Answered step by step

Verified Expert Solution

Question

1 Approved Answer

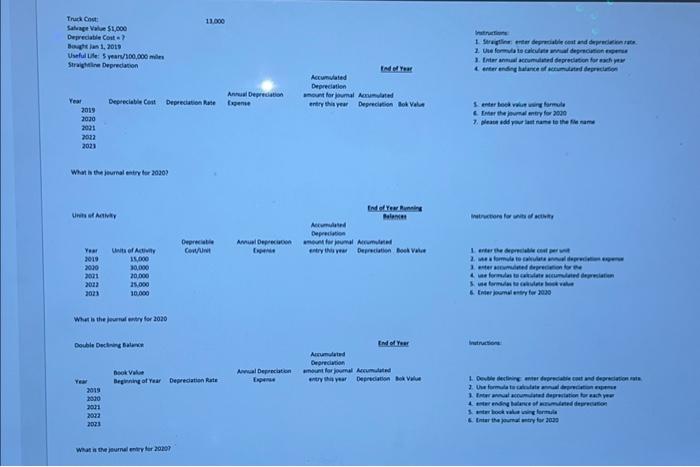

Truck Cost: Salvage Value $1,000 Depreciable Cost = ? Bought Jan 1, 2019 Useful Life: 5 years/100,000 miles Straightline Depreciation Year 2019 2020 2021 2022

Truck Cost: Salvage Value $1,000 Depreciable Cost = ? Bought Jan 1, 2019 Useful Life: 5 years/100,000 miles Straightline Depreciation Year 2019 2020 2021 2022 2023 What is the journal entry for 2020? Units of Activity Year 2019 2020 2021 2022 2023 Depreciable Cost Depreciation Rate What is the journal entry for 2020 Year Units of Activity 15,000 30,000 20,000 25,000 10,000 Double Declining Balance 2019 2020 2021 2022 2023 13,000 What is the journal entry for 2020? Depreciable Cost/Unit Book Value Beginning of Year Depreciation Rate Annual Depreciation Expense Annual Depreciation Expense Annual Depreciation Expense End of Year Accumulated Depreciation amount for journal Accumulated entry this year Depreciation Bok Value End of Year Running Balances Accumulated Depreciation amount for journal Accumulated entry this year Depreciation Book Value End of Year Accumulated Depreciation amount for journal Accumulated entry this year Depreciation Bok Value Instructions: 1. Straigtline: enter depreciable cost and depreciation rate. 2. Use formula to calculate annual depreciation expense 3. Enter annual accumulated depreciation for each year 4. enter ending balance of accumulated depreciation 5. enter book value using formula 6. Enter the journal entry for 2020 7. please add your last name to the file name Instructions for units of activity 1. enter the depreciable cost per unit 2. use a formula to calculate annual depreciation expense 3. enter accumulated depreciation for the 4. use formulas to calculate accumulated depreciation 5. use formulas to calculate book value 6. Enter journal entry for 2020 Instructions: 1. Double declining: enter depreciable cost and depreciation rate. 2. Use formula to calculate annual depreciation expense 3. Enter annual accumulated depreciation for each year 4. enter ending balance of accumulated depreciation 5. enter book value using formula 6. Enter the journal entry for 2020

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started