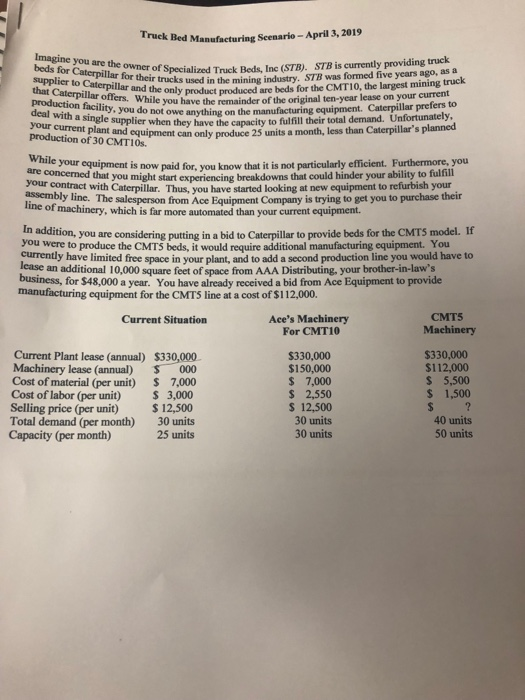

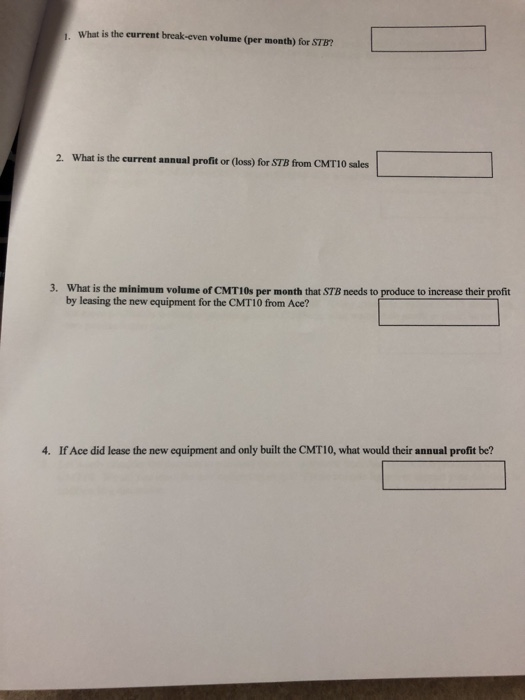

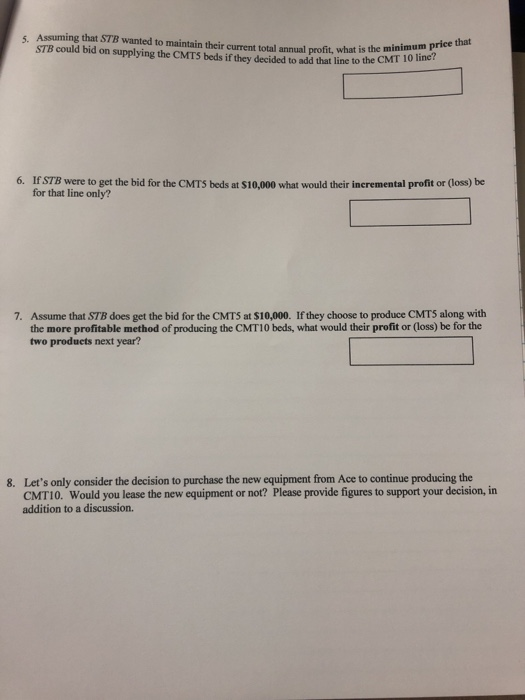

Truck Bed Manufacturing Seenario -April 3, 2019 Imagine beds for Caterpil you are the for Caterpitie owner of Specialized Tnack Beds Inc (STB). STB is cumently providing truck that Catroused in the mining industry. STB was formed five years ago, as a you have the remainder of the original ten-year lease on your current that Caterpillar production facility, you do not owe anything on the deal with a single supplier have your current plant and equipment can only produce production of 30 CMT10s. only product produced are beds for the CMT10, the largest mining truck manufacturing equipment. Caterpillar prefers to 25 units a month, less than Caterpillar's planned when they have the capacity to fulfill their total demand. Unfortunately, your equipment is now paid for, you know that it is not particularly efficient. Furthermore, you re concerned that you might start experiencing breakdowns that could hinder your ability to fulfill contract with Caterpillar. Thus, you have started looking at new equipment to refurbish your ssembly line. The salesperson from Ace Equipment Company is trying to get you to purchase their line of machinery, which is far more automated than your current equipment. In addition, you are considering putting in a bid to Caterpillar to provide beds for the CMTS model. If currently have limited free space in your plant, and to add a second production line you would have to you were to produce the CMT5 beds, it would require additional manufacturing equipment. You catse an additional 10,000 square feet of space from AAA Distributing, your brother-in-law's business, for $48,000 a year. You have already received a bid from Ace Equipment to provide manufacturing equipment for the CMTS line at a cost of $112,000. CMT5 Machinery Current Situation Ace's Machinery For CMT10 Current Plant lease (annual) $330,000 Machinery lease (annual) 000 Cost of material (per unit) 7,000 Cost of labor (per unit) S3,000 Selling price (per unit) $12,500 Total demand (per month) 30 units Capacity (per month) $330,000 $150,000 S 7,000 s 2,550 S 12,500 30 units 30 units $330,000 $112,000 $ 5,500 S 1,500 40 units 25 units 50 units 1. What is the eurrent break-even volume (per month) for STB? 2. What is the current annual profit or (loss) for STB from CMT10 sales 3. What is the minimum volume of CMT10s per month that STB needs to by leasing the new equipment for the CMT10 from Ace? to increase their profit 4. If Ace did lease the new equipment and only built the CMTI0, what would their annual profit be? 5. Assuming that STB wanted to maintain their current total annual profit, what is the mininmouin STB could bid on supplying the CMTS beds if they decided to add that line to the CMI 1 that price 6. If STB were to get the bid for the CMTS beds at $10,000 what would their incremental profit or (loss) be for that line only? Assume that STB does get the bid for the CMTS at $10,000. If they choose to produce CMT5 along with the more profitable method of producing the CMT10 beds, what would their profit or (loss) be for the two products next year? 7. Let's only consider the decision to purchase the new equipment from Ace to continue producing the CMTI0. Would you lease the new equipment or not? Please provide figures to support your decision, in addition to a discussion. 8