Answered step by step

Verified Expert Solution

Question

1 Approved Answer

TRUE OR FALSE 1. An employer has 10 employees who made in total $350,000 for the year. The employer agrees to contribute 5% of

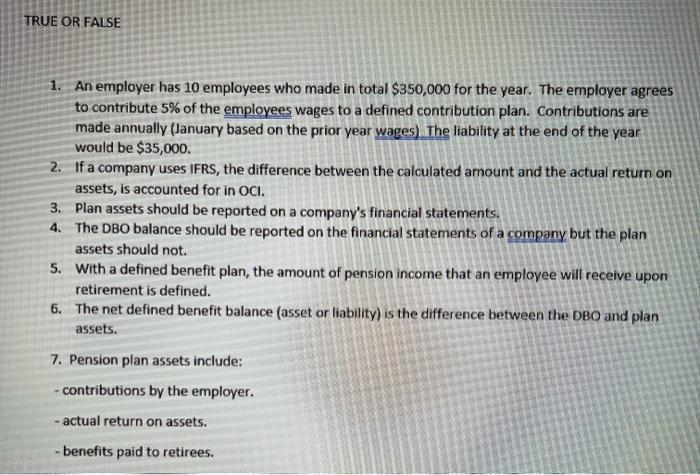

TRUE OR FALSE 1. An employer has 10 employees who made in total $350,000 for the year. The employer agrees to contribute 5% of the employees wages to a defined contribution plan. Contributions are made annually (January based on the prior year wages). The liability at the end of the year would be $35,000. 2. If a company uses IFRS, the difference between the calculated amount and the actual return on assets, is accounted for in OCI. Plan assets should be reported on a company's financial statements. The DBO balance should be reported on the financial statements of a company but the plan assets should not. 5. With a defined benefit plan, the amount of pension income that an employee will receive upon retirement is defined. 6. The net defined benefit balance (asset or liability) is the difference between the DBO and plan assets. 7. Pension plan assets include: - contributions by the employer. - actual return on assets. - benefits paid to retirees. 3. 4.

Step by Step Solution

★★★★★

3.37 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

1 The Contribution to Defined Contribution plan for the year is 17500 w...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started