Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Troubled debt Problem (Intermediate Financial Accounting) Problem 1 Troubled debt Jensen & Jensen (J&J), a public company selling telecommunication equipment's, has issued a debenture bond

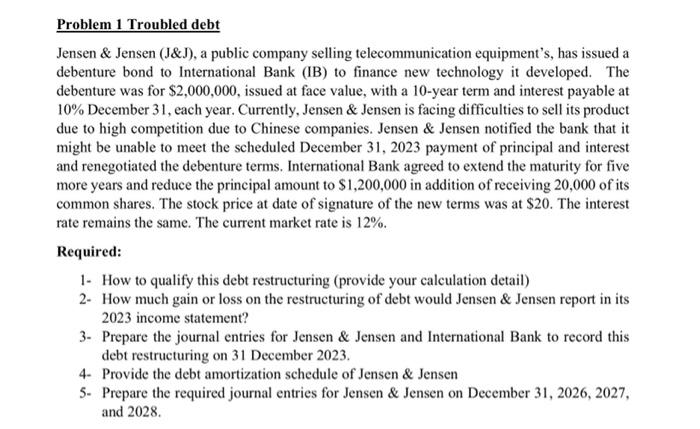

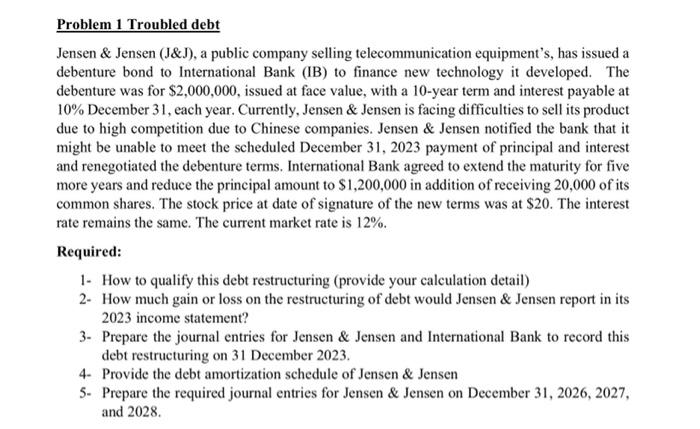

Troubled debt Problem (Intermediate Financial Accounting)

Problem 1 Troubled debt Jensen \& Jensen (J\&J), a public company selling telecommunication equipment's, has issued a debenture bond to International Bank (IB) to finance new technology it developed. The debenture was for $2,000,000, issued at face value, with a 10 -year term and interest payable at 10% December 31 , each year. Currently, Jensen \& Jensen is facing difficulties to sell its product due to high competition due to Chinese companies. Jensen \& Jensen notified the bank that it might be unable to meet the scheduled December 31,2023 payment of principal and interest and renegotiated the debenture terms. International Bank agreed to extend the maturity for five more years and reduce the principal amount to $1,200,000 in addition of receiving 20,000 of its common shares. The stock price at date of signature of the new terms was at $20. The interest rate remains the same. The current market rate is 12%. Required: 1- How to qualify this debt restructuring (provide your calculation detail) 2- How much gain or loss on the restructuring of debt would Jensen \& Jensen report in its 2023 income statement? 3- Prepare the journal entries for Jensen \& Jensen and International Bank to record this debt restructuring on 31 December 2023. 4- Provide the debt amortization schedule of Jensen \& Jensen 5- Prepare the required journal entries for Jensen \& Jensen on December 31, 2026, 2027, and 2028 . Problem 1 Troubled debt Jensen \& Jensen (J\&J), a public company selling telecommunication equipment's, has issued a debenture bond to International Bank (IB) to finance new technology it developed. The debenture was for $2,000,000, issued at face value, with a 10 -year term and interest payable at 10% December 31 , each year. Currently, Jensen \& Jensen is facing difficulties to sell its product due to high competition due to Chinese companies. Jensen \& Jensen notified the bank that it might be unable to meet the scheduled December 31,2023 payment of principal and interest and renegotiated the debenture terms. International Bank agreed to extend the maturity for five more years and reduce the principal amount to $1,200,000 in addition of receiving 20,000 of its common shares. The stock price at date of signature of the new terms was at $20. The interest rate remains the same. The current market rate is 12%. Required: 1- How to qualify this debt restructuring (provide your calculation detail) 2- How much gain or loss on the restructuring of debt would Jensen \& Jensen report in its 2023 income statement? 3- Prepare the journal entries for Jensen \& Jensen and International Bank to record this debt restructuring on 31 December 2023. 4- Provide the debt amortization schedule of Jensen \& Jensen 5- Prepare the required journal entries for Jensen \& Jensen on December 31, 2026, 2027, and 2028

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started