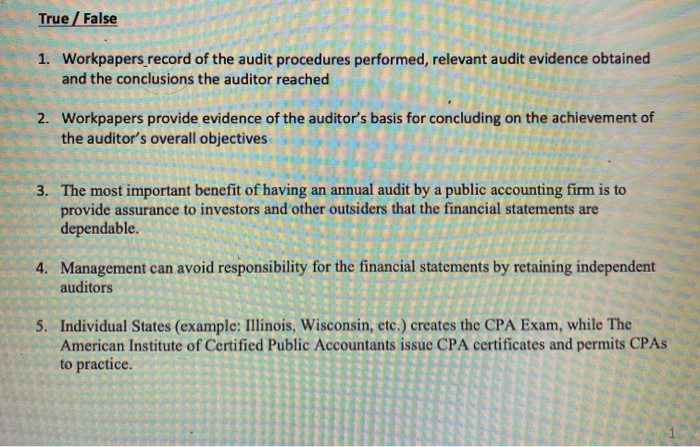

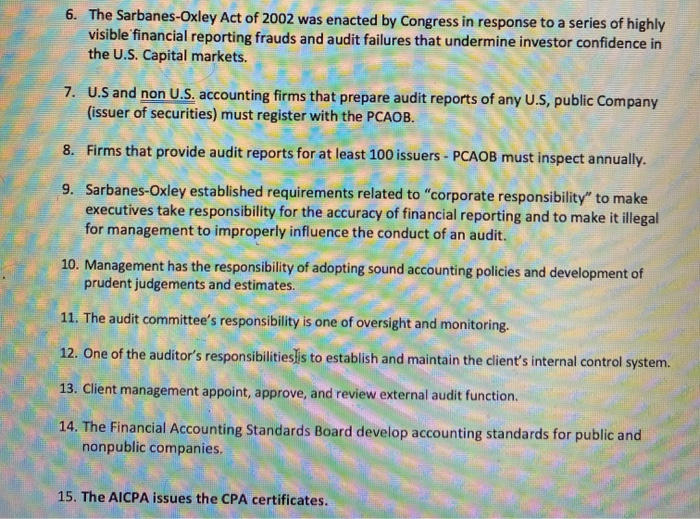

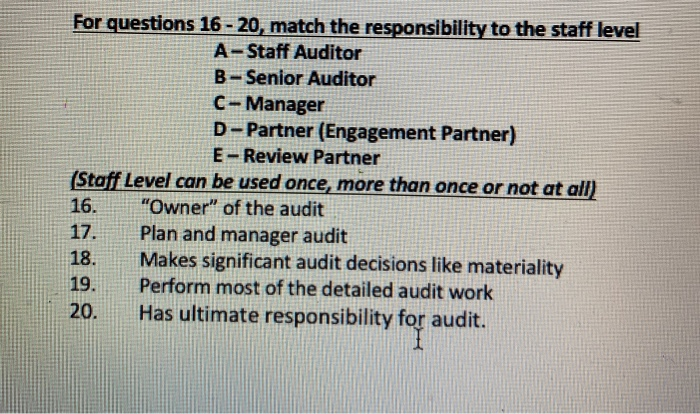

True / False 1. Workpapers record of the audit procedures performed, relevant audit evidence obtained and the conclusions the auditor reached 2. Workpapers provide evidence of the auditor's basis for concluding on the achievement of the auditor's overall objectives 3. The most important benefit of having an annual audit by a public accounting firm is to provide assurance to investors and other outsiders that the financial statements are dependable. 4. Management can avoid responsibility for the financial statements by retaining independent auditors 5. Individual States (example: Illinois, Wisconsin, etc.) creates the CPA Exam, while The American Institute of Certified Public Accountants issue CPA certificates and permits CPAS to practice. 6. The Sarbanes-Oxley Act of 2002 was enacted by Congress in response to a series of highly visible financial reporting frauds and audit failures that undermine investor confidence in the U.S. Capital markets. 7. U.S and non U.S. accounting firms that prepare audit reports of any U.S, public Company (issuer of securities) must register with the PCAOB. 8. Firms that provide audit reports for at least 100 issuers - PCAOB must inspect annually. 9. Sarbanes-Oxley established requirements related to "corporate responsibility" to make executives take responsibility for the accuracy of financial reporting and to make it illegal for management to improperly influence the conduct of an audit. 10. Management has the responsibility of adopting sound accounting policies and development of prudent judgements and estimates. 11. The audit committee's responsibility is one of oversight and monitoring. 12. One of the auditor's responsibilities]is to establish and maintain the client's internal control system. 13. Client management appoint, approve, and review external audit function. 14. The Financial Accounting Standards Board develop accounting standards for public and nonpublic companies. 15. The AICPA issues the CPA certificates. For questions 16-20, match the responsibility to the staff level A-Staff Auditor B-Senior Auditor C-Manager D-Partner (Engagement Partner) E-Review Partner (Staff Level can be used once, more than once or not at all) 16. "Owner" of the audit 17. Plan and manager audit 18. Makes significant audit decisions like materiality 19. Perform most of the detailed audit work 20. Has ultimate responsibility for audit