Answered step by step

Verified Expert Solution

Question

1 Approved Answer

true or false ; from 1 to 15 please Mark T if you think the statement is true, or 'F*if you believe the statement is

true or false ; from 1 to 15 please

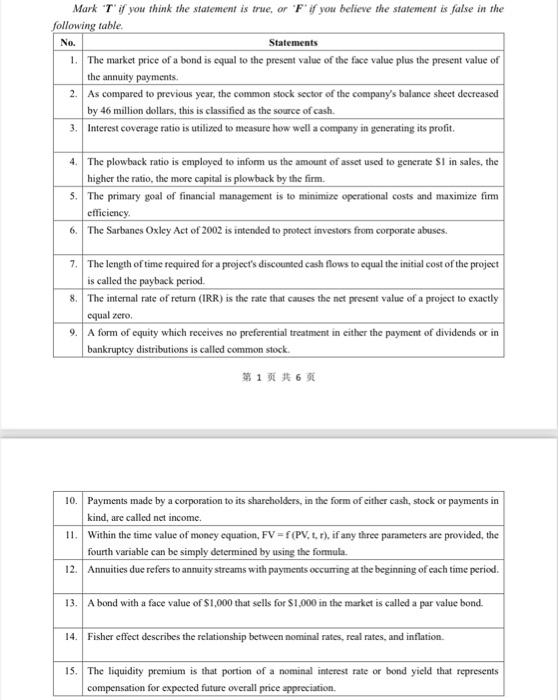

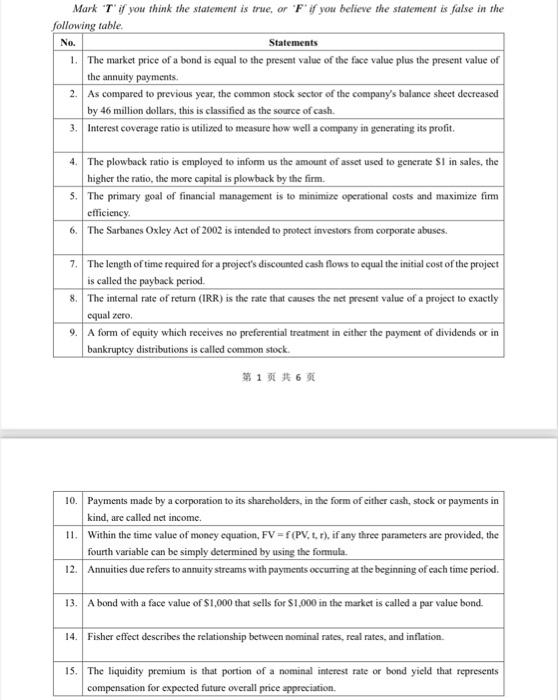

Mark T" if you think the statement is true, or 'F*if you believe the statement is false in the following table No. Statements 1. The market price of a bond is equal to the present value of the face value plus the present value of the annuity payments 2. As compared to previous year, the common stock sector of the company's balance sheet decreased by 46 million dollars, this is classified as the source of cash. 3. Interest coverage ratio is utilized to measure how well a company in generating its profit. 4. The plowback ratio is employed to inform us the amount of asset used to generate SI in sales, the higher the ratio, the more capital is plowback by the firm. 5. The primary goal of financial management is to minimize operational costs and maximize firm efficiency 6. The Sarbanes Oxley Act of 2002 is intended to protect investors from corporate abuses. 7. The length of time required for a project's discounted cash flows to equal the initial cost of the project is called the payback period 8. The internal rate of retur (IRR) is the rate that causes the net present value of a project to exactly equal xero 9. A form of equity which receives no preferential treatment in either the payment of dividends or in bankruptcy distributions is called common stock 16 10. Payments made by a corporation to its shareholders, in the form of either cash, stock or payments in kind, are called net income. 11. Within the time value of money equation, FV=f(PV. ,r), if any three parameters are provided, the fourth variable can be simply determined by using the formula 12. Annuities due refers to annuity streams with payments occurring at the beginning of each time period. 13. A bond with a face value of $1,000 that sells for $1,000 in the market is called a par value bond. 14. Fisher effect describes the relationship between nominal rates, real rates, and inflation 15. The liquidity premium is that portion of a nominal interest rate or bond yield that represents compensation for expected future overall price appreciation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started