Answered step by step

Verified Expert Solution

Question

1 Approved Answer

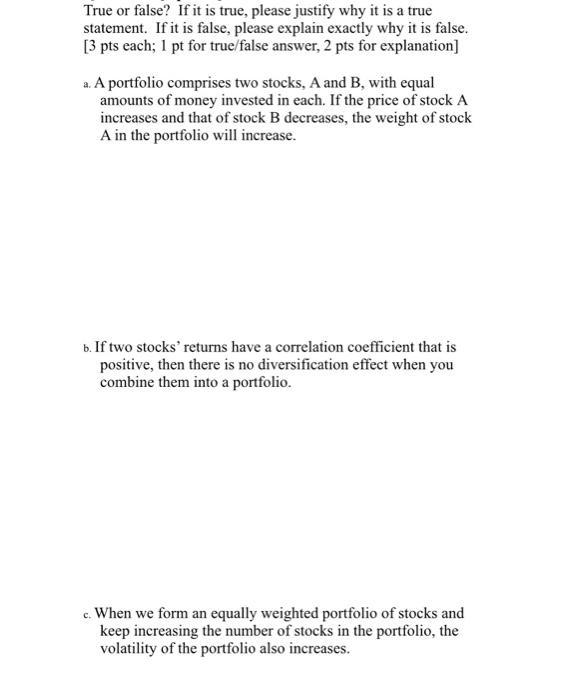

True or false? If it is true, please justify why it is a true statement. If it is false, please explain exactly why it

True or false? If it is true, please justify why it is a true statement. If it is false, please explain exactly why it is false. [3 pts each; 1 pt for true/false answer, 2 pts for explanation] a. A portfolio comprises two stocks, A and B, with equal amounts of money invested in each. If the price of stock A increases and that of stock B decreases, the weight of stock A in the portfolio will increase. b. If two stocks' returns have a correlation coefficient that is positive, then there is no diversification effect when you combine them into a portfolio. c. When we form an equally weighted portfolio of stocks and keep increasing the number of stocks in the portfolio, the volatility of the portfolio also increases.

Step by Step Solution

★★★★★

3.39 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

a True Lets say an equally weighted portfolio of A and B is created by investing 5000 each of A and ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started