Answered step by step

Verified Expert Solution

Question

1 Approved Answer

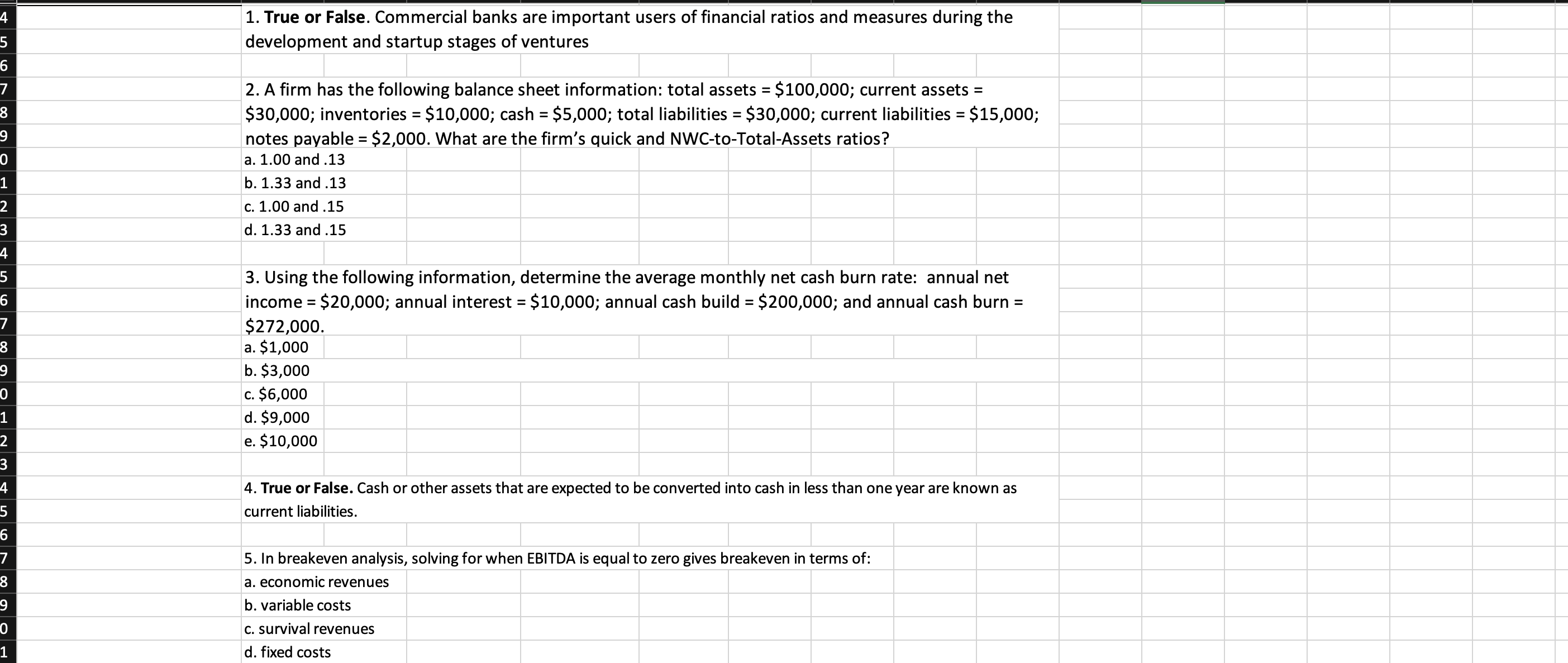

True or False. Commercial banks are important users of financial ratios and measures during the development and startup stages of ventures A firm has the

True or False. Commercial banks are important users of financial ratios and measures during the

development and startup stages of ventures

A firm has the following balance sheet information: total assets $; current assets

$; inventories $; cash $; total liabilities $; current liabilities $;

notes payable $ What are the firm's quick and NWCtoTotalAssets ratios?

a and

b and

c and

d and

Using the following information, determine the average monthly net cash burn rate: annual net

income $; annual interest $; annual cash build $; and annual cash burn

$

a $

b $

c $

d $

e $

True or False. Cash or other assets that are expected to be converted into cash in less than one year are known as

current liabilities.

In breakeven analysis, solving for when EBITDA is equal to zero gives breakeven in terms of:

a economic revenues

b variable costs

c survival revenues

d fixed costs

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started