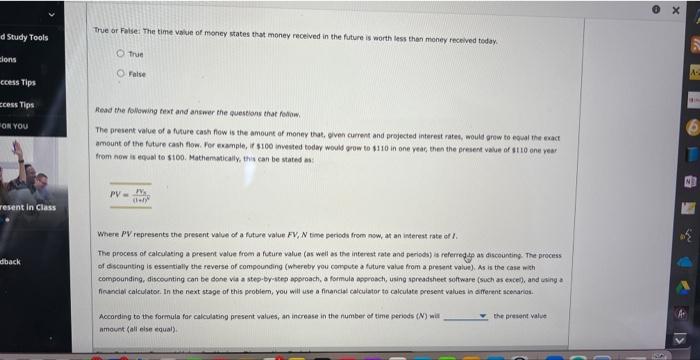

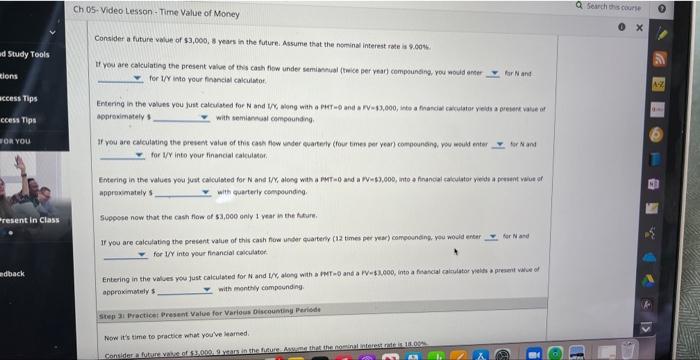

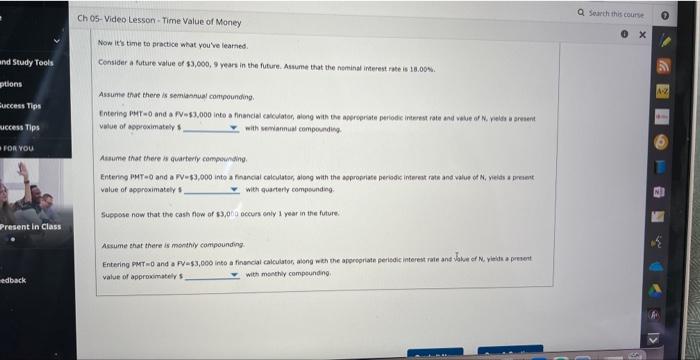

True of Faise: The time vakue of money mates that money received in the future is worth less then money recrived today. Trie Faise Head the following text and ansmer the guestions that follow. The present value of a fufure cash flow is the amount of money that, even current and projected interest rated, aould arew to equal the exact amount of the Nuture cash flom. For wample, if $100 invested todwy wovld orow to 1110 in one yeac then the present value of 31t0 one year from now it equal to 5100 . Mathensatically, this can be stated as: PV=(1+)pWs Where PV represents the present value of a future value FV,N time periods from now, at an interest rate of I. The process of calculating a present value from a fucure value (as well as the interest rate and periods) as referreqte as disceunting. The process of dscounting is essentially the reverse of compounding (whereby you compote a future value from a present value), As is the case with compounding, discoanting can be dahe vis a step.by-atep approach, a formula approsch, using spreadtheet software (such as exce), and wing of finenciel calculator. In the next stage of this problem, you will use a financial calculator to calculate present values is arrerent sconanios. According to the formula fac calculating present values, an increase in the number of time periods (N) mit the present value amount \{all else equal\}. Consider a future value of 33,000, 8 years in the future. Assume that the nominal interest rate is 9.004+ If you are calculating the present value of this cath fitw under semianiad (twice per year) compounding yey wosid anet o far a and for I/Y iate your findncial calcuitat. acpranimstely 1 with semiaresal cempoundng. tar N and for ify into your financial talcuistor; aporaymately 5 with quarteriy coenpounding. Sypcose now that the cash flow ef 33,000 enly 1 vear in the thare, Fer Na?d for 1/Y inte your finaneial calculater. appraximately 5 with monthly compsinding. Sten Ii Practicet qresent Value for Variocis Discounting Periods Now it's time to practice what you ve learned. Consider a future value of 43,000,9 yean in the future. Astume that the ntmina imerest rate is 18.00%. Assume that there is semiannual compounding. velue of asproximately 1 with semiannual composidieg . Assume that there is quarteriy compowising. Entenes PMT =0 and a FV=\$3,000 inte a financal calculator, along with the aspropriate periodic interest rate and value of N, neids a preet value of approximately is with quarterly compounding: Suppose now that the cash flow of 83,060 occurs enly 1 year in the future: Actume that there is monthiy compounding vahue of approvimatey s with monthy compoundeno