Answered step by step

Verified Expert Solution

Question

1 Approved Answer

tructions: Please answer all four problems. They are equally weighted. You have 2hrs to work on this exam. 1) You have a constant relative risk

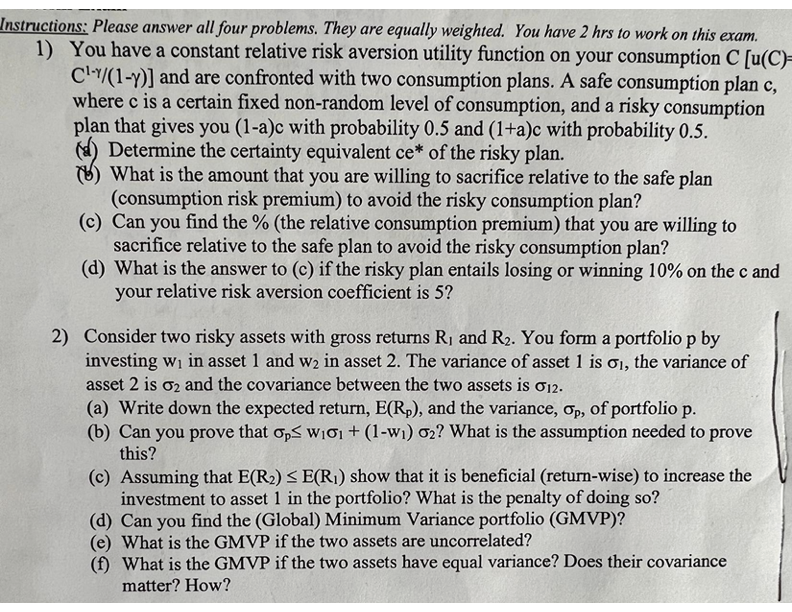

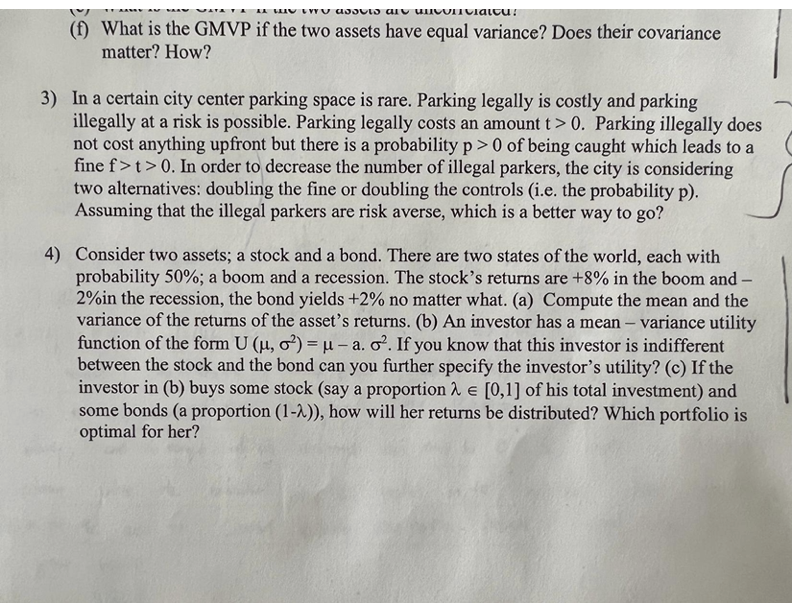

tructions: Please answer all four problems. They are equally weighted. You have 2hrs to work on this exam. 1) You have a constant relative risk aversion utility function on your consumption C[u(C) C1/(1)] and are confronted with two consumption plans. A safe consumption plan c, where c is a certain fixed non-random level of consumption, and a risky consumption plan that gives you (1-a)c with probability 0.5 and (1+a)c with probability 0.5 . (d) Determine the certainty equivalent ce* of the risky plan. (6) What is the amount that you are willing to sacrifice relative to the safe plan (consumption risk premium) to avoid the risky consumption plan? (c) Can you find the % (the relative consumption premium) that you are willing to sacrifice relative to the safe plan to avoid the risky consumption plan? (d) What is the answer to (c) if the risky plan entails losing or winning 10% on the c and your relative risk aversion coefficient is 5? 2) Consider two risky assets with gross returns R1 and R2. You form a portfolio p by investing w1 in asset 1 and w2 in asset 2 . The variance of asset 1 is 1, the variance of asset 2 is 2 and the covariance between the two assets is 12. (a) Write down the expected return, E(Rp), and the variance, p, of portfolio p. (b) Can you prove that pw11+(1w1)2 ? What is the assumption needed to prove this? (c) Assuming that E(R2)E(R1) show that it is beneficial (return-wise) to increase the investment to asset 1 in the portfolio? What is the penalty of doing so? (d) Can you find the (Global) Minimum Variance portfolio (GMVP)? (e) What is the GMVP if the two assets are uncorrelated? (f) What is the GMVP if the two assets have equal variance? Does their covariance matter? How? (f) What is the GMVP if the two assets have equal variance? Does their covariance matter? How? 3) In a certain city center parking space is rare. Parking legally is costly and parking illegally at a risk is possible. Parking legally costs an amount t>0. Parking illegally does not cost anything upfront but there is a probability p>0 of being caught which leads to a fine f>t>0. In order to decrease the number of illegal parkers, the city is considering two alternatives: doubling the fine or doubling the controls (i.e. the probability p). Assuming that the illegal parkers are risk averse, which is a better way to go? 4) Consider two assets; a stock and a bond. There are two states of the world, each with probability 50%; a boom and a recession. The stock's returns are +8% in the boom and 2% in the recession, the bond yields +2% no matter what. (a) Compute the mean and the variance of the returns of the asset's returns. (b) An investor has a mean - variance utility function of the form U(,2)=a2. If you know that this investor is indifferent between the stock and the bond can you further specify the investor's utility? (c) If the investor in (b) buys some stock (say a proportion [0,1] of his total investment) and some bonds (a proportion (1- )), how will her returns be distributed? Which portfolio is optimal for her

