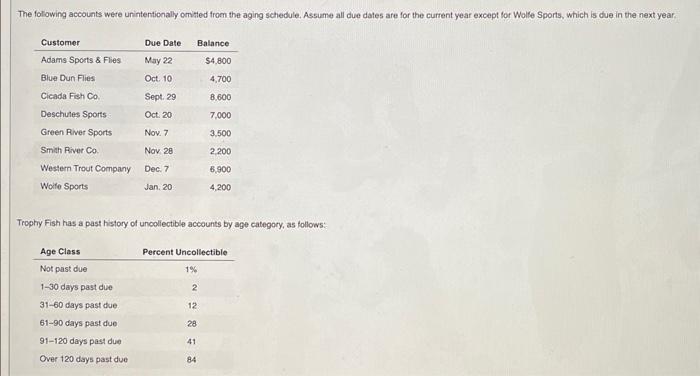

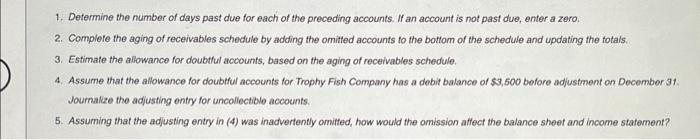

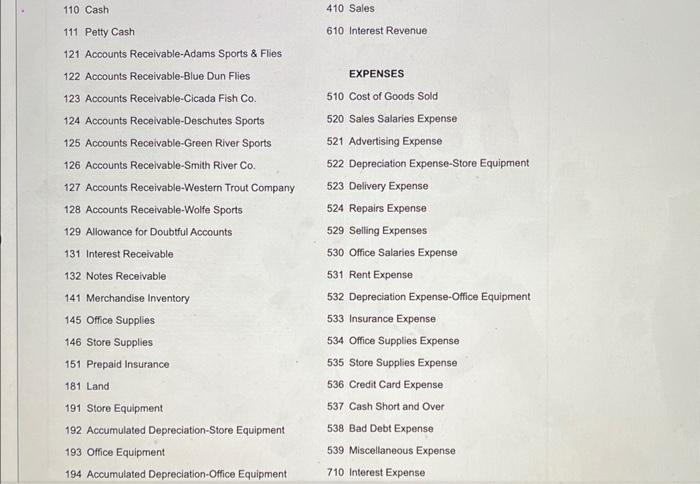

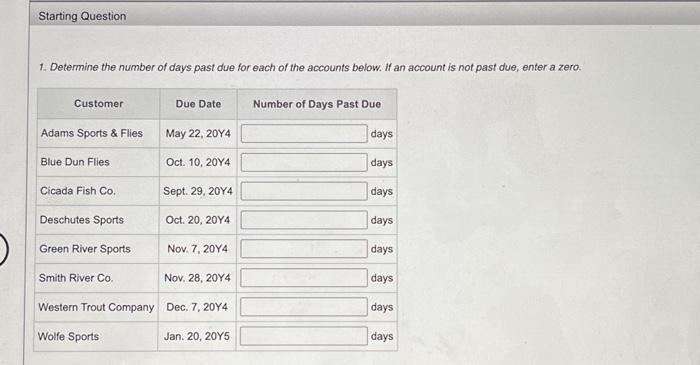

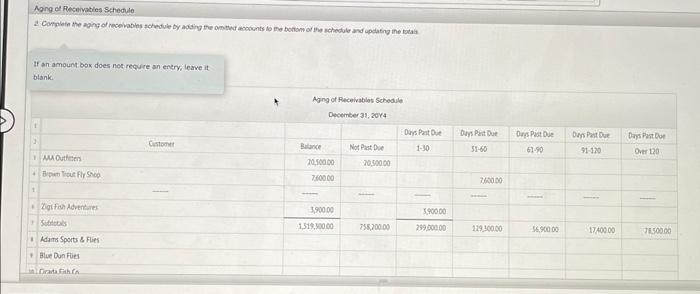

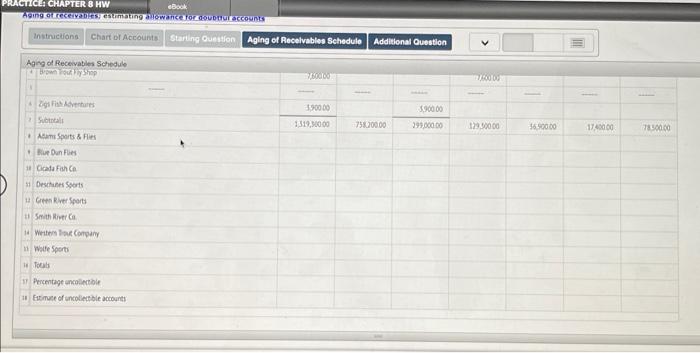

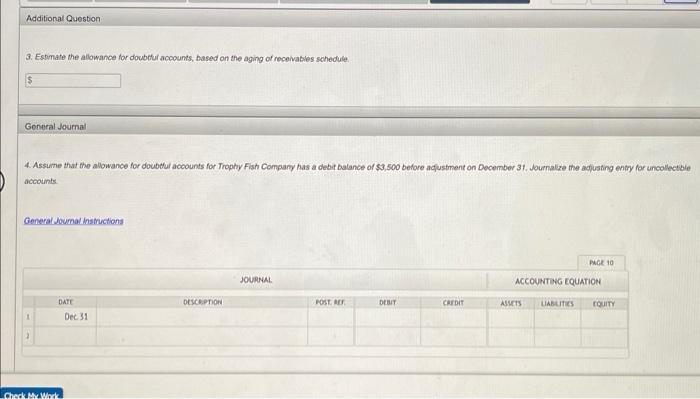

1. Determine the number of days past due for each of the accounts below. If an account is not past due, enter a zero. 3. Estimate the allowance for doubtul accounts, based on the aging of receivables schedule. General Journal 4. Assume that the allowance for doubdur acoounts for Trophy Fish Compary has a debir balance of $3,500 before adfustment on Docember 31 . Joumalize the adjusting entry for uncollectible accounts. If an amount box does nos require an entry, leave it blank. Trophy Fish has a past history of uncollectible accounts by age category, as follows: Tropty Fish Compary supples ties and fishing goaf to sporting goods stoces and outfiters throughout the western Unted States. The accesunts recenvable clerk for Trophy Fish prepared the sollowing partially completed aging of receivabies schedule as of the end of business on December 31, 20Y4: The folowing accounts were unintentonsly amithed trom the aging schedve. Assume al due dales are for the current year except for Wolle Sponts, which is due in the revit year: 1. Determine the number of days past due for each of the preceding accounts. If an account is not past due, enter a zero. 2. Complete the aging of receivables schedule by adding the omitted accounts to the bottom of the schedule and updating the totals. 3. Estimate the allowance for doubthil accounts, based on the aging of receivables schedule. 