Answered step by step

Verified Expert Solution

Question

1 Approved Answer

TRUE / FLASE 7 8 A company has a 30% tax rate. It buys a capital asset that will be depreciated for book purposes straight-line

TRUE / FLASE

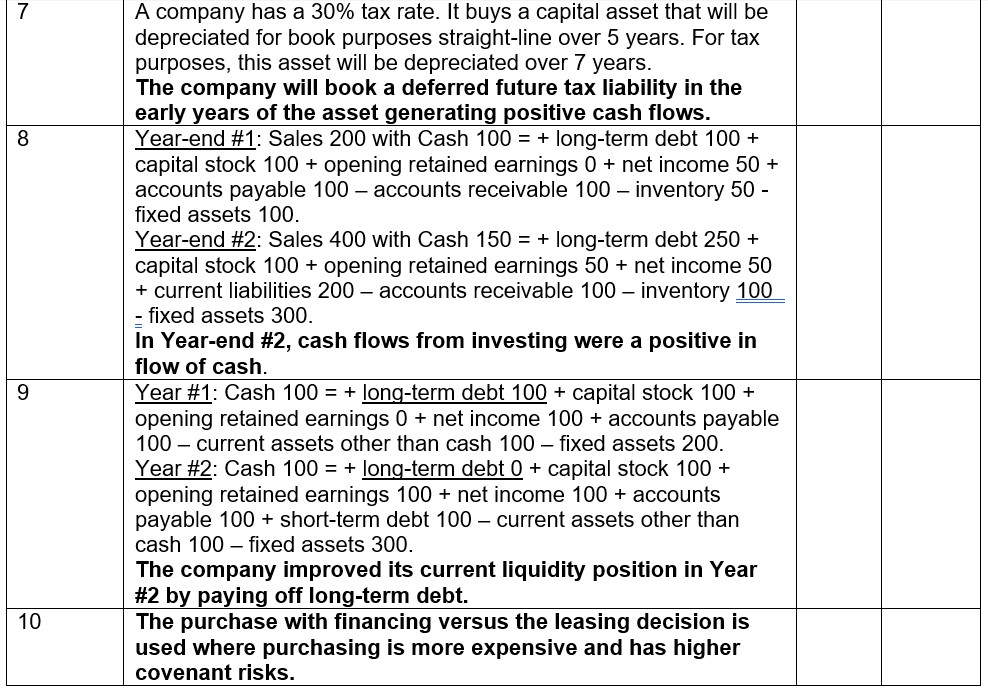

7 8 A company has a 30% tax rate. It buys a capital asset that will be depreciated for book purposes straight-line over 5 years. For tax purposes, this asset will be depreciated over 7 years. The company will book a deferred future tax liability in the early years of the asset generating positive cash flows. Year-end #1: Sales 200 with Cash 100 = + long-term debt 100+ capital stock 100 + opening retained earnings 0 + net income 50 + accounts payable 100 - accounts receivable 100 inventory 50 - fixed assets 100. Year-end #2: Sales 400 with Cash 150 = + long-term debt 250 + capital stock 100+ opening retained earnings 50 + net income 50 + current liabilities 200-accounts receivable 100 - inventory 100 - fixed assets 300. In Year-end #2, cash flows from investing were a positive in flow of cash. Year #1: Cash 100 = + long-term debt 100 + capital stock 100 + opening retained earnings 0 + net income 100 + accounts payable 100 current assets other than cash 100 fixed assets 200. Year #2: Cash 100 = + long-term debt 0 + capital stock 100 + opening retained earnings 100 + net income 100 + accounts payable 100+ short-term debt 100 current assets other than cash 100 fixed assets 300. The company improved its current liquidity position in Year #2 by paying off long-term debt. The purchase with financing versus the leasing decision is used where purchasing is more expensive and has higher covenant risks. 9 10Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started