true and false

true and false

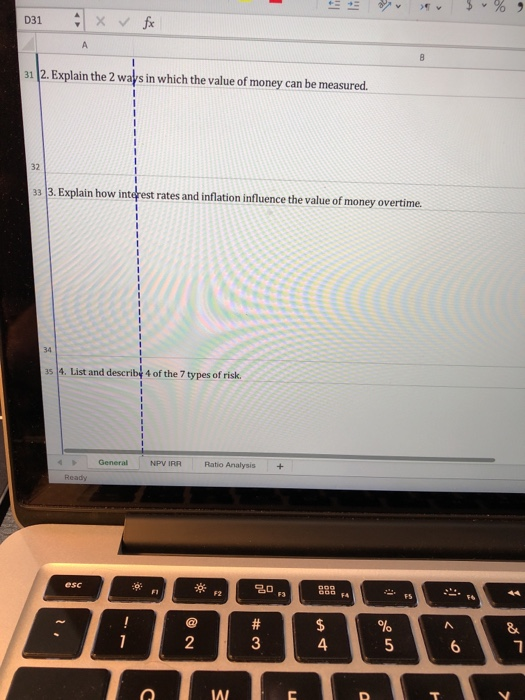

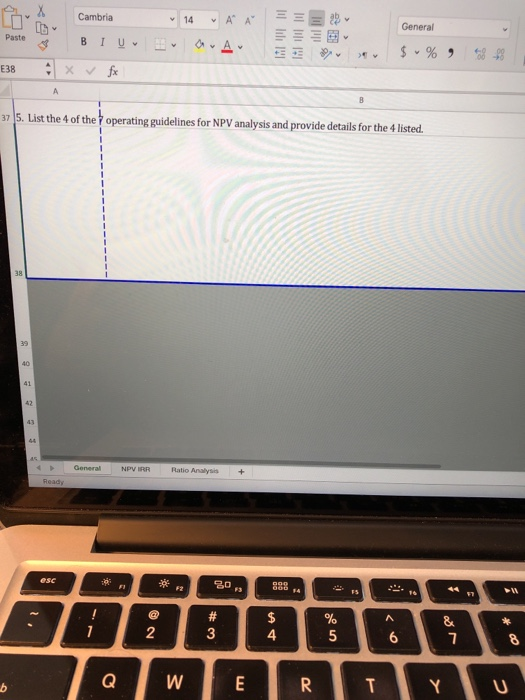

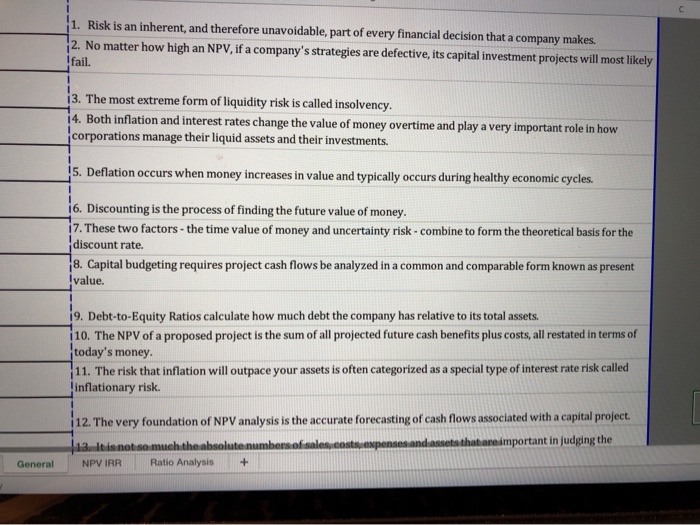

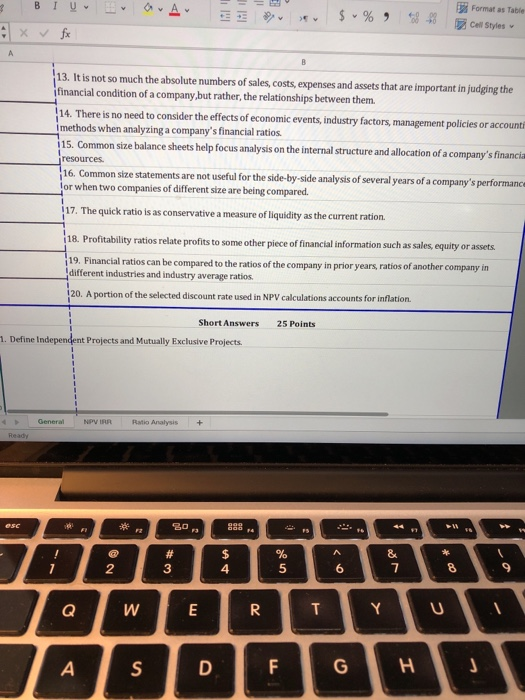

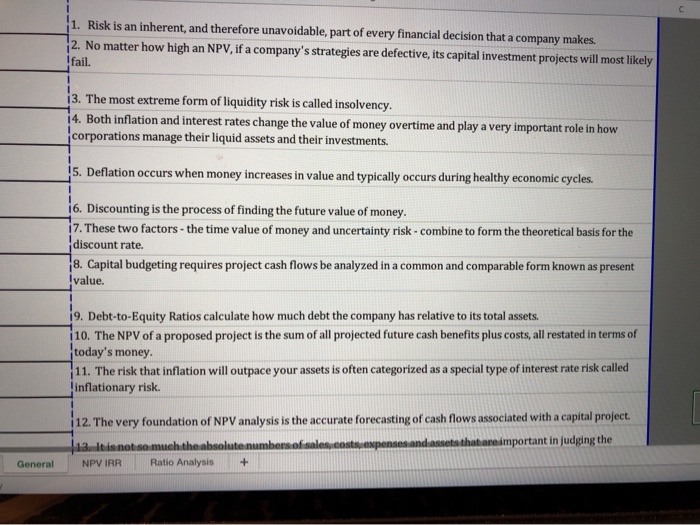

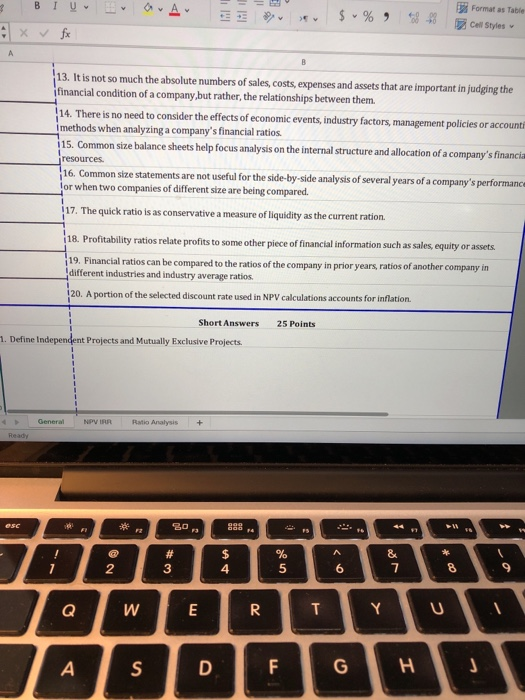

1. Risk is an inherent, and therefore unavoidable, part of every financial decision that a company makes. 2. No matter how high an NPV, if a company's strategies are defective, its capital investment projects will most likely fail. 13. The most extreme form of liquidity risk is called insolvency. 14. Both inflation and interest rates change the value of money overtime and play a very important role in how corporations manage their liquid assets and their investments. 5. Deflation occurs when money increases in value and typically occurs during healthy economic cycles. 16. Discounting is the process of finding the future value of money. 17. These two factors - the time value of money and uncertainty risk. combine to form the theoretical basis for the discount rate. 8. Capital budgeting requires project cash flows be analyzed in a common and comparable form known as present value. 19. Debt-to-Equity Ratios calculate how much debt the company has relative to its total assets. 10. The NPV of a proposed project is the sum of all projected future cash benefits plus costs, all restated in terms of today's money. 11. The risk that inflation will outpace your assets is often categorized as a special type of interest rate risk called inflationary risk. 12. The very foundation of NPV analysis is the accurate forecasting of cash flows associated with a capital project 13. It is not so much the absolute numbers of sales cost expenses and assets that are important in judging the NPV IRR Ratio Analysis + General 3 BI U vir