Answered step by step

Verified Expert Solution

Question

1 Approved Answer

TRUE OR FALSE 1.11. You can recover the transpose of the Black-Litterman tracking matrix from the variance-covariance matrix. 1.12. You can create a convex combination

TRUE OR FALSE

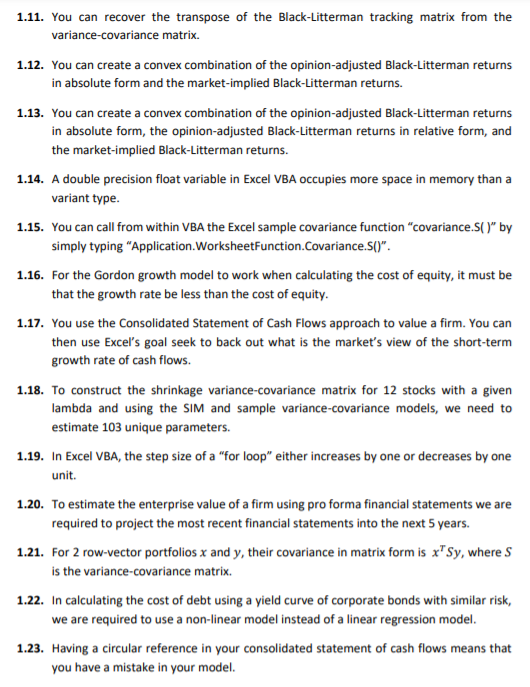

1.11. You can recover the transpose of the Black-Litterman tracking matrix from the variance-covariance matrix. 1.12. You can create a convex combination of the opinion-adjusted Black-Litterman returns in absolute form and the market-implied Black-Litterman returns. 1.13. You can create a convex combination of the opinion-adjusted Black-Litterman returns in absolute form, the opinion-adjusted Black-Litterman returns in relative form, and the market-implied Black-Litterman returns. 1.14. A double precision float variable in Excel VBA occupies more space in memory than a variant type. 1.15. You can call from within VBA the Excel sample covariance function "Covariance.S()" by simply typing "Application. WorksheetFunction.Covariance.S()". 1.16. For the Gordon growth model to work when calculating the cost of equity, it must be that the growth rate be less than the cost of equity. 1.17. You use the Consolidated Statement of Cash Flows approach to value a firm. You can then use Excel's goal seek to back out what is the market's view of the short-term growth rate of cash flows. 1.18. To construct the shrinkage variance covariance matrix for 12 stocks with a given lambda and using the SIM and sample variance-covariance models, we need to estimate 103 unique parameters. 1.19. In Excel VBA, the step size of a "for loop" either increases by one or decreases by one unit. 1.20. To estimate the enterprise value of a firm using pro forma financial statements we are required to project the most recent financial statements into the next 5 years. 1.21. For 2 row-vector portfolios x and y, their covariance in matrix form is x"Sy, where S is the variance-covariance matrix. 1.22. In calculating the cost of debt using a yield curve of corporate bonds with similar risk, we are required to use a non-linear model instead of a linear regression model. 1.23. Having a circular reference in your consolidated statement of cash flows means that you have a mistake in your model. 1.11. You can recover the transpose of the Black-Litterman tracking matrix from the variance-covariance matrix. 1.12. You can create a convex combination of the opinion-adjusted Black-Litterman returns in absolute form and the market-implied Black-Litterman returns. 1.13. You can create a convex combination of the opinion-adjusted Black-Litterman returns in absolute form, the opinion-adjusted Black-Litterman returns in relative form, and the market-implied Black-Litterman returns. 1.14. A double precision float variable in Excel VBA occupies more space in memory than a variant type. 1.15. You can call from within VBA the Excel sample covariance function "Covariance.S()" by simply typing "Application. WorksheetFunction.Covariance.S()". 1.16. For the Gordon growth model to work when calculating the cost of equity, it must be that the growth rate be less than the cost of equity. 1.17. You use the Consolidated Statement of Cash Flows approach to value a firm. You can then use Excel's goal seek to back out what is the market's view of the short-term growth rate of cash flows. 1.18. To construct the shrinkage variance covariance matrix for 12 stocks with a given lambda and using the SIM and sample variance-covariance models, we need to estimate 103 unique parameters. 1.19. In Excel VBA, the step size of a "for loop" either increases by one or decreases by one unit. 1.20. To estimate the enterprise value of a firm using pro forma financial statements we are required to project the most recent financial statements into the next 5 years. 1.21. For 2 row-vector portfolios x and y, their covariance in matrix form is x"Sy, where S is the variance-covariance matrix. 1.22. In calculating the cost of debt using a yield curve of corporate bonds with similar risk, we are required to use a non-linear model instead of a linear regression model. 1.23. Having a circular reference in your consolidated statement of cash flows means that you have a mistake in your modelStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started