Answered step by step

Verified Expert Solution

Question

1 Approved Answer

True / False questions true and false questions 1. From a real estate investment standpoint it is better to have a longer depreciation write off

True / False questions

true and false questions

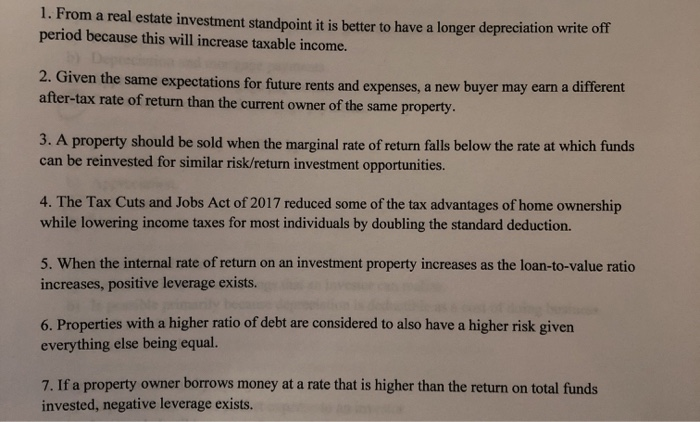

1. From a real estate investment standpoint it is better to have a longer depreciation write off period because this will increase taxable income. 2. Given the same expectations for future rents and expenses, a new buyer may earn a different after-tax rate of return than the current owner of the same property. 3. A property should be sold when the marginal rate of return falls below the rate at which funds can be reinvested for similar risk/return investment opportunities, 4. The Tax Cuts and Jobs Act of 2017 reduced some of the tax advantages of home ownership while lowering income taxes for most individuals by doubling the standard deduction. 5. When the internal rate of return on an investment property increases as the loan-to-value ratio increases, positive leverage exists. 6. Properties with a higher ratio of debt are considered to also have a higher risk given everything else being equal. 7. If a property owner borrows money at a rate that is higher than the return on total funds invested, negative leverage exists Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started