tructions: Please answer all four problems. They are equally weighted. You have 2hrs to work on this exam. 1) You have a constant relative risk aversion utility function on your consumption C[u(C) C1/(1)] and are confronted with two consumption plans. A safe consumption plan c, where c is a certain fixed non-random level of consumption, and a risky consumption plan that gives you (1-a)c with probability 0.5 and (1+a)c with probability 0.5 . (d) Determine the certainty equivalent ce* of the risky plan. (6) What is the amount that you are willing to sacrifice relative to the safe plan (consumption risk premium) to avoid the risky consumption plan? (c) Can you find the % (the relative consumption premium) that you are willing to sacrifice relative to the safe plan to avoid the risky consumption plan? (d) What is the answer to (c) if the risky plan entails losing or winning 10% on the c and your relative risk aversion coefficient is 5? 2) Consider two risky assets with gross returns R1 and R2. You form a portfolio p by investing w1 in asset 1 and w2 in asset 2 . The variance of asset 1 is 1, the variance of asset 2 is 2 and the covariance between the two assets is 12. (a) Write down the expected return, E(Rp), and the variance, p, of portfolio p. (b) Can you prove that pw11+(1w1)2 ? What is the assumption needed to prove this? (c) Assuming that E(R2)E(R1) show that it is beneficial (return-wise) to increase the investment to asset 1 in the portfolio? What is the penalty of doing so? (d) Can you find the (Global) Minimum Variance portfolio (GMVP)? (e) What is the GMVP if the two assets are uncorrelated? (f) What is the GMVP if the two assets have equal variance? Does their covariance matter? How? (f) What is the GMVP if the two assets have equal variance? Does their covariance matter? How? 3) In a certain city center parking space is rare. Parking legally is costly and parking illegally at a risk is possible. Parking legally costs an amount t>0. Parking illegally does not cost anything upfront but there is a probability p>0 of being caught which leads to a fine f>t>0. In order to decrease the number of illegal parkers, the city is considering two alternatives: doubling the fine or doubling the controls (i.e. the probability p). Assuming that the illegal parkers are risk averse, which is a better way to go? 4) Consider two assets; a stock and a bond. There are two states of the world, each with probability 50%; a boom and a recession. The stock's returns are +8% in the boom and 2% in the recession, the bond yields +2% no matter what. (a) Compute the mean and the variance of the returns of the asset's returns. (b) An investor has a mean - variance utility function of the form U(,2)=a2. If you know that this investor is indifferent between the stock and the bond can you further specify the investor's utility? (c) If the investor in (b) buys some stock (say a proportion [0,1] of his total investment) and some bonds (a proportion (1- )), how will her returns be distributed? Which portfolio is optimal for her Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started