Answered step by step

Verified Expert Solution

Question

1 Approved Answer

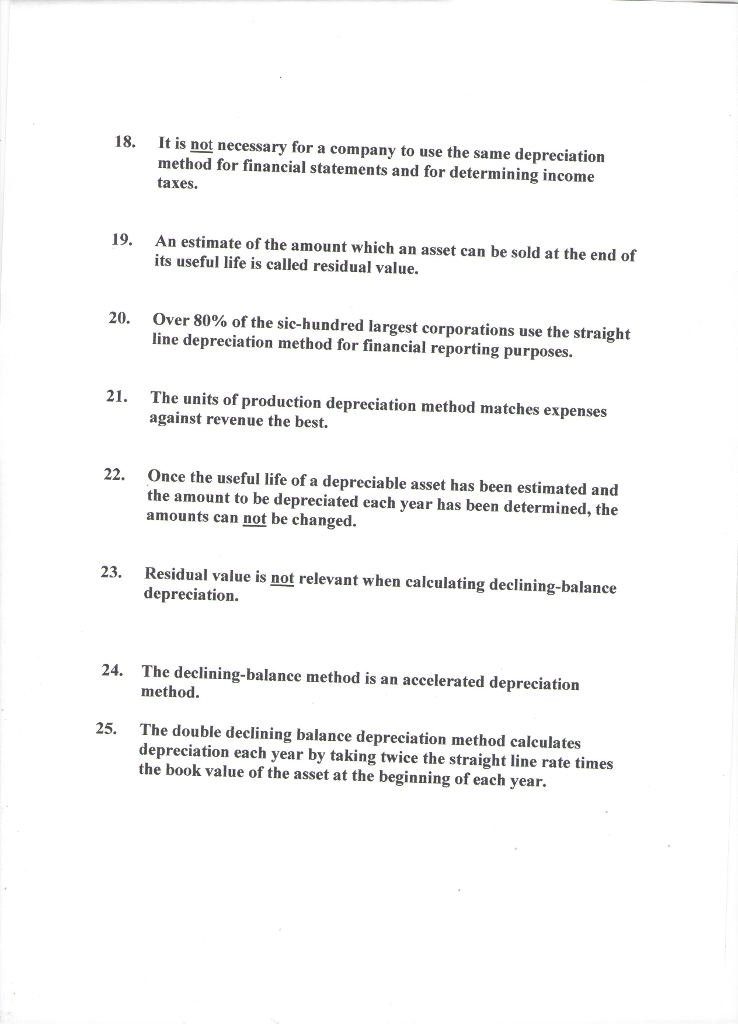

True and false questions It is not necessary for a company to use the same depreciation method for financial statements and for determining income taxes.

True and false questions

It is not necessary for a company to use the same depreciation method for financial statements and for determining income taxes. An estimate of the amount which an asset can be sold at the end of its useful life is called residual value. Over 80% of the sic-hundred largest corporations use the straight line depreciation method for financial reporting purposes. The units of production depreciation method matches expenses against revenue the best. Once the useful life of a depreciable asset has been estimated and the amount to be depreciated each year has been determined, the amounts can not be changed. Residual value is not relevant when calculating declining-balance depreciation. The declining-balance method is an accelerated depreciation method. The double declining balance depreciation method calculates depreciation each year by taking twice the straight line rate times the book value of the asset at the beginning of each yearStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started