Answered step by step

Verified Expert Solution

Question

1 Approved Answer

true or false? only a short explanation for each one c) Consider two bonds, A and B. Both bonds presently are selling at their par

true or false?

only a short explanation for each one

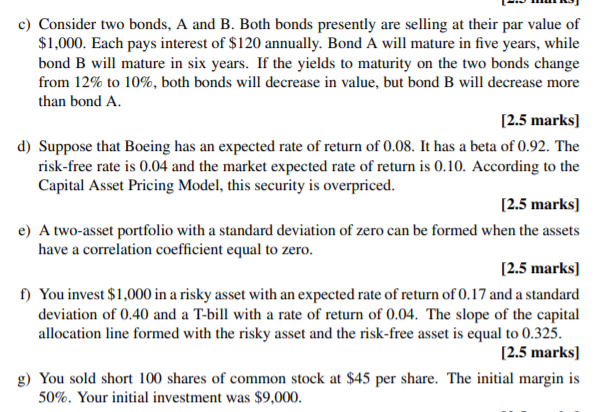

c) Consider two bonds, A and B. Both bonds presently are selling at their par value of $1,000. Each pays interest of $120 annually. Bond A will mature in five years, while bond B will mature in six years. If the yields to maturity on the two bonds change from 12% to 10%, both bonds will decrease in value, but bond B will decrease more than bond A. [2.5 marks) d) Suppose that Boeing has an expected rate of return of 0.08. It has a beta of 0.92. The risk-free rate is 0.04 and the market expected rate of return is 0.10. According to the Capital Asset Pricing Model, this security is overpriced. [2.5 marks] e) A two-asset portfolio with a standard deviation of zero can be formed when the assets have a correlation coefficient equal to zero. [2.5 marks) f) You invest $1,000 in a risky asset with an expected rate of return of 0.17 and a standard deviation of 0.40 and a T-bill with a rate of return of 0.04. The slope of the capital allocation line formed with the risky asset and the risk-free asset is equal to 0.325. [2.5 marks) g) You sold short 100 shares of common stock at $45 per share. The initial margin is 50%. Your initial investment was $9,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started