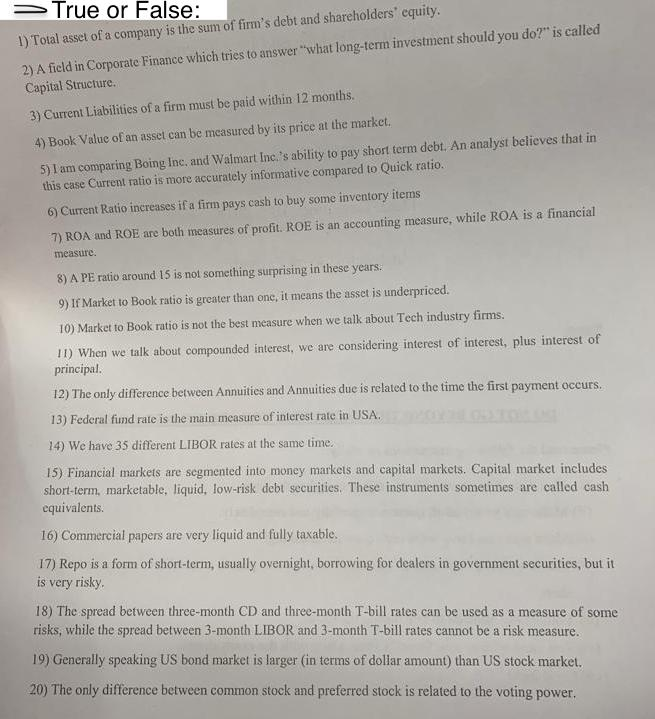

True or False questions:

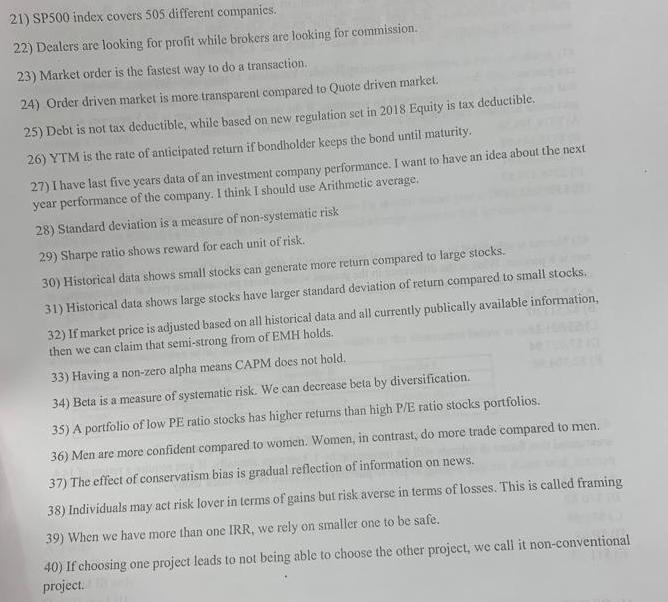

True or False l) Total asset of a company is the sum of firm's debt and shareholders equity. 2) A field in Corporate Finance which tries to answer"what long-term investment should you do?" is called Capital Structure 3) Current Liabilities of a firm must be paid within 12 months. ok Valuc of an asset can be measured by its price at the market. 5) 1 am comparing Boing Ine, and Walmart Inc.'s ability to pay short term debt. An analyst believes that in this case Current ratio is more accurately informative compared to Quick ratio. 6) Current Ratio increases if a firm pays cash to buy some inventory items 7) ROA and ROE are both measures of profit. ROE is an accounting measure, while ROA is a financial measurc 8) A PE ratio around 15 is not something surprising in these years. 9) If Market to Book ratio is greater than one, it means the asset is underpriced. 10) Market to Book ratio is not the best measure when we talk about Tech industry firms 11) When we talk about compounded interest, we are considering interest of interest, plus interest of principal 12) The only difference between Annuities and Annuities due is related to the time the first payment occurs. 13) Federal fimd rate is the main measure of interest rate in USA. 14) We have 35 different LIBOR rates at the same time. 15) Financial markets are segmented into money markets and capital markets. Capital market includes short-term, marketable, liquid, low-risk debl securities. These instruments sometimes are called cash equivalents 16) Commercial papers are very liquid and fully taxable 17) Repo is a form of short-term, usually overnight, borrowing for dealers in government securities, but it 18) The spread between three-month CD and three-month T-bill rates can be used as a measure of some risks, while the spread between 3-month LIBOR and 3-month T-bill rates cannot be a risk measure. 19) Generally speaking US bond market is larger (in terms of doliar amount) than US stock market. 20) The only difference between common stock and preferred stock is related o the voting power. 21) SP500 index covers 505 different companics. 22) Dealers are looking for profit while brokers are looking for commission 23) Market order is the fastest way to do a transaction. 24) Order driven market is more transparent compared to Quote driven market. 25) Debt is not tax deductible, w 26) hile based on new regulation set in 2018 Equity is tax deductible. YTM is the rate of anticipated return if bondholder keeps the bond until maturity. 27) I have last five years data of an investment company performance. I want to have an idea about the next year performance of the company. I think I should use Arihmctic average. 28) Standard deviation is a measure of non- systematic risk 29) Sharpe ratio shows reward for each unit of risk. 30) Historical data shows small stocks can generate more return com pared to large stock s. 31) Historical data shows large stocks have larger standard deviation of return compared to small stocks 32) If market price is adjusted based on all historical data and all currently publically available information, then we can claim that semi-strong from of EMH holds. 33) Having a non-zero alpha means CAPM does not hold. 34) Beta is a measure of systematic risk. We can decrease beta by diversification. 35) A portfolio of low PE ratio stocks has higher returns than high P/E ratio stocks portfolios. 36) Men are more confident compared to women. Women, in contrast, do more trade compared to men. 37) The effect of conservatism bias is gradual reflection of information on news. 38) Individuals may act risk lover in terms of gains but risk averse in terms of losses. This is called framing 39) When we have more than one IRR, we rely on smaller one to be safe. 40) If choosing one project leads to not being able to choose the other project, we call it non-conventional project