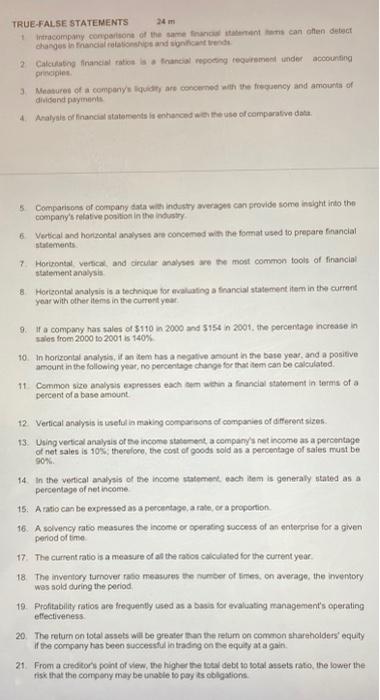

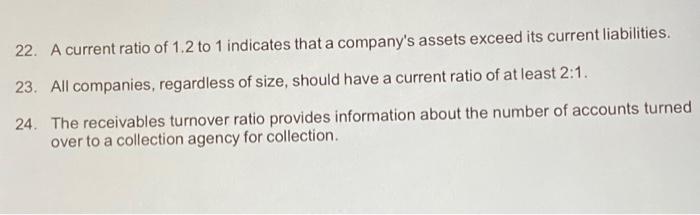

TRUE FALSE STATEMENTS 24 m Intracompany comparison of the same finance can often detect changes in Tinancial relationships and trend 2 Calcutting and social reporting requirement under accounting prie 3 Measures of a company's quity are concerned with the trency and amounts of dividend payments Analysis of financial statements is enhanced we use of comparative data. 6 statements 5 Comparison of company data with industry average can provide some insight into the company's relative position in the industry Vertical and horizontal analyses are concerned with the format used to prepare financial 7 Horizontal vertical and circular wayses were most common tools of financial 8 Horizontal analysis is a technique for evaluating a financial statement hem in the current year with other items in the current year statement analysis a company has sales of $110 in 2000 and 5158 n 2001, the percentage increase in sales from 2000 to 2001 is 140% 10. In horizontal analysis, if an item has a negative amount in the base year, and a positive amount in the following year, no percentage change for that item can be calculated 11 common size analysis expresses each com wth a francial statement in terms of a percent of a base amount 12 Vertical analysis in unetul in making comparsons of companies of different sizes 13. Using vertical analysis of the income statement a company's net income as a percentage of net sales is 10%, therefore, the cost of goods sold as a percentage of sales must be 90% 14. In the vertical analysis of the income statement each tam is generally stated as a percentage of net income 15. A ratio can be expressed as a percentage, a rate, era proportion. 16. A solvency ratio measures the income or operating success of an enterprise for a ghen period of time 17. The current ratio is a measure of all the ratios calculated for the current year. 18 The inventory turnover raso measures the number of times, on average, the inventory was sold during the period 19. Profitability ratios are frequently used as a basis for evaluating management's operating effectiveness 20. The return on total assets will be greater than the retum on common shareholders' equity if se company has been successful in trading on the equity at again 21. From a creditor's point of view, the higher the total debt to total assets ratio, the lower the risk that the company may be unable to pay its obligations 22. A current ratio of 1.2 to 1 indicates that a company's assets exceed its current liabilities. 23. All companies, regardless of size, should have a current ratio of at least 2:1. 24. The receivables turnover ratio provides information about the number of accounts turned over to a collection agency for collection