avau 4 x v fx $ % $8-88 Format as Table Cell Styles 13. It is not so much the absolute numbers of sales, costs, expenses and assets that are important in judging the financial condition of a company,but rather, the relationships between them. 14. There is no need to consider the effects of economic events, industry factors, management policies or accounti I methods when analyzing a company's financial ratios. 115. Common size balance sheets help focus analysis on the internal structure and allocation of a company's financia resources. 16. Common size statements are not useful for the side-by-side analysis of several years of a company's performance or when two companies of different size are being compared. 17. The quick ratio is as conservative a measure of liquidity as the current ration 118. Profitability ratios relate profits to some other piece of financial information such as sales, equity or assets. 19. Financial ratios can be compared to the ratios of the company in prior years, ratios of another company in different industries and industry average ratios 120. A portion of the selected discount rate used in NPV calculations accounts for inflation 25 Points Short Answers 1. Define Independent Projects and Mutually Exclusive Projects General NPV IRR Ratio Analysis + 031 x v fx 31 (2. Explain the 2 ways in which the value of money can be measured. 333. Explain how interest rates and inflation influence the value of money overtime. 3 4. List and describe 4 of the 7 types of risk. General NPV IRR Ratio Analysis + Ready w EE Cambria - ~14 ~ A Paste 8 BI U vor avau 38 x v fx General $ -% - -75. List the 4 of the operating guidelines for NPV analysis and provide details for the 4 listed. General NPV R a tio Analysis + AAAI@G

true and false

true and false true and false

true and false