Answered step by step

Verified Expert Solution

Question

1 Approved Answer

True or False for the questions below 1. Prices in efficient capital markets fully reflect all available information and rapidly adjust to new information. 2.

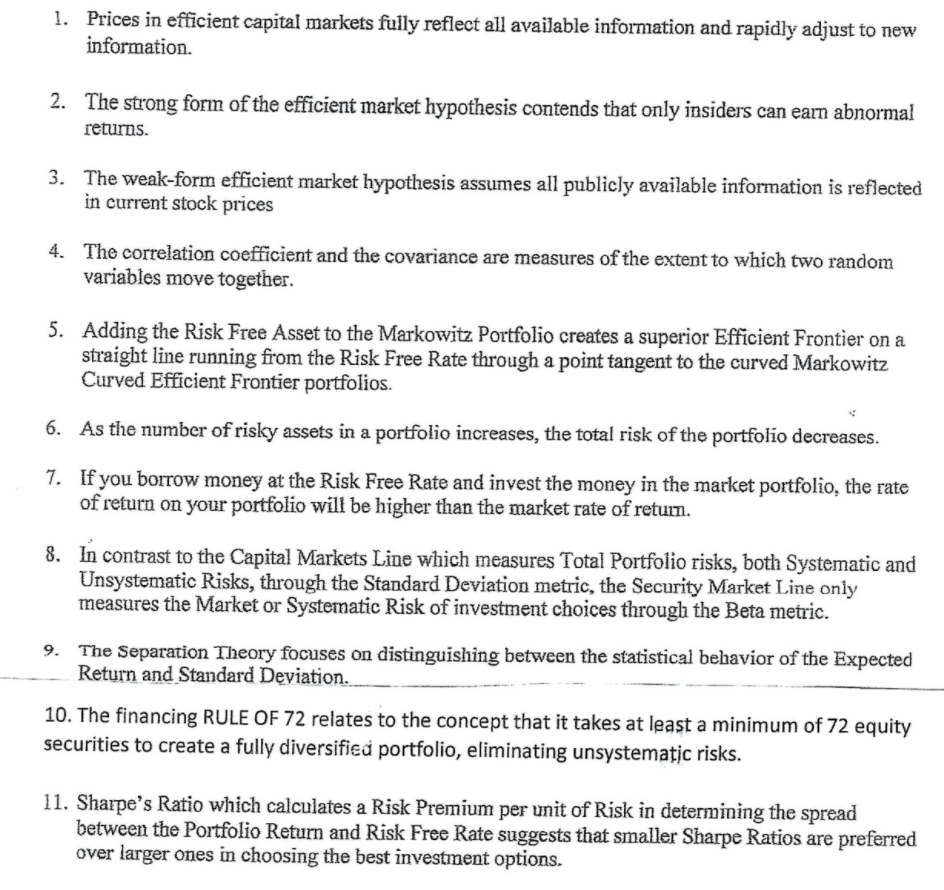

True or False for the questions below

1. Prices in efficient capital markets fully reflect all available information and rapidly adjust to new information. 2. The strong form of the efficient market hypothesis contends that only insiders can earn abnormal returns. 3. The weak-form efficient market hypothesis assumes all publicly available information is reflected in current stock prices 4. The correlation coefficient and the covariance are measures of the extent to which two random variables move together. 5. Adding the Risk Free Asset to the Markowitz Portfolio creates a superior Efficient Frontier on a straight line running from the Risk Free Rate through a point tangent to the curved Markowitz Curved Efficient Frontier portfolios. 6. As the number of risky assets in a portfolio increases, the total risk of the portfolio decreases. 7. If you borrow money at the Risk Free Rate and invest the money in the market portfolio, the rate of return on your portfolio will be higher than the market rate of return. 8. In contrast to the Capital Markets Line which measures Total Portfolio risks, both Systematic and Unsystematic Risks, through the Standard Deviation metric, the Security Market Line only measures the Market or Systematic Risk of investment choices through the Beta metric. The Separation Theory focuses on distinguishing between the statistical behavior of the Expected Return and Standard Deviation. 10. The financing RULE OF 72 relates to the concept that it takes at least a minimum of 72 equity securities to create a fully diversified portfolio, eliminating unsystematic risks. 11. Sharpe's Ratio which calculates a Risk Premium per unit of Risk in determining the spread between the Portfolio Return and Risk Free Rate suggests that smaller Sharpe Ratios are preferred over larger ones in choosing the best investment options

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started