4. Assume that the allowance for doubtful accounts for Trophy Fish Company has a debit batance of \$3,500 before adjustment on December 31 Journakze the adjusting entry for uncollectible accounts. 5. Assuming that the adjusting entry in (4) was inadvertently omitted, how would the omission affect the balance sheet and income staternent? 110 Cash 111 Petty Cash 121 Accounts Receivable-Adams Sports \& Flies 122 Accounts Receivable-Blue Dun Flies 123 Accounts Recelvable-Cicada Fish Co. 124 Accounts Recelvable-Deschutes Sports 125 Accounts Receivable-Green River Sports 126 Accounts Recelvable-Smith River Co. 127 Accounts Receivable-Western Trout Company 128 Accounts Receivable-Wolfe Sports 129 Allowance for Doubtful Accounts 131 Interest Receivable 132 Notes Receivable 141 Merchandise Inventory 145 Office Supplies 146 Store Supplies 151 Prepaid Insurance 181 Land 191 Store Equipment 192 Accumulated Depreciation-Store Equipment 193 Office Equipment 194 Accumulated Depreciation-Office Equipment 410 Sales 610 Interest Revenue EXPENSES 510 Cost of Goods Sold 520 Sales Salaries Expense 521 Advertising Expense 522 Depreciation Expense-Store Equipment 523 Delivery Expense 524 Repairs Expense 529 Selling Expenses 530 Office Salaries Expense 531 Rent Expense 532 Depreciation Expense-Office Equipment 533 Insurance Expense 534 Office Supplies Expense 535 Store Supplies Expense 536 Credit Card Expense 537 Cash Short and Over 538 Bad Debt Expense 539 Miscellaneous Expense 710 Interest Expense Aging of Recelvables schedule Additionat Question Aang of Receivatiles Schedule 2. Sutatiali - Bueponflies 11 Coata Fan ca. it Desciens Sorts 14 Geen Ruer Sports 11 Smath Riverica 14 Writes loxe Conpary 11 Wate sperto if Touts 11. Percentage uncolinciole i1 Etomer of sncolemable accounts